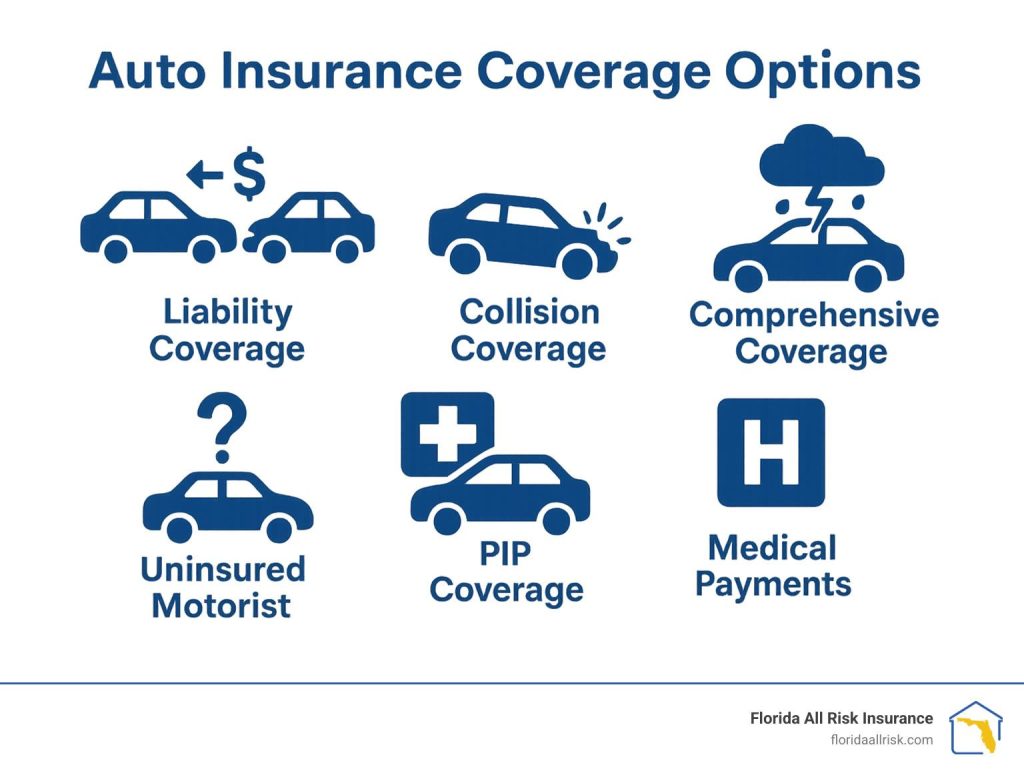

When it comes to protecting your vehicle and your finances, understanding the different types of auto insurance coverage is essential. Navigating the world of auto insurance can often feel overwhelming, with a variety of terms, options, and policies that might leave you wondering what you truly need. In this article, we break down the key types of auto insurance coverage, explaining what each one covers and why it matters. Whether you’re a new driver or looking to update your current policy, gaining a clear understanding will help you make informed decisions and ensure you’re adequately protected on the road. Let’s dive in and explore the fundamentals of auto insurance to give you peace of mind every time you get behind the wheel.

Table of Contents

- Understanding Liability Coverage and Its Importance in Auto Insurance

- Exploring Collision and Comprehensive Coverage for Maximum Protection

- The Role of Uninsured and Underinsured Motorist Coverage in Risk Management

- Tips for Choosing the Right Auto Insurance Coverage Based on Your Needs

- In Conclusion

Understanding Liability Coverage and Its Importance in Auto Insurance

Liability coverage is a fundamental component of auto insurance that protects you financially when you’re at fault in an accident. It typically covers two primary areas: bodily injury liability and property damage liability. Bodily injury liability takes care of medical expenses, lost wages, and legal fees if the other party sustains injuries in an accident you caused. Property damage liability, on the other hand, compensates for repairs or replacement of the other person’s vehicle or property. Without adequate liability coverage, you could be personally responsible for these significant costs, which can quickly escalate.

