Navigating health insurance can sometimes feel like decoding a secret language, especially when you come across terms like “out-of-pocket maximum.” But don’t worry—understanding this important part of your insurance plan doesn’t have to be complicated. In this simple guide, we’ll break down what an out-of-pocket maximum really means, why it matters, and how it can help you manage your healthcare expenses with confidence. Whether you’re new to insurance or just need a refresher, we’ve got you covered!

Table of Contents

- What Exactly is an Out-of-Pocket Maximum and Why It Matters

- How Out-of-Pocket Maximums Protect Your Wallet in Health Emergencies

- Common Expenses That Count Toward Your Out-of-Pocket Maximum

- Smart Tips to Choose the Right Plan Based on Your Out-of-Pocket Limits

- Future Outlook

What Exactly is an Out-of-Pocket Maximum and Why It Matters

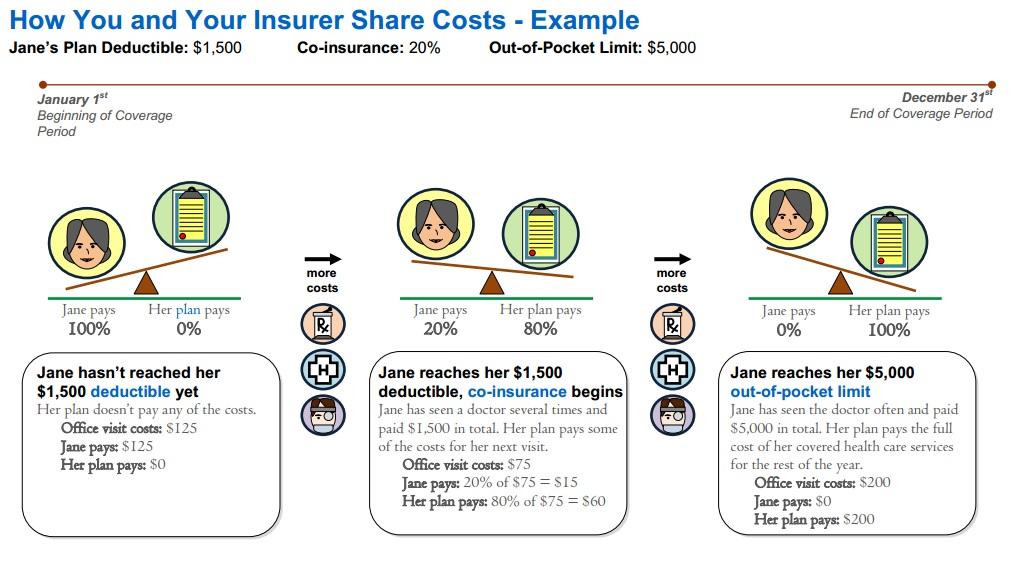

Imagine a safety net in your health insurance—this is essentially what the out-of-pocket maximum acts like. It’s the maximum amount of money you’ll have to pay out of your own pocket for covered medical expenses during a plan year. Once you reach this limit, your insurance company picks up the tab for 100% of covered services. This includes deductibles, copayments, and coinsurance, but it typically doesn’t cover your monthly premiums or services not included in your plan. Knowing this number gives you peace of mind, because it caps your financial responsibility and prevents unexpected, overwhelming medical bills.

Why does this matter so much? Because health care costs can quickly add up, even for routine visits or prescription medications. Having a clear understanding of your out-of-pocket maximum helps you:

- Plan your budget effectively throughout the year

- Make informed decisions about when to seek care

- Compare insurance plans with a real eye on the long-term cost implications

Having this knowledge empowers you to navigate the often confusing world of health insurance with confidence and make smarter choices for your health and your wallet.

How Out-of-Pocket Maximums Protect Your Wallet in Health Emergencies

Imagine facing a sudden health emergency without the fear of endless bills piling up. That’s exactly what the out-of-pocket maximum offers—a financial safety net that shields you from excessive medical expenses. Once you hit this limit, your insurance steps in to cover 100% of the costs for covered services, meaning you won’t have to dig deeper into your savings during tough times.

Here are some key ways this feature can ease your stress and protect your wallet:

- Caps your annual spending: No surprise costs after reaching the maximum.

- Provides peace of mind: You can focus on recovery rather than bills.

- Helps with budgeting: Knowing your max helps plan for worst-case scenarios.

In short, it’s your plan’s promise that when health emergencies happen, financial ruin won’t have to follow.

Common Expenses That Count Toward Your Out-of-Pocket Maximum

When it comes to your health insurance, it’s important to know which costs actually help you reach your out-of-pocket maximum. Typically, the expenses that count include your deductible, copayments, and coinsurance payments. These are the amounts you pay when you visit the doctor, fill prescriptions, or get medical tests done. However, premiums generally do not count toward this limit, so it’s good to keep that in mind when budgeting for healthcare.

Here are some common expenses that usually contribute to your out-of-pocket maximum:

- Doctor’s office visits: Copays or coinsurance for check-ups and specialist appointments.

- Prescription medications: Any medication costs requiring copay or coinsurance.

- Hospital stays: Fees for inpatient care and procedures.

- Lab tests and imaging: Costs linked to blood tests, X-rays, MRIs, etc.

- Emergency room visits: Copays or coinsurance for urgent care.

Smart Tips to Choose the Right Plan Based on Your Out-of-Pocket Limits

When choosing a health plan, it’s crucial to closely examine your out-of-pocket limits as these directly affect your financial risk in case of unexpected medical expenses. Start by thinking about your typical healthcare needs and your risk tolerance. If you prefer peace of mind and want to avoid large expenses, look for plans with lower out-of-pocket maximums, even if the monthly premiums are a bit higher. Conversely, if you’re healthy and rarely visit the doctor, a plan with a higher out-of-pocket limit but lower premium might save you money in the long run.

Keep these smart tips in mind as you compare plans:

- Calculate your worst-case scenario: Add up your deductibles, copays, and coinsurance to see if the out-of-pocket max feels manageable.

- Check which services apply: Make sure the plan’s out-of-pocket max covers all essential services you might need, like prescriptions or specialist visits.

- Consider family vs. individual limits: If you’re insuring dependents, pay attention to combined family caps versus individual ones.

By focusing on these factors, you’ll be able to select a plan that fits your budget without surprising you with unexpected medical bills.

Future Outlook

And there you have it—a simple breakdown of the out-of-pocket maximum! Understanding this key part of your health insurance can take a load off your mind and help you make smarter decisions about your care. Remember, once you hit that limit, your insurer covers the rest of your costs for the year—pretty great peace of mind, right? So keep an eye on those expenses, know your limits, and don’t hesitate to ask questions if anything feels unclear. Here’s to taking control of your health and your budget!