When it comes to protecting the ones we love most, having the right life insurance can make all the difference. Whether you’re starting a family, planning for the future, or simply want peace of mind, finding a policy that fits your unique needs is key. In today’s world, there are plenty of options designed specifically with families in mind—offering not just financial security but also flexibility and support when it matters most. In this article, we’ll explore the top life insurance policies perfect for families today, helping you make an informed choice to safeguard your loved ones’ tomorrow. Let’s dive in!

Table of Contents

- Understanding Why Life Insurance Matters for Families

- Exploring Different Types of Family-Friendly Life Insurance Plans

- Key Features to Look for When Choosing a Policy

- Top Life Insurance Recommendations Tailored for Modern Families

- Final Thoughts

Understanding Why Life Insurance Matters for Families

Families are the cornerstone of our lives, and securing their future is a priority that cannot be overlooked. Life insurance acts as a financial safety net, offering peace of mind by helping loved ones navigate unexpected challenges without the added burden of financial stress. It ensures that daily expenses, mortgage payments, education costs, and even future plans remain intact, even when the unexpected occurs. Having this protection in place allows families to focus on healing and moving forward rather than worrying about money.

Choosing the right policy means understanding the unique needs of your family, such as:

- Coverage amount that supports your current lifestyle and future goals

- Flexibility in premiums to accommodate changing financial circumstances

- Additional benefits like living benefits or riders tailored to health considerations

By tailoring your coverage to fit your family’s specific situation, you create a customized protection plan that grows with you—providing the support your loved ones deserve, no matter what life brings.

