When life throws curveballs, having a solid insurance plan can make all the difference. But sometimes, your standard policies just don’t cut it—enter umbrella insurance, your trusty extra layer of protection. Think of it as a safety net that kicks in when your other coverage isn’t enough, giving you peace of mind and financial security against unexpected big-ticket claims. In this article, we’ll explore why umbrella insurance is worth considering and how it can keep you protected when life gets unpredictable. Let’s dive in!

Table of Contents

- Why Umbrella Insurance Covers What Your Basic Policies Don’t

- How Umbrella Insurance Protects Your Assets and Future Income

- When to Consider Adding Umbrella Insurance to Your Coverage

- Tips for Choosing the Right Umbrella Insurance Policy for Your Needs

- In Summary

Why Umbrella Insurance Covers What Your Basic Policies Don’t

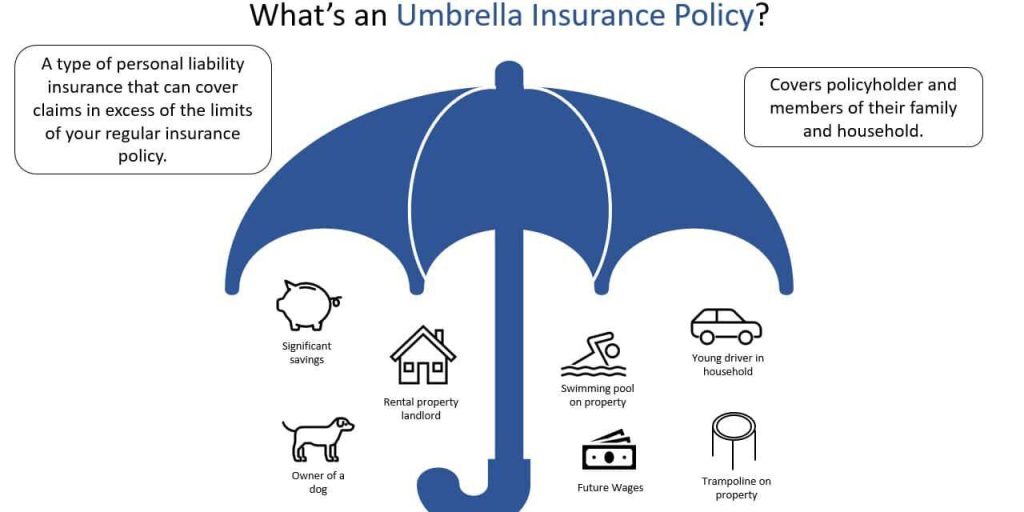

While standard insurance policies like auto, home, or renters insurance provide essential coverage, they often come with limits that might leave you exposed. For instance, most liability coverages cap the amount they will pay for bodily injury or property damage. When an accident results in costs exceeding those limits, you’re left responsible for the remainder. This is where an umbrella policy shines—acting as a financial safety net that steps in to cover the excess, protecting your assets from unexpected, high-cost claims.

Unlike basic policies, umbrella insurance:

- Covers claims that your primary insurance might exclude, such as libel, slander, or false arrest.

- Extends protection to incidents that happen outside your home state or country.

- Provides additional liability coverage beyond standard policy limits, often in increments of $1 million.

- Offers peace of mind by safeguarding your savings, investments, and future earnings against lawsuits.

How Umbrella Insurance Protects Your Assets and Future Income

When unexpected events occur, your standard insurance policies might not provide enough coverage to shield your valuable assets. This is where umbrella insurance steps in as a crucial safety net. It offers an additional layer of protection that kicks in after your primary policies reach their limits, ensuring that your savings, investments, and property remain secure. Whether it’s a major liability claim or a lawsuit that could potentially drain your financial resources, umbrella insurance can cover legal fees, medical bills, and damages that might otherwise jeopardize your financial stability.

Some key benefits of this extra coverage include:

- Broader coverage scope: Protection extends beyond the confines of auto, home, or boat insurance policies.

- Income preservation: Safeguards your future earnings by preventing wage garnishments in liability claims.

- Peace of mind: Knowing your wealth and lifestyle are defended against unforeseen catastrophes.

When to Consider Adding Umbrella Insurance to Your Coverage

Knowing the right moment to boost your insurance portfolio can be a game-changer when it comes to protecting your assets and peace of mind. If you’ve recently experienced life changes such as purchasing a new home, expanding your family, or significantly increasing your net worth, it’s a smart idea to consider an extra safety net. Umbrella insurance steps in when your primary policies, like auto or homeowners insurance, might fall short—especially in scenarios where lawsuits or claims extend beyond your typical coverage limits.

Consider reaching for this supplemental protection if you:

- Own valuable assets that exceed the liability limits of your current policies.

- Engage in hosting or renting out property regularly, increasing your exposure to liability.

- Participate in activities with higher risk, such as coaching youth sports or volunteering in community events.

- Desire peace of mind from unforeseen legal claims that could impact your financial stability.

Tips for Choosing the Right Umbrella Insurance Policy for Your Needs

When selecting an umbrella insurance policy, it’s essential to consider more than just the price tag. Begin by evaluating your total assets and potential risks. Think beyond your home and car — include savings, investments, and other valuables that could be vulnerable in a lawsuit. Policies often come with coverage limits, so choose one that comfortably exceeds your net worth to ensure full protection. Additionally, review the policy’s exclusions carefully, as some may not cover specific types of claims that could be relevant to your lifestyle.

Don’t forget to assess the umbrella policy’s interaction with your existing insurance. Ideally, an umbrella should supplement your current plans seamlessly. Look for features such as broader liability coverage that could cover claims like libel or slander, which are not always included in standard policies. It’s also wise to consult with an insurance professional who can tailor recommendations to your unique circumstances. Remember, investing time in research now saves you stress and financial strain later if you ever need your umbrella policy.

- Check the minimum underlying coverage requirements before purchasing.

- Compare deductibles and how they affect your out-of-pocket costs.

- Ask about worldwide coverage if you travel frequently.

- Verify the insurer’s reputation for claims handling and customer service.

In Summary

At the end of the day, life is full of surprises—some good, some not so much. Umbrella insurance acts as that trusty extra layer of protection, giving you peace of mind when the unexpected happens. It’s not just about safeguarding your assets; it’s about protecting your future and everything you’ve worked so hard to build. So, whether you’re new to insurance or looking to beef up your coverage, think of umbrella insurance as your safety net in a world of uncertainties. Stay safe, stay covered, and keep enjoying life without the extra worry!