When it comes to life insurance, most people buy a policy for peace of mind, expecting that their loved ones will be protected when it matters most. But what happens if a claim gets denied just when your family needs that financial support? Unfortunately, life insurance claim denials aren’t as rare as you might think, and they often leave families confused and stressed during an already difficult time. In this article, we’ll break down the top reasons why life insurance claims get denied—and, more importantly, share practical tips on how you can avoid these pitfalls. By understanding the common issues upfront, you can make sure your policy works exactly as you intended, giving you and your family the reassurance you deserve.

Table of Contents

- Common Policy Details That Can Trip Up Your Claim

- Understanding the Fine Print to Stay Ahead

- How to Keep Your Documentation Rock Solid

- Tips for Clear Communication With Your Insurer

- Final Thoughts

Common Policy Details That Can Trip Up Your Claim

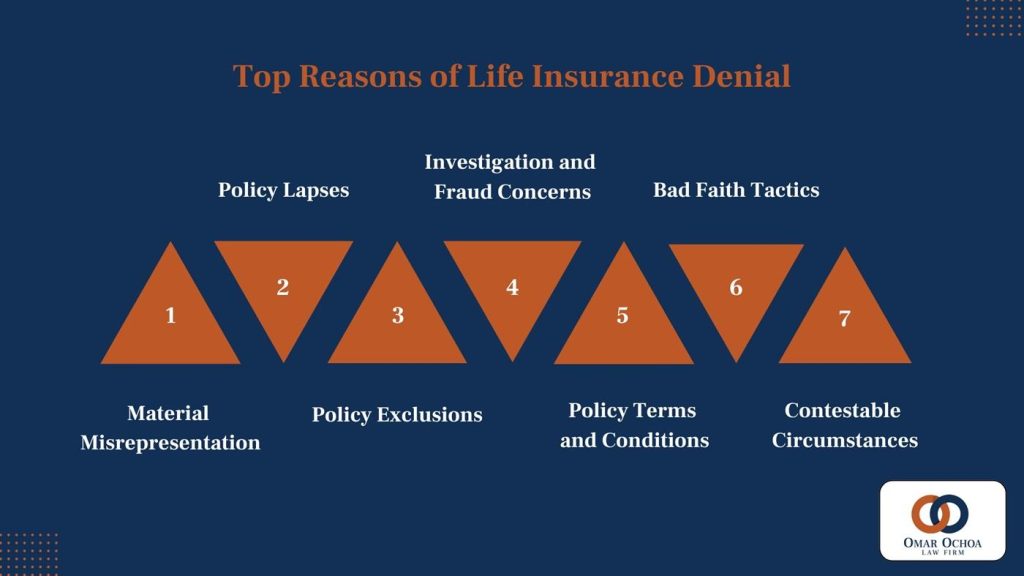

One of the most frequent hurdles in settling a life insurance claim lies in overlooked or misunderstood policy stipulations. Policy exclusions, for instance, can be a silent trap for beneficiaries. These often include clauses related to suicide, specific high-risk activities, or deaths caused by certain illnesses within a contestability period. When beneficiaries are unaware of these, unexpected denials can occur. It’s crucial to thoroughly review the policy’s fine print and discuss any unclear points with your insurance agent to prevent surprises later.

Another common pitfall involves inaccurate beneficiary information or failure to update this after major life changes such as marriage, divorce, or the birth of a child. These details must be precise and current, or the claim might be contested or delayed. Additionally, misunderstandings about premium payments—whether all have been made or if a policy has lapsed—can also trip up your claim. Keep a detailed record of your payments and regularly confirm your coverage status to maintain smooth processing when a claim needs to be filed.

Understanding the Fine Print to Stay Ahead

When it comes to securing your family’s future, understanding every detail in your life insurance policy is crucial. Many claims get denied simply because the policyholder missed a critical clause hidden in the fine print. For example, exclusions related to pre-existing medical conditions or certain types of risky activities can lead to a denied claim if not properly disclosed upfront. To avoid this, always take the time to read every section carefully and never hesitate to ask your insurer about anything that sounds unclear or ambiguous.

Some key points to watch out for include:

- Waiting periods before coverage activates

- Required documentation and deadlines for filing claims

- Coverage limits on particular causes of death

- Policy lapses if premiums are missed

Doing a thorough review early on ensures you stay ahead of potential pitfalls and safeguards your family against unexpected surprises.

How to Keep Your Documentation Rock Solid

Keeping your life insurance documentation foolproof means staying organized and proactive. Start by creating a dedicated folder—digital or physical—where you store all related paperwork like policy documents, medical records, and communication with the insurer. Regularly update this folder anytime you receive new documents or make changes to your policy. Remember, having everything in one place not only speeds up the claims process but also minimizes errors and misunderstandings. Tip: Scan and back up your documents in the cloud to ensure they’re accessible from anywhere and safe from physical damage.

Next, pay close attention to the details! Even a small typo or missing signature can spell trouble during a claim review. Double-check names, policy numbers, and dates against the original policy to keep everything accurate. Also, don’t hesitate to ask your insurance agent to review your documentation annually—they can spot inconsistencies and suggest essential updates. Pro tip: Keep a checklist of required forms and proof items handy, so you never miss a crucial piece of information. Remember, clear, complete, and current paperwork is your best defense against claim denial.

Tips for Clear Communication With Your Insurer

When dealing with your insurer, transparency and precision are your best allies. Always ensure that you provide complete and accurate information, especially when submitting your claim documents. Avoid assumptions—ask for clarification if any part of the policy or claim process feels unclear. This not only prevents misunderstandings but also builds trust, making it easier to navigate any complex situations. Remember, being proactive about updates or changes in your health or personal circumstances can save you from unpleasant surprises down the line.

Maintaining open channels of communication is just as important. Use multiple methods like phone calls, emails, or even their official app for documentation, ensuring you have proof of correspondence. When speaking with your insurer, keep these handy:

- Record names and contact details of representatives you speak with

- Note down dates and summaries of all conversations

- Ask for written confirmation of any agreements or instructions

These small steps help keep your claims process smooth and safeguard your interests should any disputes arise.

Final Thoughts

In the end, understanding why life insurance claims get denied is the first step toward protecting your loved ones and ensuring your policy delivers when it matters most. By being thorough with your paperwork, honest in your application, and diligent in maintaining your policy, you can avoid common pitfalls that lead to claim denials. Remember, life insurance is meant to offer peace of mind—so take these tips to heart and keep your coverage strong and reliable. After all, it’s all about making sure your family is taken care of when they need it the most. Stay informed, stay prepared, and rest easy knowing you’ve done everything you can.