When it comes to hitting the open road in an RV, understanding the different types of recreational vehicles is just the beginning. Equally important—but often overlooked—is knowing how insurance coverage varies across these diverse RV categories. Whether you’re a weekend warrior with a pop-up camper or a full-time traveler in a Class A motorhome, choosing the right insurance can protect your investment and provide peace of mind during your adventures. In this article, we’ll break down the main types of RVs and explore the insurance options tailored to each, helping you make informed decisions before your next journey begins.

Table of Contents

- Types of Recreational Vehicles and Their Unique Insurance Needs

- Key Factors to Consider When Choosing RV Insurance Coverage

- Comparing Comprehensive, Liability, and Collision Insurance for Your RV

- Expert Tips for Finding the Best Insurance Policies for Different RV Types

- In Summary

Types of Recreational Vehicles and Their Unique Insurance Needs

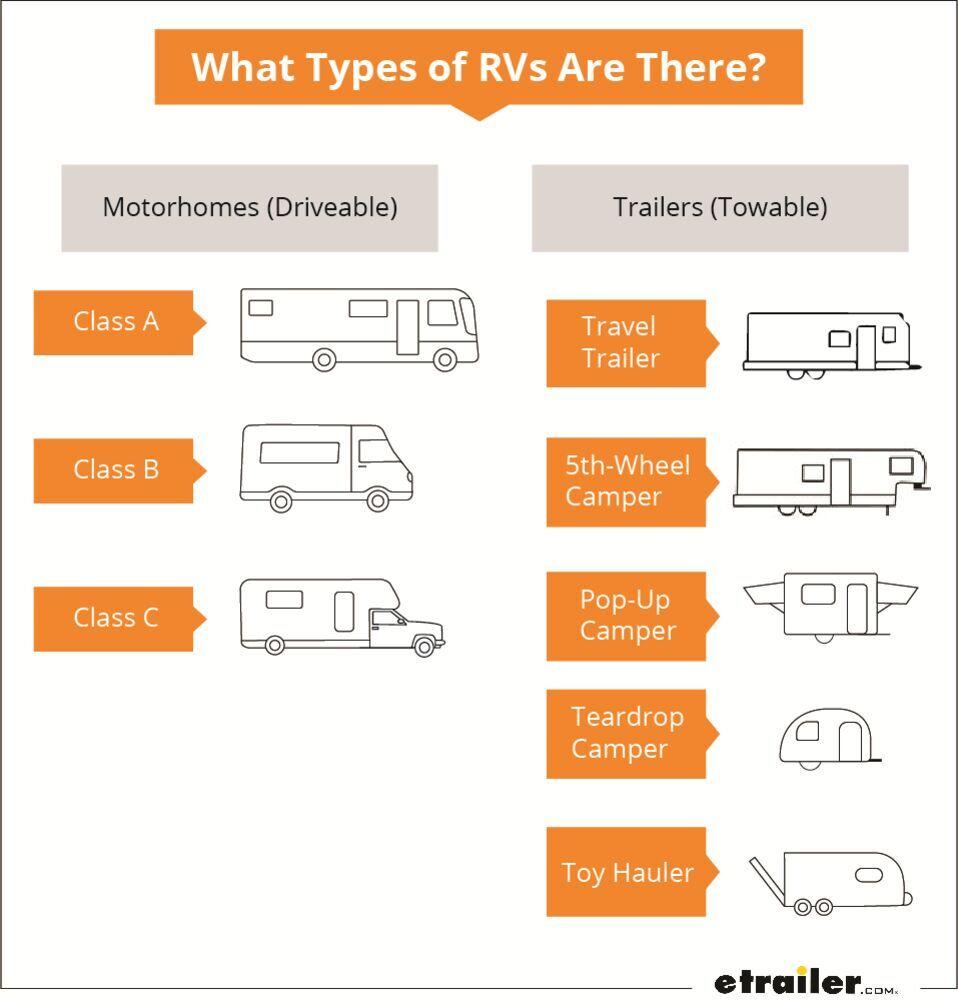

When it comes to recreational vehicles, each type demands tailored insurance coverage to meet its distinct characteristics and usage patterns. Class A motorhomes, known for their luxury and size, often require comprehensive policies that cover high repair costs, potential liability, and even specialized roadside assistance. Meanwhile, travel trailers and fifth wheels typically need separate insurance from the towing vehicle, focusing on protection from damage during transit, as well as storage and liability coverage when parked. For smaller, more agile vehicles like Class B vans, policies might blend personal auto and RV insurance features to reflect their dual-purpose nature.

