When it comes to running a home health care business, safety and security are always top priorities. After all, you’re not just providing care—you’re building trust with clients and their families. But with the many risks involved in home health services, from unexpected accidents to liability claims, having just the basic insurance coverage might not cut it. That’s where umbrella insurance comes in. Think of it as an extra layer of protection that helps keep your business—and your peace of mind—safe, no matter what comes your way. In this post, we’ll explore why umbrella insurance is a smart move for home health providers who want to boost their safety net and focus more on what really matters: care.

Table of Contents

- Why Home Health Providers Need Umbrella Insurance for Extra Protection

- Understanding the Key Coverage Areas That Umbrella Insurance Extends

- How Umbrella Insurance Helps Manage Liability Risks in Home Care

- Practical Tips for Choosing the Right Umbrella Policy for Your Home Health Service

- To Conclude

Why Home Health Providers Need Umbrella Insurance for Extra Protection

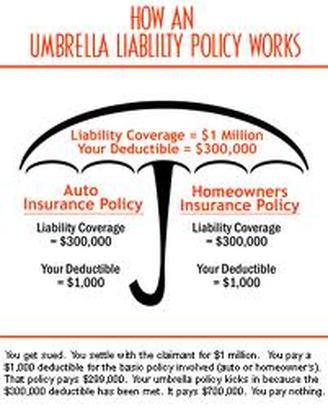

Home health providers operate in environments filled with unpredictable variables. While general liability and professional insurance cover many scenarios, unforeseen events can easily surpass those limits, potentially putting personal and business assets at risk. Having umbrella insurance means an extra layer of financial protection kicks in when standard policies reach their cap. This supplementary coverage can be a true lifesaver for cases involving large medical lawsuits, property damage, or accidental injuries that exceed primary policy limits, offering peace of mind amid the uncertainties of daily care work.

Beyond the added financial security, umbrella insurance often includes perks that standard coverage lacks. For example, it can cover legal fees, defense costs, and claims that might be excluded elsewhere. Key benefits include:

- Broader coverage scope – protection extends beyond typical liability claims

- Affordable premiums relative to the high coverage limits

- Safeguarding personal assets in the event of a lawsuit exceeding business policy limits

- Coverage for reputational claims such as libel or slander that may arise in day-to-day operations

Investing in umbrella insurance isn’t just a smart business move—it’s an essential strategy that supports long-term sustainability and builds trust with clients who value responsibility and preparedness.

Understanding the Key Coverage Areas That Umbrella Insurance Extends

Home health providers navigate a unique landscape filled with both rewarding experiences and hidden risks. Umbrella insurance steps in as a robust safety net by covering liabilities that traditional policies might miss. Beyond the usual medical malpractice and property damage, it extends protection to areas like personal injury claims, legal defense costs, and incidents involving non-medical accidents. This means if a client slips and falls or if a defamation lawsuit arises from an online review, umbrella insurance can help absorb the financial shock, ensuring that your commitment to care doesn’t get derailed by unexpected legal hurdles.

Some key protection benefits include:

- Supplementing liability limits from primary policies, providing an extra layer of security

- Covering libel, slander, or invasion of privacy claims which can occur in close client interactions

- Supporting defense costs even if a claim is groundless, offering peace of mind when facing legal challenges

- Extending coverage to incidents involving hired aides or subcontractors under your care

This comprehensive guardrail allows home health providers to focus on what truly matters — offering personalized, compassionate care — without constantly worrying about potential financial exposures. By weaving umbrella insurance into your risk management strategy, you boost both your protection and your professional confidence.

How Umbrella Insurance Helps Manage Liability Risks in Home Care

When working in home health care, providers often face a spectrum of liability risks that can feel overwhelming. Umbrella insurance steps in as a crucial safety net, offering coverage beyond the limits of standard policies. This means that if an unexpected event arises—like a lawsuit involving bodily injury or property damage—the extra protection can cover costs that might otherwise come out of pocket. For home health providers, this added layer brings peace of mind, allowing them to focus on delivering compassionate care without constantly worrying about potential financial fallout.

Beyond just extending coverage limits, umbrella insurance also covers scenarios that typical home or professional liability policies may exclude. For example, it might provide protection against certain personal injury claims or incidents occurring off-site, which are increasingly common in home care settings. Some key benefits include:

- Broader coverage for lawsuits and legal fees that exceed primary policy limits

- Protection against claims of libel, slander, or defamation

- Coverage for incidents involving non-business activities that still impact your liability risk

This extended coverage is especially valuable for small-scale providers and agencies looking to safeguard not just their business, but also their personal assets.

Practical Tips for Choosing the Right Umbrella Policy for Your Home Health Service

When selecting an umbrella policy for your home health service, start by evaluating your existing liability coverage. Umbrella insurance is designed to extend your current policies, so understanding where your gaps lie is crucial. Look closely at the coverage limits on your general liability, professional liability, and commercial auto insurance, then choose an umbrella policy that boosts those limits significantly. Remember, it’s not just about having more coverage but ensuring the additional protection aligns with the unique risks your home health business faces, such as client injuries, property damage, or legal claims.

Next, consider the reputation and flexibility of the insurance provider. You want a company that not only offers comprehensive umbrella policies but also supports you with clear claims processes and responsive customer service. Ask about customizable add-ons and exclusions to tailor the coverage precisely to your needs. Also, assess policy limits and exclusions carefully—some umbrella policies may exclude certain liabilities common in health services. Make a checklist of your priorities and don’t hesitate to consult with an insurance expert who understands home health industry risks to ensure you’re making the best investment in your business’s safety net.

- Review existing liability limits and coverage gaps

- Choose a policy that significantly increases protection limits

- Research the insurer’s customer support and reputation

- Explore customizable options and add-ons

- Consider exclusions relevant to home health services

To Conclude

In the unpredictable world of home health care, having umbrella insurance isn’t just a smart choice — it’s a vital layer of protection that helps keep both providers and patients safe. By going beyond standard coverage, umbrella insurance offers peace of mind, financial security, and the confidence to focus on what truly matters: delivering quality care. If you’re a home health provider looking to safeguard your practice and your future, umbrella insurance is definitely worth considering. Stay protected, stay confident, and keep making a difference!