Owning a boat is a rewarding experience, offering endless opportunities for leisure and adventure on the water. However, one aspect that often catches boat owners off guard is the cost of insurance. Boat insurance premiums can quickly become a sizable part of your expenses, but the good news is there are practical ways to manage and reduce these costs without compromising coverage. In this article, we’ll share top tips to help you lower your boat insurance premiums easily, ensuring you can enjoy your time on the water with greater peace of mind and financial confidence. Whether you’re a seasoned boat owner or new to the boating world, these insights will help you navigate the insurance landscape smartly and save money along the way.

Table of Contents

- Understanding Key Factors That Influence Boat Insurance Premiums

- Choosing the Right Coverage to Match Your Boating Needs

- Implementing Safety Measures to Lower Your Risk Profile

- Exploring Discounts and Loyalty Programs for Additional Savings

- In Retrospect

Understanding Key Factors That Influence Boat Insurance Premiums

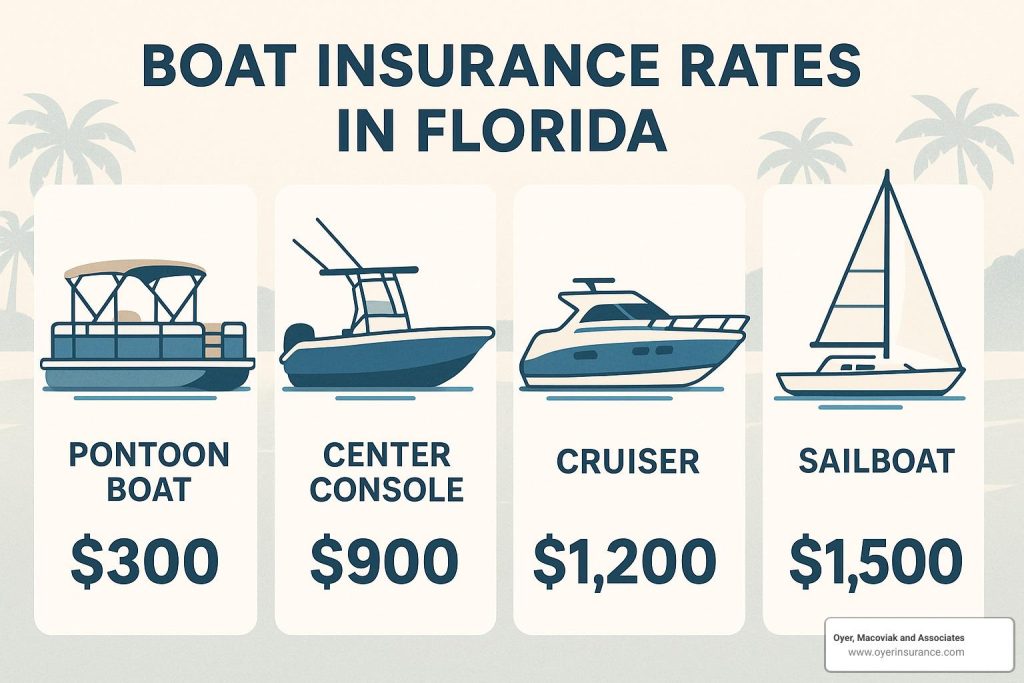

Boat insurance premiums can fluctuate based on several important factors, all aimed at assessing the level of risk associated with insuring your watercraft. Key elements include the size and type of your boat—luxury yachts tend to carry higher rates compared to smaller fishing boats due to their replacement costs and complexity. Your boat’s age also plays a significant role, as older models might lack modern safety features, driving up premiums. The intended usage, whether for leisure or commercial purposes, affects rates as well; boats used frequently or in challenging waters will often command higher premiums. Additionally, geographical location matters, since areas prone to storms or with heavy boating traffic increase risk exposure for insurers.

Beyond the boat’s characteristics, your personal record and security measures can impact your insurance cost dramatically. Having a clean boating history with no claims or accidents reflects responsible operation and can earn you discounts. Installing advanced safety and anti-theft devices, such as GPS trackers and alarms, signals to insurers that your boat is better protected, which can lower your rate. Maintaining professional boat handling certifications also demonstrates competence, encouraging insurers to view you as a lower-risk client. To summarize, understanding these factors helps you identify targeted ways to manage and potentially reduce your boat insurance premiums.

