Losing your job or experiencing a change in employment can bring a lot of uncertainty—especially when it comes to your health insurance. That’s where COBRA coverage steps in as a helpful option to keep your benefits intact. If you’ve heard the term but aren’t quite sure what COBRA is or how it works, don’t worry! In this simple guide, we’ll break down everything you need to know about COBRA coverage, so you can make informed decisions and keep your health insurance when you need it most. Whether you’re facing a job transition or just curious, let’s dive in and make sense of COBRA together!

Table of Contents

- Understanding COBRA Coverage and How It Works

- Who Qualifies for COBRA Benefits and How to Apply

- Tips for Managing Your COBRA Costs to Stay Covered

- Alternatives to COBRA for Continuing Your Healthcare Benefits

- Concluding Remarks

Understanding COBRA Coverage and How It Works

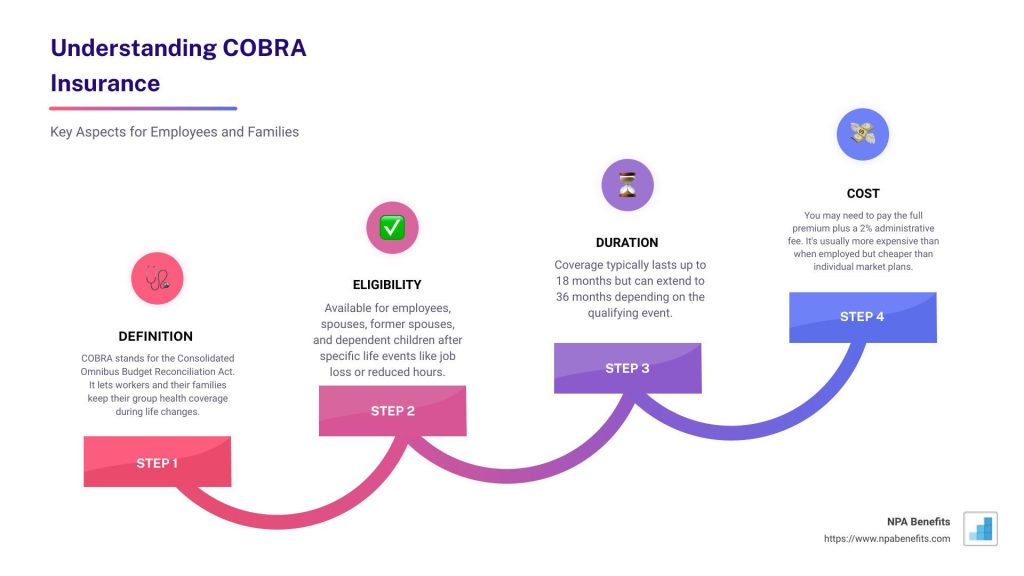

COBRA coverage allows you to maintain your employer-sponsored health insurance temporarily if you experience a qualifying event such as job loss, reduction in work hours, or other life changes. Rather than losing your benefits immediately, COBRA gives you the chance to keep them for up to 18 months (and sometimes longer, depending on circumstances). This safety net ensures you won’t face a gap in health coverage while you transition to a new job or insurance plan. But it’s important to know that while the coverage terms remain similar, you’re typically responsible for paying the full premium—both your share and the portion your employer used to cover.

To qualify and keep your coverage under COBRA, you’ll usually need to follow a few straightforward steps:

- Notification: Your employer or plan administrator must notify you within 14 days of a qualifying event.

- Election Period: You have 60 days to decide whether to accept COBRA and enroll in coverage.

- Premium Payments: Premiums must be paid on time to avoid losing coverage.

Keeping track of deadlines and premium due dates is key. Yes, COBRA coverage might come at a higher cost, but it’s often the fastest way to avoid losing health benefits altogether—offering peace of mind during life’s unexpected transitions.

Who Qualifies for COBRA Benefits and How to Apply

COBRA coverage is designed for individuals who experience a qualifying event that results in the loss of their employer-sponsored health insurance. Typically, this applies to employees (and sometimes their dependents) who have been laid off, had their hours reduced, or left their jobs voluntarily or involuntarily. It also covers spouses and dependent children of employees who undergo life changes like divorce, legal separation, or the death of the covered employee. Small businesses with fewer than 20 employees usually do not fall under COBRA, but might be subject to similar state-level continuation laws known as “mini-COBRA.”

Applying for COBRA benefits requires timely action — usually within 60 days after receiving your COBRA election notice from your former employer or the plan administrator. It’s important to carefully review this notice as it outlines your rights and the steps to continue your coverage. To get started, you’ll need to fill out the election form included and submit your premium payments directly to the plan administrator. Keep in mind, unlike employer coverage, you’ll be responsible for the full premium cost plus a small administrative fee, so budgeting ahead can make this transition much smoother.

Tips for Managing Your COBRA Costs to Stay Covered

Managing COBRA expenses doesn’t have to feel overwhelming. One savvy approach is to review your coverage options carefully and compare costs with alternative plans, such as those offered through the Health Insurance Marketplace. By doing this, you might find a more affordable plan that still meets your healthcare needs. Additionally, consider reaching out to your former employer’s benefits administrator to confirm the exact cost of your COBRA premium—sometimes, administrative fees or payment schedules can be flexible, helping you spread out costs more easily.

Another smart strategy is to take full advantage of any available assistance programs. Many states offer subsidies or financial help for COBRA coverage, which can significantly cut down your monthly payments. Also, keep an eye on deadlines; timely payment is critical to avoid losing coverage. Setting reminders or automating payments can help make sure you stay on track without stress. Remember, staying proactive and informed is key to keeping your benefits intact without breaking the bank.

Alternatives to COBRA for Continuing Your Healthcare Benefits

When COBRA doesn’t seem like the best fit, there are several other options to keep your healthcare coverage intact without breaking the bank. One popular route is enrolling in a health plan through the Health Insurance Marketplace, where you might qualify for subsidies or tax credits based on your income. This option often provides a variety of plans that can be tailored to your budget and health needs. Additionally, if you’re transitioning to a new job, check if your new employer offers health benefits that start immediately, which can often provide seamless coverage without the higher premiums associated with COBRA.

Another alternative is seeking coverage under a spouse’s or domestic partner’s health insurance plan, which can be a cost-efficient solution when available. Short-term health insurance plans also exist, offering temporary coverage that can bridge gaps between jobs or insurance transitions, though it’s important to note these may have limitations in terms of coverage scope. In some cases, Medicaid or other state-specific programs can provide low-cost or no-cost insurance for individuals who qualify, giving you a safety net if your income falls within certain thresholds.

Concluding Remarks

And there you have it—a straightforward look at COBRA coverage and how it can help you keep your health benefits during a transition. While navigating health insurance can feel overwhelming, knowing that COBRA offers a safety net can bring some peace of mind. Remember to weigh your options, keep track of deadlines, and reach out for help if you need it. Staying informed is the best way to protect your health and your wallet. Thanks for reading, and here’s to making confident choices for your coverage!