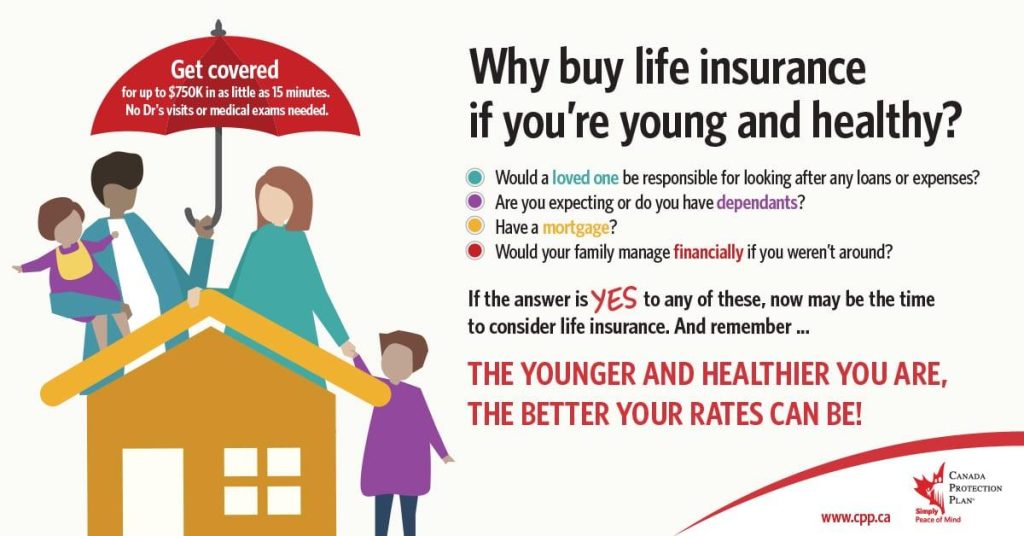

Hey there! Thinking about life insurance might not be at the top of your fun-to-do list, especially when you’re young and healthy. But here’s the thing: buying life insurance early can actually be one of the smartest financial moves you make. Not only does it often mean lower premiums, but it also sets you up with peace of mind and financial security down the road. In this article, we’re diving into why snapping up life insurance while you’re young isn’t just a responsible choice — it’s a savvy one. Let’s break it down!

Table of Contents

- The Long-Term Financial Benefits of Early Life Insurance Ownership

- How Lower Premiums Save You More Over Time

- Peace of Mind for You and Your Loved Ones from Day One

- Choosing the Right Policy for Your Age and Lifestyle

- In Conclusion

The Long-Term Financial Benefits of Early Life Insurance Ownership

Investing in life insurance at a young age opens the door to substantial financial advantages over time. Premiums tend to be significantly lower for younger applicants because insurers factor in reduced health risks and longer coverage periods. Locking in these rates early means you can enjoy affordable protection that doesn’t spike with age. Additionally, policies purchased when you’re young often build cash value faster, providing a growing nest egg that can be borrowed against or used in times of need. This makes life insurance not just a safety net but also a versatile financial tool that supports your long-term goals.

Another powerful benefit is the increased flexibility and options available with early ownership. Starting young gives you the opportunity to customize your coverage as your life evolves — from boosting your death benefit when you start a family to leveraging riders that tailor protection to your unique needs. Here are some perks to keep in mind:

- Lower Lifetime Premiums: Pay less overall by securing affordable rates early.

- Cash Value Growth: Build savings that you can tap into for emergencies or investment opportunities.

- Financial Security: Protect loved ones against debt or unforeseen expenses long before major life events.

- Peace of Mind: Enjoy confidence knowing your coverage is locked in, no matter how life changes.

By taking advantage of these long-term benefits, you’re not just purchasing a policy—you’re making a smart financial choice that pays dividends beyond coverage.

How Lower Premiums Save You More Over Time

Locking in life insurance at a young age means securing much lower premiums than you would later in life. Because insurers base rates partly on age and health, starting early means less risk for them—and more savings for you. Over time, those smaller monthly payments add up significantly, freeing up your budget for other important priorities like investing, education, or a family vacation.

Consider the advantages beyond just the immediate cost savings:

- Stable Rates: Premiums often remain level throughout the policy, so you avoid sudden hikes as you grow older or encounter health issues.

- More Coverage for Less: Younger buyers can often afford higher coverage, protecting your loved ones more comprehensively.

- Financial Flexibility: Paying less early on means you can reallocate funds to build an emergency fund or other long-term goals.

Overall, paying less now translates into smarter financial health down the road, making it an incredibly savvy move to start your life insurance journey sooner rather than later.

Peace of Mind for You and Your Loved Ones from Day One

Starting a life insurance policy early means locking in lower premiums that stay with you throughout the years, giving you financial security without breaking the bank. As life grows more complex—with new responsibilities, career milestones, and loved ones depending on you—having coverage in place ensures that sudden expenses or unexpected losses don’t derail your family’s future. Beyond just the numbers, there’s a profound comfort in knowing that protection is already set up, allowing you to focus on enjoying life’s moments without worry.

By securing a policy young, you gain flexibility and options that aren’t available later in life. Early enrollment often means fewer health questions and a smoother approval process. Plus, as your needs evolve, many policies offer the chance to adapt coverage to fit new life stages. Consider the benefits:

- Affordable premiums locked in early, saving money over time

- Financial safety net that supports loved ones in difficult times

- Peace of mind knowing you are prepared for the unexpected

- Opportunity to build cash value with certain types of policies

Choosing the Right Policy for Your Age and Lifestyle

When selecting a life insurance policy, it’s crucial to align the coverage with both your current age and lifestyle needs. Younger individuals often have a wider range of options, from term life insurance that offers affordable rates and straightforward coverage to whole life policies that build cash value over time. Consider factors like your financial responsibilities, health status, and future goals—whether you’re planning for a family, buying a home, or investing in your career. A policy tailored to your unique stage of life ensures you’re not overpaying for coverage you don’t need or under-protected during critical years.

Keep in mind the importance of flexibility. For example, some policies allow you to convert term insurance to a permanent one later, providing peace of mind as your circumstances evolve. Look for features such as:

- Affordable premiums minimized by your young age

- Options for riders that add extra protection

- Coverage amounts aligned with current and anticipated financial obligations

- Simple application processes, especially if you’re in good health

By carefully matching your policy to your lifestyle, you’ll maximize benefit and value, making early life insurance a genuinely smart investment in your financial security.

In Conclusion

In the end, buying life insurance when you’re young isn’t just about preparing for the unexpected—it’s a smart financial move that sets you up for greater peace of mind and security down the road. The earlier you start, the more you’ll save, and the stronger your safety net becomes. So, if you haven’t already, consider taking that step today. Your future self will thank you!