Thinking about life insurance can feel overwhelming, but it doesn’t have to be complicated. Term life insurance is a straightforward and affordable way to protect your loved ones financially, without all the confusing jargon. Whether you’re a first-timer or just need a refresher, this guide will break down everything you need to know about term life insurance – in plain, simple language. Let’s make sure you have the right coverage to give you peace of mind and security for the future!

Table of Contents

- Understanding the Basics of Term Life Insurance and How It Works

- Choosing the Right Term Length and Coverage for Your Needs

- Common Myths About Term Life Insurance Debunked

- Tips for Finding the Best Policy Without Breaking the Bank

- The Way Forward

Understanding the Basics of Term Life Insurance and How It Works

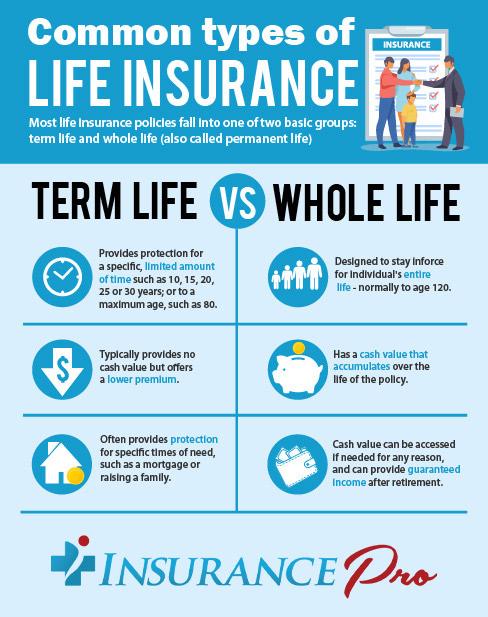

At its core, term life insurance is a straightforward way to provide financial protection to your loved ones for a specific period. Unlike whole life insurance, which covers you for a lifetime, term life offers coverage for a fixed number of years—commonly 10, 20, or 30. If the insured person passes away during this term, the policy pays out a death benefit to the beneficiaries, offering them a financial safety net. However, if you outlive the term, the policy simply expires without value, which is why it’s often dubbed a “pure” insurance product focused solely on protection.

Choosing the right term life policy involves understanding a few key features that determine how it works in your favor:

- Level premiums: You pay the same amount each year during the term, making budgeting easier.

- Renewability: Many policies allow renewal after the term ends, though premiums may increase based on age and health.

- Convertible options: Some term plans offer the option to convert to a permanent life insurance policy without a medical exam.

This flexibility means term life insurance can adapt to your changing needs and budget, making it a popular choice for many families looking for manageable, focused coverage.

Choosing the Right Term Length and Coverage for Your Needs

Finding the perfect term length and coverage amount is all about matching the policy to your unique life situation. When selecting the term length, consider significant financial milestones like paying off a mortgage, funding your children’s college education, or reaching retirement. You want the coverage to last through periods when your dependents would most need financial protection. Choosing a term that’s too short might leave gaps in coverage, while opting for an unnecessarily long term could mean paying for coverage you no longer need.

Coverage amount should reflect your current and future financial responsibilities. A helpful way to estimate this is by adding up your debts, future expenses, and income replacement needs. Don’t forget to factor in inflation and potential lifestyle changes. Some things to keep in mind:

- Outstanding debts such as mortgages, car loans, and credit cards

- Future costs like education and healthcare

- Income replacement for your family’s daily living expenses

- Emergency fund buffers for unexpected expenses

Ultimately, the right balance will give you peace of mind that your loved ones are financially safeguarded—without straining your budget.

Common Myths About Term Life Insurance Debunked

One of the biggest misconceptions is that term life insurance is too expensive or only for people with high-risk jobs. In reality, term life insurance is often the most affordable way to secure financial protection, especially compared to whole life or universal policies. Premiums are typically fixed for the duration of the term, making it easier to budget. Plus, many healthy individuals qualify for discounted rates, so it’s not just limited to those with risky lifestyles. Another myth is that having term life insurance means you’ll end up with no payout if you outlive your term. While it’s true the coverage doesn’t last forever, it’s designed to cover you during the years when your dependents and debts need protection the most.

- Myth: “Only breadwinners should get term life insurance.”

Fact: Everyone who contributes financially or emotionally to a household can benefit. - Myth: “Term life insurance can’t be renewed or converted.”

Fact: Many policies offer renewal or conversion options even after the term ends. - Myth: “You don’t need term insurance if you have savings.”

Fact: Life insurance offers protection beyond just money—it provides peace of mind during unexpected events.

Tips for Finding the Best Policy Without Breaking the Bank

When hunting for affordable term life insurance, start by assessing your true coverage needs—don’t just opt for a high sum because it sounds “safe.” The key is balancing protection with your budget. Many insurers offer customizable plans allowing you to adjust the term length or coverage amount. Exploring these options helps prevent overpaying for unnecessary coverage. Additionally, shopping around is crucial. Use online comparison tools and request quotes from multiple providers to spot the best deals and discounts tailored to your profile. Remember, your health, lifestyle, and even occupation can impact rates, so be honest and thorough when filling out applications.

Another savvy move is to prioritize insurers with strong financial ratings and good customer reviews; low cost doesn’t always mean good value if the company struggles with claims processing. Look out for riders or add-ons that can enhance your policy without sending premiums through the roof. Simple features like accelerated death benefits or waiver of premium can provide extra security without a hefty price tag. By focusing on flexibility, transparency, and reputable providers, you can secure a solid plan that protects your loved ones and keeps your wallet happy.

The Way Forward

And there you have it—term life insurance made simple! With a clear understanding of what it is, how it works, and why it might be a smart choice for you, you’re now better equipped to make decisions that protect your loved ones. Remember, the best policy is one that fits your unique needs and gives you peace of mind. So take your time, compare your options, and don’t hesitate to ask questions along the way. Here’s to feeling confident and covered for whatever the future holds!