In today’s complex transportation landscape, the relationship between brokers and carriers is more critical than ever. Ensuring that this partnership is safeguarded by the right insurance coverage is not just a legal formality—it’s a cornerstone of trust, risk management, and financial stability. Understanding the role of broker-carrier insurance today means delving into how it protects all parties involved from unforeseen liabilities and helps maintain smooth operations across the supply chain. In this article, we’ll explore why this specialized insurance matters, what it covers, and how it shapes the dynamics between brokers and carriers in an evolving industry.

Table of Contents

- Understanding Broker-Carrier Insurance and Its Critical Importance in Transportation

- Key Components and Coverage Types in Broker-Carrier Insurance Policies

- Assessing Risks and Ensuring Compliance Through Effective Broker-Carrier Insurance

- Best Practices for Choosing and Managing Broker-Carrier Insurance Providers

- In Retrospect

Understanding Broker-Carrier Insurance and Its Critical Importance in Transportation

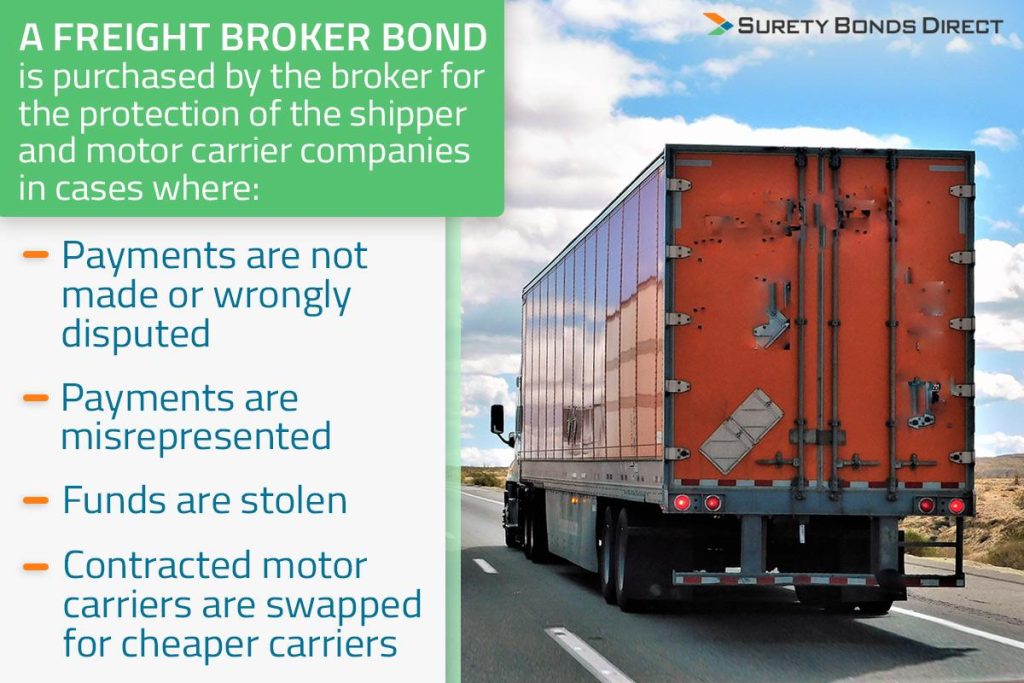

In the complex ecosystem of transportation logistics, broker-carrier insurance emerges as a pivotal safeguard that underpins every successful freight movement. This specialized insurance binds brokers and carriers in a mutual shield, protecting both parties from potential financial losses stemming from accidents, cargo damage, or legal liabilities. Without this essential coverage, brokers could face substantial risks when coordinating shipments with various carriers, while carriers might struggle to secure trust and contracts in an industry that demands certainty and accountability.

Key aspects of broker-carrier insurance include:

- Liability Protection: Covers bodily injury and property damage claims arising during transit, ensuring legal and financial backing.

- Cargo Coverage: Provides security against loss, theft, or damage of goods, directly impacting client satisfaction and carrier credibility.

- Compliance Assurance: Helps brokers and carriers maintain regulatory compliance, a non-negotiable factor in the transportation sector.