Exploring Different Types of Family-Friendly Life Insurance Plans

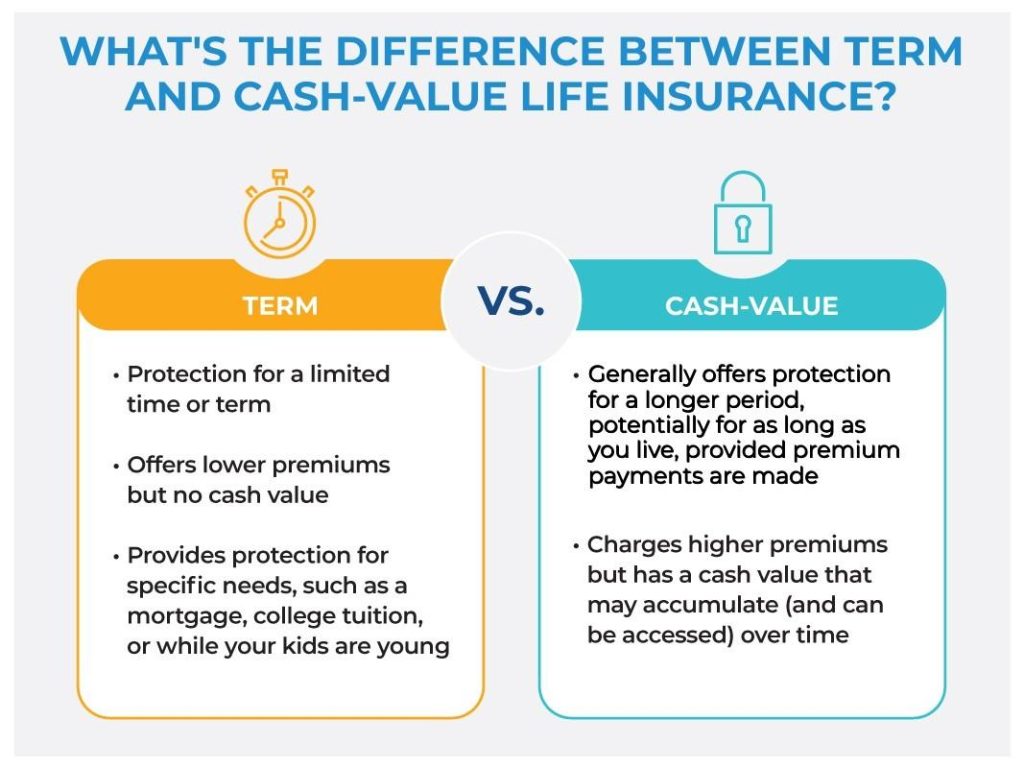

When considering protection for your loved ones, life insurance plans designed for families offer tailored benefits that go beyond basic coverage. Term life insurance, for example, is a popular choice among families due to its affordability and straightforward nature. It provides coverage for a specific period—commonly 10, 20, or 30 years—making it ideal for ensuring financial security during the years when children are growing up or when mortgage payments are ongoing. Additionally, many term policies come with flexible riders such as child term riders and waiver of premium, helping families adapt the policy as their needs evolve.

Whole life insurance, on the other hand, can serve both as a protection tool and an investment vehicle. This plan guarantees coverage for life, and its cash value component grows over time, offering a financial cushion that families can borrow against if needed. Other family-focused options include universal life plans that combine lifelong protection with the flexibility to adjust premiums and death benefits, accommodating changing financial circumstances. Choosing the right plan means looking at your family’s unique financial goals and long-term needs, from college funds to retirement support, ensuring every policy you consider aligns with your peace of mind.

- Term Life Insurance: Affordable, temporary coverage with customizable riders.

- Whole Life Insurance: Permanent coverage with a cash value benefit.

- Universal Life Insurance: Flexible premiums and benefits suited for evolving family finances.

- Child Term Riders: Supplementary coverage for children under the main policy.

Key Features to Look for When Choosing a Policy

When narrowing down your options, focus on policies that offer flexibility and comprehensive coverage. A policy tailored to evolve with your family’s changing needs can be a true game-changer. Look for features like adjustable coverage amounts, riders that protect against critical illnesses, and premium payment options that fit your budget. Don’t forget to check if the plan provides benefits such as terminal illness cover, which can offer financial relief during tough times.

Another crucial aspect is the insurer’s reputation for claim settlement and customer service. Transparency in policy terms and prompt claim processing can save a lot of headaches down the road. It’s wise to consider policies that also offer online account management tools, making it easier to track your investments and update beneficiaries without hassle. Ultimately, a balance between affordability and robust protection ensures peace of mind for your entire family.

- Customizable coverage options to match different life stages

- Add-on riders for extra protection like critical illness or disability

- Flexible premium payment plans that suit your financial flow

- High claim settlement ratio and positive customer feedback

- Digital accessibility and easy policy management tools

Top Life Insurance Recommendations Tailored for Modern Families

When it comes to safeguarding your family’s future, choosing the right life insurance plan can make all the difference. Modern families need policies that offer flexibility and comprehensive coverage to suit their ever-changing lifestyles. Consider plans that not only provide a substantial death benefit but also include living benefits such as terminal illness coverage or critical illness riders. This approach ensures that your family is financially supported in both expected and unforeseen situations. Term life insurance often stands out for its affordability and straightforward protection, ideal for young families focused on budget-conscious security without compromising on coverage.

Another option gaining popularity among contemporary households is whole life insurance, which blends lifetime protection with a cash value component that grows over time — a useful resource for college funds or emergency expenses. Families with multiple financial goals and long-term plans often find value in policies offering customization through add-ons like child riders or waiver of premium features, which provide peace of mind during difficult times. Key factors to keep in mind include:

- Policy flexibility to adjust coverage as family needs evolve

- Speedy and hassle-free claim processing

- Competitive premiums without compromising benefits

- Additional riders for extra layers of security

Final Thoughts

Choosing the right life insurance policy for your family is one of the most important decisions you can make to protect their future. Whether you’re looking for comprehensive coverage, affordability, or flexibility, there’s a perfect plan out there tailored to your unique needs. Remember, investing in life insurance isn’t just about dollars and cents—it’s about peace of mind and knowing your loved ones will be taken care of, no matter what. So take your time, explore your options, and pick the policy that feels right for your family. Here’s to securing a safer, brighter tomorrow!