When it comes to planning for your financial future, insurance is often a key piece of the puzzle. Among the many options out there, whole life insurance stands out as a choice that promises lifelong coverage and a savings component — but it’s not without its quirks. In this post, we’re diving into the good and the not-so-good of whole life insurance to help you decide if it’s the right fit for you. Whether you’re a first-timer exploring your options or just curious about how this type of policy works, we’ll break down the essentials in a friendly, easy-to-understand way. Let’s get started!

Table of Contents

- Understanding Whole Life Insurance and How It Works

- The Benefits That Make Whole Life Insurance Stand Out

- The Drawbacks You Should Consider Before Committing

- Tips for Choosing the Right Whole Life Insurance Policy for You

- Wrapping Up

Understanding Whole Life Insurance and How It Works

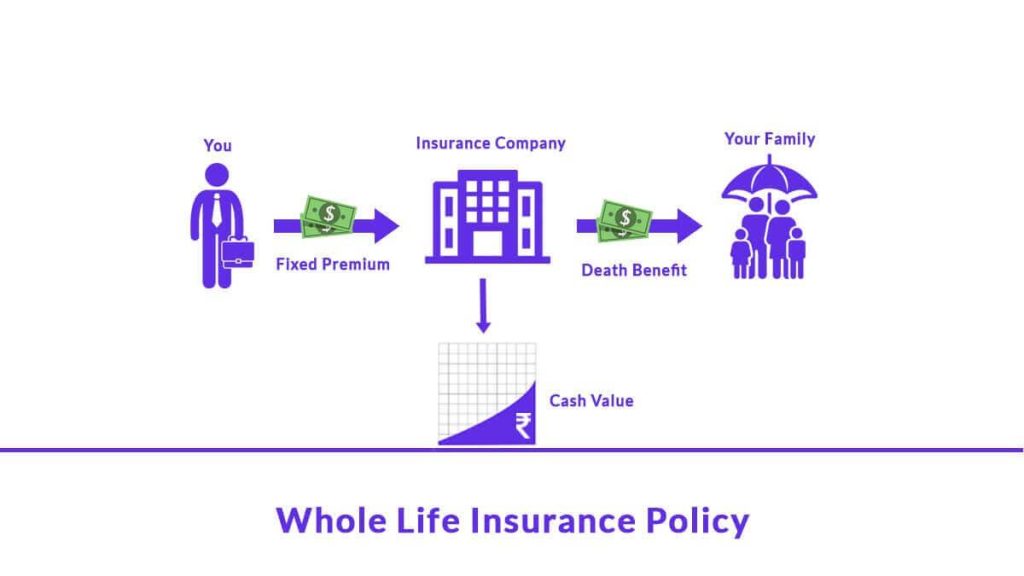

Whole life insurance is a unique type of policy that combines lifelong coverage with a savings component, often referred to as the cash value. Unlike term insurance, which only provides protection for a set period, this policy lasts for your entire life as long as the premiums are paid. Each payment you make not only contributes to the insurance but also accumulates savings that grow tax-deferred over time. This dual feature offers a sense of security, ensuring your beneficiaries receive a payout while you also build an additional financial asset.

Some aspects to keep in mind about whole life insurance include:

- Fixed premiums: Your payments generally remain the same throughout the policy’s life, making budgeting easier.

- Cash value access: You can borrow against the cash value during your lifetime, which may be helpful in emergencies—though it affects the death benefit.

- Potential dividends: Some policies pay out dividends that can be taken as cash or reinvested to increase your policy’s value.

While this type of insurance can be a great tool for long-term planning and financial protection, it’s important to weigh these benefits against costs and personal goals before deciding if it fits your needs.

The Benefits That Make Whole Life Insurance Stand Out

Whole life insurance offers more than just a death benefit—it builds cash value that grows over time, providing a unique financial advantage. This means your policy isn’t just a safety net for your loved ones; it’s also an asset you can tap into during your lifetime. The cash value component can be borrowed against for emergencies, education expenses, or even to supplement retirement income. Unlike term insurance, whole life policies come with fixed premiums that won’t increase as you age, offering peace of mind and predictability in your financial planning.

- Lifetime coverage: Protection that doesn’t expire as long as premiums are paid.

- Tax-deferred growth: Cash value grows without immediate tax implications.

- Dividend potential: Some policies pay dividends, which can increase your cash value or reduce premiums.

- Financial flexibility: Use the accumulated cash value to cover unexpected expenses without complicated credit checks.

Another compelling aspect is the ability to leave a lasting legacy. Whole life insurance can serve as an inheritance tool, ensuring your heirs receive not only a lump sum but also the benefit of a policy that has potentially increased in value over time. This unique blend of stability, growth, and legacy planning distinguishes whole life insurance as a powerful component of a well-rounded financial strategy.

The Drawbacks You Should Consider Before Committing

Committing to whole life insurance means locking yourself into a policy that often comes with higher premiums compared to term insurance. While the lifelong coverage sounds appealing, the cost can become a significant financial burden, especially if your budget is tight or changes over time. Additionally, the complexity of whole life policies can be overwhelming. Unlike term policies that offer straightforward protection, whole life insurance involves a cash value component that grows over time—this can be a double-edged sword, requiring more attention to understand how your premiums, interest, and dividends interact.

There are also some less obvious downsides that can catch policyholders off guard, such as:

- Limited flexibility: Whole life policies are less adaptable to changes in your life circumstances or financial goals.

- Slow cash value growth: The cash value builds gradually and may not provide substantial returns early on.

- Potential surrender charges: If you decide to cancel your policy within the first several years, you could face penalties that eat into your investment.

Before diving in, make sure you weigh these factors carefully to ensure your insurance fits both your needs and your wallet.

Tips for Choosing the Right Whole Life Insurance Policy for You

Start by evaluating your financial goals and overall budget. Whole life insurance is a long-term commitment, so it’s crucial to understand how much you can comfortably invest without sacrificing other priorities. Don’t forget to factor in the policy’s cash value component—does it grow at a rate that meets your expectations? Comparing the premium costs and benefits from various insurers helps ensure you get value for your money without unexpected financial strain. Remember, the cheapest option isn’t always the best; focus on quality and reliability.

Pay special attention to the insurer’s reputation and policy flexibility. Look for companies with strong financial stability ratings and positive customer reviews, as this affects claim processing and the security of your investment. Flexibility matters too—some policies allow you to adjust premiums or death benefits as life changes. Check if there are options to borrow against the cash value or customize riders that suit your specific needs. By knowing what features align with your future plans, you’ll pick a policy that serves you well through life’s twists and turns.

- Compare multiple quotes and coverage options

- Understand fees, penalties, and surrender charges

- Consider guaranteed vs. non-guaranteed elements

- Ask about dividend performance history

- Consult with a licensed insurance advisor for personalized advice

Wrapping Up

Wrapping things up, whole life insurance is definitely not a one-size-fits-all solution. While its lifelong coverage and cash value benefits can be a great fit for some, the higher premiums and complexity might not appeal to everyone. The key is understanding your own financial goals and needs before making a decision. Whether you’re looking for stability, a way to build cash value over time, or just peace of mind, whole life insurance has its perks—and its pitfalls. Hopefully, this rundown has helped you see both sides of the coin so you can make a choice that’s right for you. If you’re still on the fence, chatting with a trusted financial advisor can clear up any lingering questions. Here’s to making smart, informed decisions that protect your future!