- Risk Mitigation: Reduces potential disputes and costly litigation, fostering smoother partnerships within the freight ecosystem.

Key Components and Coverage Types in Broker-Carrier Insurance Policies

The effectiveness of broker-carrier insurance relies heavily on several core components that work in tandem to ensure comprehensive protection and risk management. At its foundation, the policy typically features liability coverage, which safeguards carriers against claims arising from bodily injury or property damage during transit. Another essential element is cargo insurance, designed to cover losses or damages to freight, providing peace of mind to both brokers and carriers. Additionally, many policies incorporate auto physical damage coverage to protect the vehicles themselves against collision, theft, or vandalism. These components create a multi-layered shield that decreases financial exposure and supports operational continuity.

Beyond the foundational coverage types, broker-carrier insurance can include specialized endorsements tailored to the specific needs of the logistics industry. For instance, policies may offer coverage for non-traditional freight, hazardous materials handling, and even contingent cargo liability. This flexibility is critical, as it allows brokers and carriers to adapt their risk management strategies to evolving market demands and regulatory landscapes. Some notable coverage options include:

- General liability: Protection against third-party claims unrelated to vehicle operation.

- Workers’ compensation: Coverage for employee injuries sustained while on the job.

- Excess liability: Additional limits beyond primary coverage to guard against catastrophic losses.

- Cyber liability: Emerging importance as logistics rely more on digital technologies.

Assessing Risks and Ensuring Compliance Through Effective Broker-Carrier Insurance

Effectively managing risks in the broker-carrier relationship is paramount to maintaining operational integrity and protecting all parties involved. Insurance serves as a critical safety net, mitigating potential financial burdens that arise from accidents, cargo damage, or legal claims. Brokers must ensure that carriers hold appropriate coverage levels—not only to comply with regulatory mandates but also to safeguard their own business interests. This includes verifying insurance certificates, understanding policy limits, and recognizing the nuances of coverage types such as liability, cargo, and workers’ compensation. A proactive approach to risk assessment reduces exposure to unforeseen liabilities and fosters trust, ultimately strengthening business partnerships.

Key components to focus on when ensuring compliance include:

- Regularly reviewing carrier insurance certificates for validity and adequacy

- Understanding state and federal insurance requirements for operating carriers

- Utilizing technology platforms to track insurance expirations and renewals

- Collaborating closely with insurance providers and legal advisors to interpret policy coverage

By embedding these strategies into daily workflows, brokers can create transparent, compliant, and resilient freight management frameworks that withstand the evolving complexities of transportation risk. This vigilance not only protects financial interests but also fosters an industry culture centered on accountability and professionalism.

Best Practices for Choosing and Managing Broker-Carrier Insurance Providers

Choosing the right insurance provider is pivotal for ensuring seamless operations and protecting businesses from unforeseen liabilities. Start by conducting thorough research to evaluate providers’ track records and financial stability. Look beyond premiums—assess their claims process efficiency, customer service responsiveness, and the breadth of coverage options. Establishing a clear line of communication with your provider ensures a collaborative relationship, enabling rapid responses to any changes in your operations or risk profile.

Effective management goes beyond selection; it requires continuous oversight and proactive engagement. Maintain detailed documentation of all policies and claims, and schedule regular reviews to confirm alignment with your evolving business needs. Leverage digital tools for monitoring policy renewals and regulatory compliance, ensuring you never face gaps in coverage. Remember to:

- Regularly review and update your coverage as your business grows or shifts.

- Work closely with risk management teams to identify emerging threats.

- Foster transparency to minimize disputes and expedite claims processing.

In Retrospect

In today’s rapidly evolving transportation landscape, broker-carrier insurance stands as a critical pillar ensuring trust, compliance, and financial protection for all parties involved. Understanding its role is no longer optional but essential for brokers and carriers aiming to navigate industry complexities confidently. By prioritizing proper insurance coverage and staying informed about regulatory requirements, businesses can safeguard their operations and build stronger partnerships. As the market continues to change, keeping a clear grasp on broker-carrier insurance will remain key to sustaining success and resilience in this competitive field.