Moreover, liability coverage is often mandated by law, making it a legal necessity for drivers in most states. It helps maintain financial responsibility on the road, ensuring victims of accidents receive fair compensation. When choosing liability limits, consider factors such as your assets, driving environment, and potential risks. A prudent level of coverage not only safeguards your finances but also provides peace of mind, allowing you to focus on safe driving rather than worrying about the what-ifs.

Exploring Collision and Comprehensive Coverage for Maximum Protection

When it comes to safeguarding your vehicle, collision and comprehensive coverage serve as two critical pillars that help protect against a variety of unforeseen circumstances. Collision coverage specifically handles damages resulting from accidents involving other vehicles or objects, such as a tree or guardrail. It ensures that repairs or replacement costs are covered regardless of who is at fault, providing peace of mind and financial security after an accident on the road.

On the other hand, comprehensive coverage casts a wider net by covering non-collision-related damages. This includes incidents like theft, vandalism, natural disasters, and animal strikes. Together, these coverages form a strong foundation, often recommended for anyone looking to maximize protection for their vehicle. Key benefits include:

- Extensive protection: From accidents to theft and weather damage

- Financial security: Reduces out-of-pocket expenses in major repair situations

- Flexible claims process: Often includes options for rental car reimbursement during repairs

The Role of Uninsured and Underinsured Motorist Coverage in Risk Management

Navigating the unpredictability of the road requires more than just basic auto insurance. When faced with accidents involving drivers who have inadequate or no insurance at all, your own financial protection becomes crucial. Uninsured and underinsured motorist coverage steps in as a vital safety net, ensuring you’re not left shouldering medical expenses, vehicle repairs, or lost wages when the at-fault party cannot fully compensate you. This coverage effectively bridges the gap between standard liability limits and actual damages, helping safeguard your assets and well-being.

Incorporating this coverage into your insurance portfolio enhances your overall risk management strategy with benefits such as:

- Financial Security: Protection from unexpected out-of-pocket costs in accidents involving underinsured or uninsured drivers.

- Peace of Mind: Confidence knowing you have recourse even when the other driver lacks proper coverage.

- Broader Coverage: Extension of your insurance policy to cover injuries, vehicle damage, and sometimes even hit-and-run incidents.

This strategic layer of protection ultimately helps reduce risk and shields you from potential financial hardship on the road.

Tips for Choosing the Right Auto Insurance Coverage Based on Your Needs

Choosing the right auto insurance coverage starts with a clear understanding of your personal circumstances and risk tolerance. If you primarily drive in urban areas with heavy traffic, comprehensive coverage that protects against theft, vandalism, and natural disasters may be more beneficial than basic liability. Conversely, if you have an older vehicle with low market value, you might prioritize affordability by opting for liability-only coverage. Don’t forget to factor in your financial situation—adequate coverage should shield you from costly out-of-pocket expenses while fitting within your budget.

When evaluating your needs, consider essential aspects like:

- Driving habits: Frequent long-distance drivers often benefit from extended coverage options such as collision insurance.

- Vehicle type and age: Newer or high-value cars may require higher coverage limits and additional protections.

- Legal requirements: Each state mandates minimum coverage levels; ensure you meet or exceed these to avoid penalties.

- Potential discounts: Bundling policies, safe driving records, and good credit scores can reduce premiums significantly.

By reflecting on these factors and consulting with your insurance provider, you can tailor a policy that offers peace of mind without unnecessary extras.

In Conclusion

Navigating the world of auto insurance can feel overwhelming, but understanding the key types of coverage is essential to protecting yourself, your vehicle, and your finances. Whether you’re a new driver or reviewing your existing policy, knowing what each coverage type offers empowers you to make informed decisions tailored to your needs. By taking the time to explore your options and ask the right questions, you’ll drive away with confidence—knowing that you’re adequately covered no matter what the road throws your way. Stay informed, stay protected, and happy driving!