Additionally, unique insurance needs arise from the way RV owners use their vehicles. For example, those who rent their RVs or rely on them for extended travel may need added coverage such as rental reimbursement or increased liability limits. Furthermore, park models and pop-up campers generally require tailored policies emphasizing vandalism, weather damage, and off-season protection. Understanding these distinctions is essential for securing the right insurance that not only protects your investment but also offers peace of mind whenever you hit the road or settle in a favorite spot.

Key Factors to Consider When Choosing RV Insurance Coverage

When selecting insurance for your RV, it’s crucial to evaluate several essential factors that directly impact your coverage. Start by assessing the type of RV you own—whether it’s a motorhome, travel trailer, fifth wheel, or pop-up camper—as each has unique insurance requirements and risk profiles. Additionally, consider the usage frequency and travel habits; RVs used for occasional vacations require different coverage levels compared to full-time mobile living. Think about the value and age of your RV, too, since these influence both premiums and the need for comprehensive or specialized policies.

Another critical aspect involves reviewing the types of protection that will safeguard both your investment and your personal liability. Common coverage options include:

- Liability insurance: Protection against damages or injuries you may cause.

- Comprehensive coverage: Guards against theft, vandalism, and natural disasters.

- Collision coverage: Covers repairs needed after an accident.

- Personal belongings protection: Insures your RV’s interior contents.

- Emergency roadside assistance: Offers support in case of breakdowns during travel.

Ensuring your policy aligns with your specific RV type and lifestyle will help you maximize protection without unnecessary expense. Always compare insurers and policy details to find the coverage that best fits your adventure needs.

Comparing Comprehensive, Liability, and Collision Insurance for Your RV

When it comes to insuring your RV, understanding the differences between comprehensive, liability, and collision coverage is essential for protecting your investment on the road. Comprehensive insurance offers protection against a wide range of risks outside of accidents, such as theft, vandalism, natural disasters, and even damage caused by falling objects or animals. This coverage is particularly valuable if your RV is parked for extended periods or if you travel through areas prone to environmental hazards. Keep in mind that comprehensive insurance usually involves a deductible, but it can save you from unexpected out-of-pocket expenses resulting from non-collision incidents.

On the other hand, liability insurance is mandatory in most states and focuses on covering damages or injuries you may cause to others while operating your RV. This form of insurance doesn’t protect your vehicle but offers crucial financial protection if you’re found at fault in an accident. Collision insurance complements liability by covering repairs to your RV if you’re involved in a collision, regardless of who is at fault. Together, these coverages ensure a well-rounded safety net, balancing legal requirements with practical protection for both your RV and your peace of mind.

- Comprehensive: Protects against theft, weather damage, and animal collisions.

- Liability: Covers bodily injury and property damage you cause to others.

- Collision: Pays for repairs to your RV after a crash.

Expert Tips for Finding the Best Insurance Policies for Different RV Types

When shopping for the ideal insurance policy for your RV, it’s essential to first understand the specific needs that come with your RV type, whether it’s a Class A motorhome, a fifth-wheel trailer, or a pop-up camper. Different RVs carry varying risks and values, which influence coverage requirements. For instance, high-value Class A motorhomes often benefit from comprehensive coverage that protects against collision, theft, and natural disasters, while lightweight travel trailers might prioritize liability and personal belongings coverage. Tailoring your insurance to these essential aspects ensures you’re not overpaying for unnecessary features while still guarding your investment adequately.

Another crucial tip is to evaluate add-on options or endorsements that cater specifically to RV owners. These may include:

- Roadside assistance: Especially vital for long trips in remote areas

- Emergency expense coverage: Covers lodging and food if your RV becomes uninhabitable following an incident

- Personal effects coverage: Protects your belongings inside the RV from theft or damage

- Vacation liability: Offers protection if someone gets injured while inside or near your RV

Carefully comparing these options across various insurers and understanding how they align with your specific RV type will help you craft a policy that offers maximum protection without unnecessary costs.

In Summary

Navigating the world of RV types and their insurance coverage options can initially feel overwhelming, but with the right information, you can confidently choose the best fit for your lifestyle and protect your investment. Whether you’re drawn to the spacious comfort of a Class A motorhome or the nimble convenience of a travel trailer, understanding how insurance policies vary between RV types is crucial for peace of mind on the road. Keep these key points in mind as you explore coverage options, and don’t hesitate to consult with an insurance professional to tailor a plan that matches your needs. Ultimately, well-informed decisions today ensure many safe and enjoyable adventures tomorrow. Safe travels!