In a world where unexpected accidents and costly lawsuits can turn your life upside down, having just the basic insurance coverage might not be enough. That’s where umbrella insurance steps in — acting as an extra layer of protection to help you stay secure no matter what life throws your way. In this article, we’ll explore how umbrella insurance boosts your overall safety net, giving you peace of mind and financial confidence so you can focus on what really matters. Ready to discover why this often-overlooked coverage could be your smartest move yet? Let’s dive in!

Table of Contents

- Benefits of Umbrella Insurance Beyond Basic Coverage

- Understanding Common Risks That Umbrella Policies Shield You From

- Tips for Choosing the Right Umbrella Insurance for Your Needs

- Maximizing Your Protection with Umbrella Insurance and Smart Financial Planning

- Final Thoughts

Benefits of Umbrella Insurance Beyond Basic Coverage

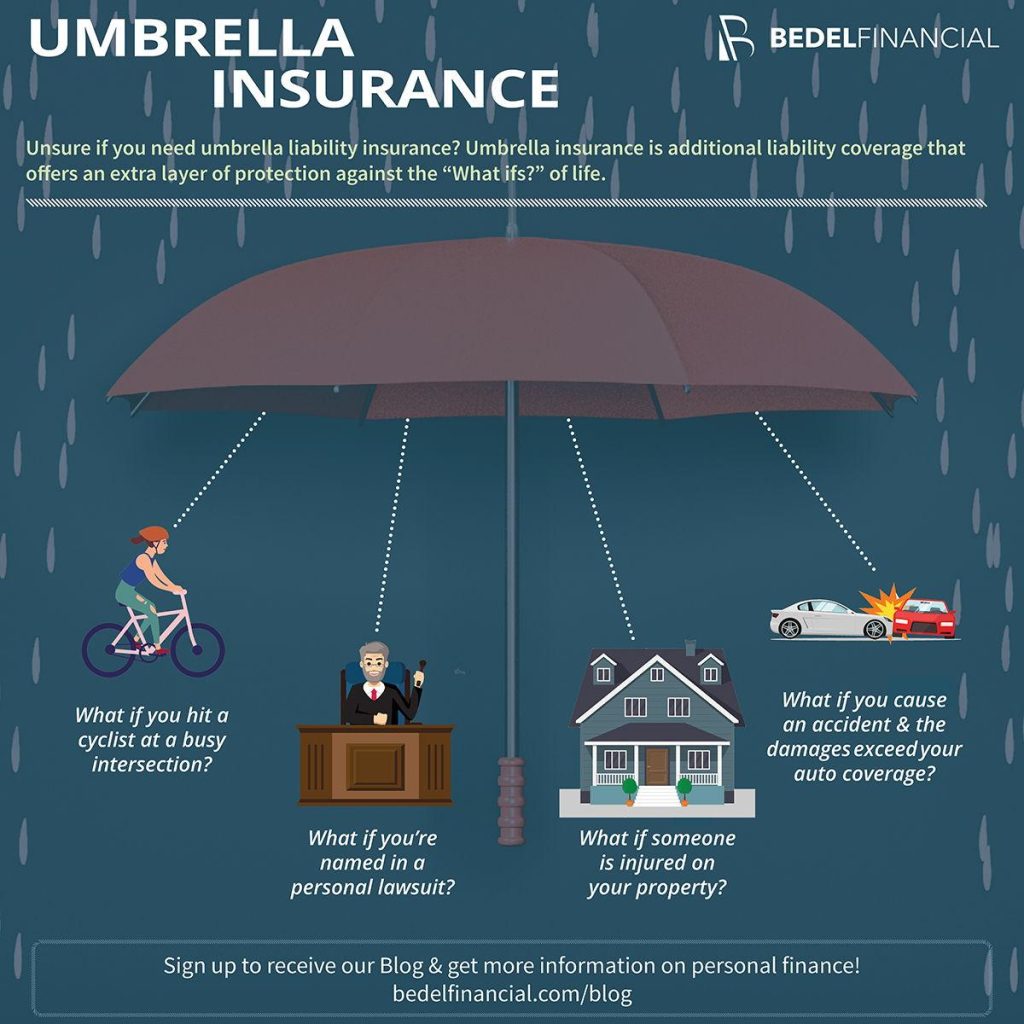

When life throws unexpected challenges your way, having umbrella insurance offers a robust layer of protection that goes far beyond your basic policies. Unlike standard home or auto insurance, umbrella coverage safeguards your assets by extending liability limits—often by millions of dollars. This means you can confidently face lawsuits or claims without the fear of depleting your savings or investments. It acts as a financial safety net, ensuring that unexpected legal battles, personal injury claims, or property damage don’t jeopardize your long-term stability.