- Boat size and type: Smaller boats usually mean lower premiums.

- Usage patterns: Recreational use is often cheaper to insure than commercial use.

- Location: Insuring boats in less risky waters can reduce costs.

- Safety equipment: Anti-theft and safety features qualify for discounts.

- Operator qualifications: Certified boating courses might lower premiums.

- Claims history: A no-claims record enhances insurance affordability.

Choosing the Right Coverage to Match Your Boating Needs

Understanding your specific boating habits and needs is essential to select coverage that’s both comprehensive and cost-effective. Not all boat owners require the same insurance policies—whether you’re a weekend cruiser, a competitive racer, or someone who uses their vessel for fishing trips, your insurance should reflect this. Prioritize coverage that protects against the risks you’re most likely to encounter, such as liability for watercraft accidents, theft, or damage from natural elements. Opting for tailored policies rather than generic ones can often reduce your premiums while ensuring you aren’t paying for unnecessary extras.

Consider the following factors to help refine your coverage options:

- Type and size of your boat: Larger or high-performance boats may require specialized coverage.

- Usage frequency: Occasional users might benefit from seasonal or limited-use policies.

- Storage method: Boats stored in a marina versus a private dock might face different risks.

- Safety equipment installed: Discounts often apply if your boat is equipped with alarms, GPS trackers, or fire suppression systems.

Matching your insurance to your boating lifestyle not only saves money but also provides peace of mind. Regularly reviewing and adjusting your coverage in line with any changes in your usage or boat modifications is a smart strategy to keep premiums low and protection high.

Implementing Safety Measures to Lower Your Risk Profile

Taking proactive steps to enhance your boat’s safety not only protects your investment but also signals to insurers that you’re a responsible risk. Installing advanced safety equipment such as GPS tracking systems, fire extinguishers, and automatic bilge pumps can make a significant difference. Additionally, maintaining regular upkeep—like inspecting hull integrity, checking engine performance, and updating navigation tools—shows commitment to minimizing hazards on the water. Insurance companies often reward these efforts with lower premiums, recognizing that a well-maintained and well-equipped boat is less likely to incur costly claims.

Enhancing your safety profile can be as straightforward as adopting a few key habits:

- Completing certified boating safety courses annually.

- Ensuring all crew members wear life jackets consistently.

- Installing approved anti-theft devices to reduce theft risk.

- Following manufacturer-recommended service schedules comprehensively.

- Documenting safety drills and emergency procedures onboard.

Each of these steps contributes to lowering your overall risk, encouraging insurers to offer you more competitive rates. In the end, an investment in safety is an investment in peace of mind and affordability.

Exploring Discounts and Loyalty Programs for Additional Savings

Many insurers offer exclusive discounts that can significantly reduce your premiums if you qualify. These may include multi-policy discounts when you bundle boat insurance with other policies like home or auto insurance, or safe-boater discounts for those who have completed recognized safety courses. Additionally, maintaining a clean claim history can often unlock further reductions, rewarding your responsible boating habits. Be sure to inquire about seasonal promotions and payment plan discounts—some companies provide savings for paying annually rather than monthly.

Don’t overlook the power of loyalty programs designed to keep valued customers engaged and saving. These programs can offer benefits such as lower deductibles for long-term policyholders, cashback rewards, or even partner discounts on boating gear and maintenance services. By staying with the same insurer and participating in their loyalty rewards, you not only enjoy ongoing financial advantages but also gain access to personalized services tailored to your boating lifestyle.

- Multi-policy bundles – Combine insurance for extra savings.

- Safety course completion – Earn discounts with certified training.

- No-claims bonuses – Get rewarded for accident-free periods.

- Loyalty rewards – Benefit from long-term relationships with insurers.

- Seasonal and payment discounts – Take advantage of timing and payment methods.

In Retrospect

Reducing your boat insurance premiums doesn’t have to be a daunting task. By implementing these straightforward tips—from comparing multiple quotes and maintaining a clean safety record to investing in proper security measures—you can significantly lower your costs without compromising on coverage. Remember, staying proactive and informed is key to protecting your vessel while keeping your expenses manageable. Sail smarter and save more by applying these strategies to your insurance approach today!