Being a landlord comes with plenty of perks — like earning rental income and building your investment — but it also comes with its fair share of worries. One way to ease those concerns is by having the right landlord insurance in place. If you’re new to the world of rental properties or just want to understand your coverage better, you’re in the right spot. In this friendly guide, we’ll break down what landlord insurance typically covers, helping you feel confident that your property (and your peace of mind) is well protected. Let’s dive in!

Table of Contents

- Understanding Property Damage Protection

- How Liability Coverage Safeguards You as a Landlord

- The Importance of Loss of Rent Insurance

- Tips for Choosing the Right Landlord Insurance Policy

- The Way Forward

Understanding Property Damage Protection

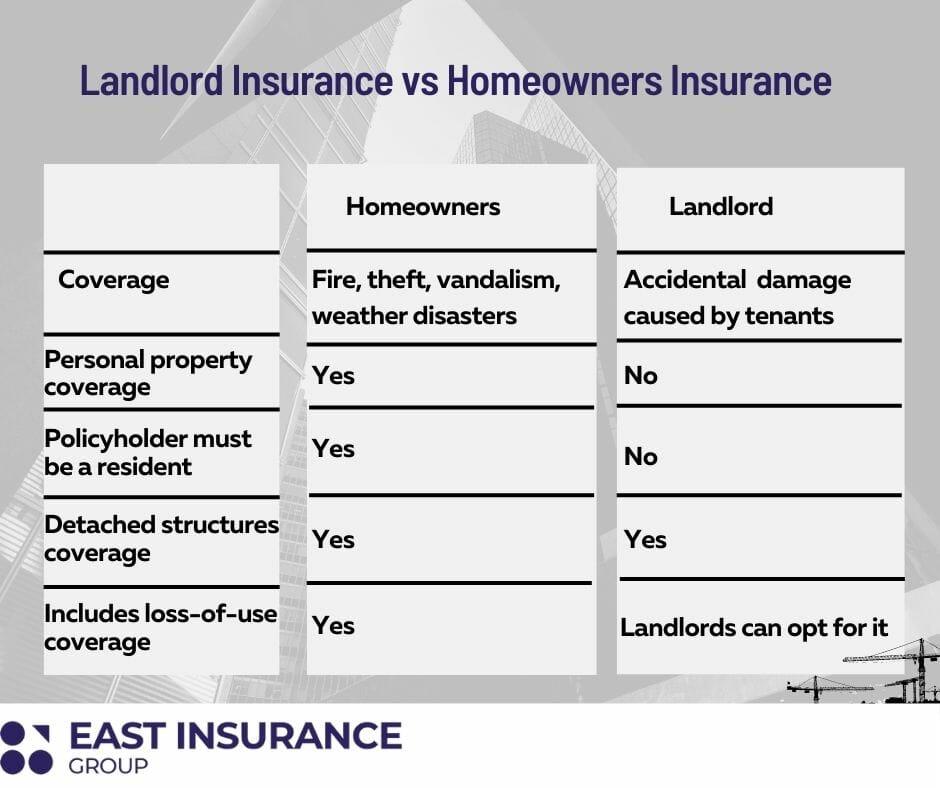

When you hear about protection for your property, it’s easy to think it just means covering major disasters. But property damage protection is much more comprehensive than that. It helps safeguard your investment from a wide range of unexpected events that can leave your rental looking worse for wear. From accidental damage caused by tenants to weather-related issues like hail or windstorms, this coverage ensures you’re not left footing the entire bill for repairs or replacements. Essentially, it acts as a safety net that helps keep your property in good shape and your peace of mind intact.

Here’s what property damage protection typically covers:

- Fire and smoke damage – Should a fire break out, this coverage helps with the cost to repair or rebuild.

- Water damage – From burst pipes to accidental overflows, it supports you in managing clean-up and repairs.

- Storm and natural disaster damage – Wind, hail, and other weather events can cause serious harm, which this insurance can address.

- Vandalism and accidental damage – Whether from tenants or intruders, unexpected damage won’t drain your savings.

With this protection in place, landlords can relax knowing that many common mishaps won’t derail their plans or finances.

How Liability Coverage Safeguards You as a Landlord

When you rent out a property, there’s always a chance that something could go wrong – whether it’s a tenant accidentally causing damage, a slip-and-fall in a common area, or even legal disputes arising from the rental agreement. Liability coverage acts like a safety net, protecting your finances and peace of mind by covering legal fees, medical expenses, and damages if you’re found responsible for injuries or property damage. Essentially, it helps ensure that one unexpected situation won’t turn into a costly nightmare.

This coverage doesn’t just help with accidents inside the rental property—it can also cover incidents that happen in shared areas, such as hallways or driveways, where you still have some responsibility as a landlord. Here are some key protections liability coverage offers:

- Medical payments for guest injuries on your property

- Legal defense costs if you’re sued by a tenant or visitor

- Property damage claims if your negligence causes harm to someone else’s belongings

- Settlement expenses to resolve lawsuits outside of court

With liability coverage baked into your landlord insurance, you’re not just insured against damage to your building—you’re shielded from the expensive fallout of unexpected accidents and claims.

The Importance of Loss of Rent Insurance

Unexpected events like fire, flood, or damage to a rental property can lead to serious financial strain for landlords, especially when tenants have to move out temporarily. This is where loss of rent insurance can be a true lifesaver. It ensures that you continue receiving rental income even if your property becomes uninhabitable due to a covered incident. Without this protection, you could face months without rent while repairs are completed, impacting your ability to cover mortgage payments or other expenses.

Many landlords underestimate how essential this coverage is until they are caught off guard. Aside from protecting your cash flow, it also provides peace of mind by:

- Covering lost rent for a specified period, typically up to 12 months

- Helping maintain a steady income during unexpected property emergencies

- Allowing you to focus on repairs without stressing over finances

Including loss of rent insurance in your landlord policy is a smart way to safeguard your investment and keep your rental business running smoothly no matter what surprises come your way.

Tips for Choosing the Right Landlord Insurance Policy

Choosing the best landlord insurance policy can feel overwhelming, but focusing on what matters most to your rental situation will make the process smoother. Start by prioritizing coverage options that protect your property’s unique risks, such as damage from natural disasters or tenant-related issues. Don’t forget to consider liability protection, which can save you from unexpected legal costs if someone gets injured on your property. Also, check if the policy includes loss of rent coverage, so your income stays steady even if your tenants can’t occupy the place temporarily.

It’s also a smart move to look at the insurer’s reputation for customer service and claim handling — because when something goes wrong, you want quick, helpful support. Comparing quotes is essential, but remember that sometimes the cheapest option isn’t the best. Read the fine print carefully and ask questions like:

- What exactly is covered under the policy?

- Are there exclusions or conditions that might surprise you?

- How flexible is the policy if your needs change?

Choosing wisely today can save you headaches down the line, letting you enjoy the benefits of being a landlord with confidence.

The Way Forward

And there you have it—a straightforward look at what landlord insurance covers! Knowing the basics can give you peace of mind and help protect your investment from unexpected hiccups. Whether it’s damage to your property, liability claims, or lost rental income, having the right coverage can make all the difference. Remember, every landlord’s needs are a bit different, so take the time to explore your options and find a policy that fits you just right. Thanks for stopping by—here’s to happy, stress-free renting!