Moreover, umbrella insurance often covers scenarios that might not be included under your primary policies, providing a wider shield against risks such as:

- Libel, slander, or defamation suits

- Incidents involving rental properties

- Accidents caused by teenagers driving other vehicles

- Claims arising from false arrest, invasion of privacy, or malicious prosecution

Investing in this type of coverage means peace of mind—knowing you’re prepared for even the most complex and costly situations. It’s not just about protection; it’s about stepping forward with confidence in a world full of uncertainties.

Understanding Common Risks That Umbrella Policies Shield You From

When life throws unexpected challenges your way, a standard insurance policy might not cover all the bases. Umbrella insurance steps in as an extra layer of security, specifically designed to guard against high-cost liability claims that could otherwise disrupt your financial stability. It typically protects you from lawsuits related to personal injury, property damage, and even libel or slander. This means if you’re found responsible for costly accidents beyond your home or vehicle, your umbrella policy can absorb those expenses, keeping your savings intact.

Beyond these, umbrella policies often cover risks that fall outside the scope of traditional insurance plans, such as:

- Rental property liabilities

- Legal defense costs in lawsuits even if you’re not at fault

- Accidents involving recreational vehicles like boats or ATVs

- False arrest or wrongful eviction claims

By providing broad and flexible protection, umbrella insurance enhances your peace of mind. It’s not just about covering claims but ensuring you remain resilient in the face of financial surprises that could otherwise threaten your lifestyle.

Tips for Choosing the Right Umbrella Insurance for Your Needs

When selecting an umbrella insurance policy, it’s essential to evaluate the scope of your current coverage and pinpoint potential gaps. Start by assessing your existing liability limits on auto, home, and other primary policies to understand where you might be vulnerable. Think about your lifestyle and assets—do you own rental properties, have significant savings, or host large events at your home? These factors can influence the amount of additional protection you’ll need to confidently weather unexpected claims or lawsuits.

Consider these key points:

- Ensure the umbrella policy covers a broad range of liabilities, including personal injury, property damage, and legal defense costs.

- Look for policies with flexible terms that can be tailored to your unique risks.

- Compare deductibles and premiums—sometimes paying a bit more upfront can save you from substantial out-of-pocket expenses later.

- Check for exclusions and understand what’s not covered to avoid surprises down the road.

Maximizing Your Protection with Umbrella Insurance and Smart Financial Planning

When it comes to safeguarding your assets, umbrella insurance offers an essential layer of protection beyond your standard policies. This type of coverage steps in when your primary insurance limits are exhausted, shielding your savings, future earnings, and property from substantial liabilities. Integrating umbrella insurance into your financial strategy means you’re not just relying on one safety net; instead, you’re building a fortress that anticipates unforeseen challenges. Smart financial planning alongside umbrella insurance helps ensure that your personal and professional investments remain secure, even in the face of unexpected events.

To truly maximize your protection, consider these guiding principles:

- Assess your risk exposure: Understanding your lifestyle and assets helps tailor coverage to your specific needs.

- Combine with other protections: Umbrella insurance works best when layered with comprehensive home, auto, and business policies.

- Maintain an emergency fund: Alongside insurance, having liquid assets ready ensures no gap in coverage during stressful times.

- Regularly review policies: Life changes, and so should your coverage limits and terms to reflect new circumstances.

By weaving umbrella insurance into a broader financial plan, you empower yourself with confidence and resilience against life’s uncertainties.

Final Thoughts

In today’s unpredictable world, staying one step ahead when it comes to your protection is more important than ever. Umbrella insurance offers that extra layer of security and peace of mind, helping you safeguard your future from unexpected risks. By investing in this powerful coverage, you’re not just protecting your assets—you’re embracing a proactive approach to your financial well-being. So why wait? Take charge of your security today and enjoy the confidence that comes with knowing you’re truly covered. Here’s to staying safe, prepared, and optimistic about whatever comes next!