When it comes to the things and people we hold dear, there’s an unspoken promise we make—to protect, to care, and to safeguard their future. Whether it’s your home, your family, or your most cherished possessions, having comprehensive coverage offers more than just peace of mind; it’s a lifeline when life takes unexpected turns. In this article, we’ll explore why comprehensive coverage matters and how it can be the safety net that helps you protect what you love most, ensuring that no matter what happens, you’re prepared to face it with confidence and resilience.

Table of Contents

- Understanding the True Value of Comprehensive Coverage

- Protecting Your Loved Ones from Unforeseen Risks

- Tailoring Your Coverage to Fit Your Unique Needs

- Practical Steps to Strengthen Your Insurance Protection

- To Wrap It Up

Understanding the True Value of Comprehensive Coverage

Comprehensive coverage goes beyond the basics, offering a safety net that shields you from unexpected challenges. It’s not just about protecting a single item or event—it’s about preserving peace of mind across all areas that matter most in your daily life. From safeguarding your home and belongings against natural disasters to ensuring your vehicle and personal assets remain secure, this coverage adapts to life’s unpredictable moments, providing a cushion when you need it most.

By choosing a protection plan that encompasses a wide range of risks, you gain access to benefits like:

- Financial security during emergencies, reducing out-of-pocket expenses

- Support services that streamline claims and repairs, helping you recover faster

- Customized options tailored to your unique lifestyle needs and assets

- Long-term assurance as your life and priorities evolve

Comprehensive protection isn’t just an expense—it’s an investment in safeguarding what you love most, offering reassurance when life throws curveballs your way.

Protecting Your Loved Ones from Unforeseen Risks

When it comes to safeguarding the people we cherish most, there’s a profound peace in knowing they’re shielded from life’s unexpected turns. Comprehensive coverage acts as a robust safety net, ensuring that regardless of what the future holds, your loved ones are not left vulnerable. It’s more than just a policy—it’s a commitment to preserving their well-being and financial stability during times of crisis. This kind of protection acknowledges the unpredictable nature of life, preparing you for scenarios that many might overlook but can have lasting impacts.

Key benefits of comprehensive protection include:

- Financial Security: Provides monetary support that helps cover medical bills, property damage, or income loss.

- Emotional Relief: Alleviates stress by knowing your family’s future isn’t jeopardized by unforeseen events.

- Holistic Coverage: Addresses a wide range of risks rather than focusing on single, isolated incidents.

- Peace of Mind: Fosters confidence that your loved ones will be cared for no matter what challenges arise.

Tailoring Your Coverage to Fit Your Unique Needs

Insurance is not a one-size-fits-all solution. Each person’s life, assets, and priorities are different, making it essential to customize your policy rather than settling for standard packages. By identifying what matters most—be it your home, car, health, or valuables—you can select options that offer meaningful protection without paying for unnecessary extras. Consider factors such as your lifestyle, budget, and risk tolerance, and remember that your coverage should evolve alongside the changes in your life.

When tailoring your coverage, focus on these key elements to ensure it feels truly personal and supportive:

- Evaluate your risk exposure: Understand what risks you face daily and which ones could impact your financial stability.

- Prioritize essential assets: Protect items and areas of your life that would be hardest to recover or replace.

- Customize deductibles and limits: Balance your premium costs with deductibles to create affordable yet adequate protection.

- Add riders or endorsements: These can fill gaps in coverage, offering peace of mind for unique situations or possessions.

Practical Steps to Strengthen Your Insurance Protection

Taking control of your insurance starts with a clear understanding of what risks you face and the assets that need protection. Begin by conducting a thorough review of your existing policies to identify any gaps or overlaps. Gather all relevant documents and make notes about coverage limits, deductibles, and exclusions. Don’t hesitate to consult with a trusted insurance advisor who can provide expert insights tailored to your unique situation. Remember, insurance isn’t a one-size-fits-all solution — it’s about crafting a safety net designed specifically for your life and possessions.

Once you have a comprehensive overview, consider these practical measures to bolster your protection:

- Increase coverage limits where necessary to avoid underinsurance, especially for high-value items or newly acquired assets.

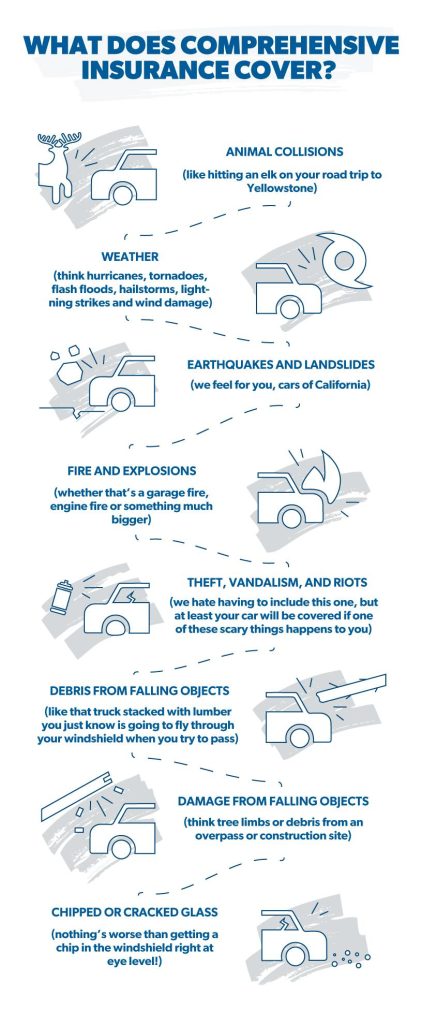

- Add riders or endorsements for specialized protection, such as flood or earthquake insurance that may not be included in standard policies.

- Bundle policies to often receive discounts and simplify management by consolidating your auto, home, and life insurance under one provider.

- Regularly update your beneficiary designations and personal information to ensure claims are processed smoothly when it matters most.

To Wrap It Up

In the end, comprehensive coverage is more than just a policy—it’s a promise to safeguard the moments, memories, and people you hold dear. Life is beautifully unpredictable, and having the right protection in place offers not only financial security but also peace of mind. When you invest in comprehensive coverage, you’re choosing to protect what you love most, so you can focus on what truly matters: living fully, loving deeply, and embracing whatever comes next with confidence. Remember, it’s not just about preparing for the unexpected; it’s about nurturing the life you’ve built and ensuring it continues to thrive.