When it comes to protecting your vehicle and your wallet, understanding auto insurance laws is crucial—but navigating the maze of regulations can feel overwhelming. Each state has its own set of rules and requirements that impact everything from minimum coverage limits to how claims are handled. In this state-by-state guide, we’ll break down the key auto insurance laws across the country, helping you stay informed and make smarter decisions whether you’re buying a new policy, renewing an existing one, or simply trying to stay compliant. Whether you’re a seasoned driver or a new license-holder, knowing the legal landscape in your state can save you time, money, and headaches down the road.

Table of Contents

- State Variations in Minimum Coverage Requirements and What They Mean for You

- Liability Limits Explained State by State for Better Policy Selection

- Understanding Mandatory Insurance Options and Additional Coverage Choices

- How to Navigate State-Specific Discounts and Penalties for Auto Insurance

- Future Outlook

State Variations in Minimum Coverage Requirements and What They Mean for You

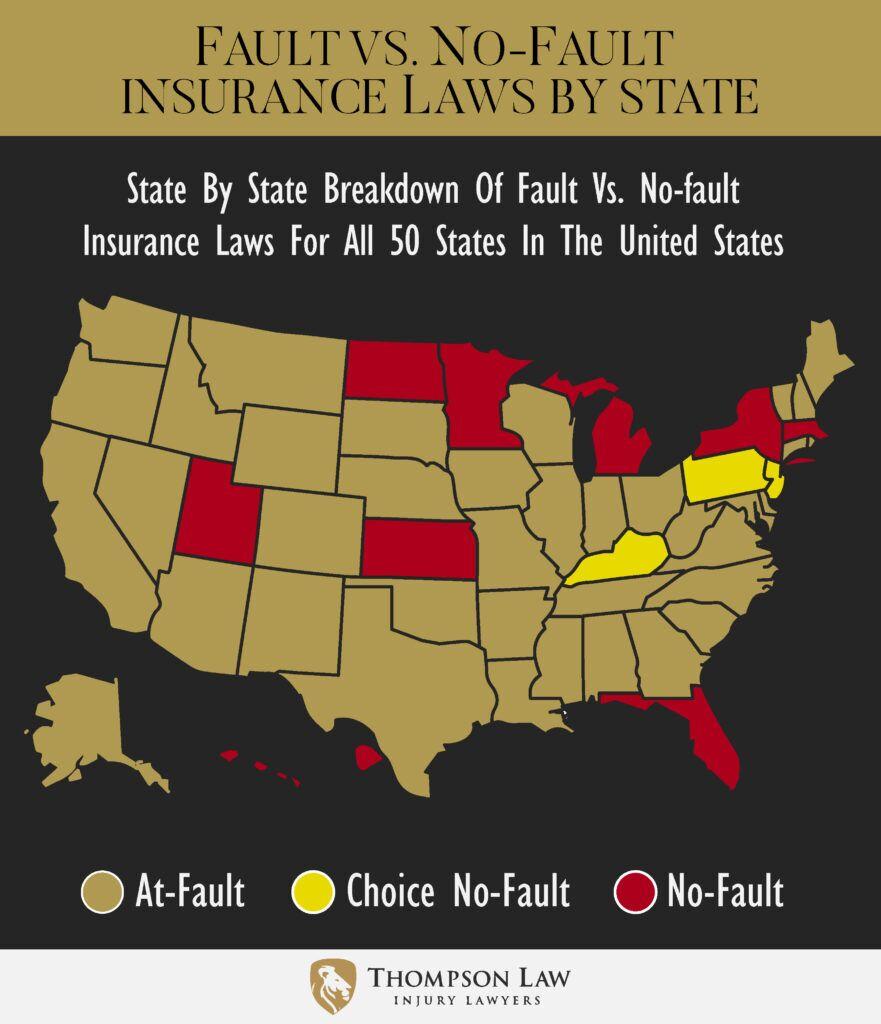

When it comes to auto insurance, each state sets its own baseline for what coverage drivers must carry on their vehicles. These minimum requirements can vary widely—not just in the monetary limits for bodily injury and property damage, but also in the types of coverage mandated. For example, some states require only liability insurance, while others also mandate personal injury protection (PIP) or uninsured motorist coverage. Understanding these distinctions is crucial because carrying less than the required coverage can lead to hefty fines, license suspensions, or even legal trouble following an accident.

Beyond legal compliance, these state-specific coverage mandates influence the financial safety net you will have in the event of an accident. Here are a few things to keep in mind:

- Higher minimum limits typically mean better protection, but also higher premiums.

- No-fault states often require PIP, which covers your medical expenses regardless of who caused the accident.

- States with lower minimums might leave you vulnerable to significant out-of-pocket costs if an accident exceeds your coverage limits.

- Uninsured motorist coverage requirements are essential in states with high rates of uninsured drivers.

Picking the right coverage isn’t just about meeting legal requirements—it’s about tailoring your policy to protect your finances and peace of mind depending on where you live.

Liability Limits Explained State by State for Better Policy Selection

Each state imposes its own minimum liability limits, defining the maximum amount your insurer will pay if you’re at fault in an auto accident. These limits typically cover three key areas: bodily injury per person, bodily injury per accident, and property damage. For instance, states like California mandate limits such as $15,000 per person and $30,000 per accident for bodily injury, while others like New York require higher minimums. Understanding these variations is crucial because selecting coverage that only meets the state minimums can leave you financially vulnerable if damages exceed those caps.

When comparing policies, pay attention to the state-required limits but also consider your personal risk exposure, including the value of your assets and potential medical expenses. States with lower minimums might tempt you toward cheaper policies, yet opting for higher liability limits can provide a stronger safety net. Here’s what to consider when choosing your limits:

- State minimum requirements: The legal baseline that all drivers must meet.

- Potential out-of-pocket costs: What happens if damages exceed your limits.

- Personal financial situation: Your assets, income, and ability to cover costs after a claim.

Understanding Mandatory Insurance Options and Additional Coverage Choices

Every state mandates certain minimum auto insurance requirements to ensure that drivers can cover costs related to injuries and damages in the event of an accident. These mandatory coverages typically include liability insurance, which pays for bodily injury and property damage to others, and in some cases, personal injury protection (PIP) or uninsured/underinsured motorist coverage. The exact minimum amounts and specific types of required coverage vary widely depending on the state, which means it’s crucial to understand your local laws to avoid penalties and ensure compliance.

Beyond these basic limits, many drivers choose to enhance their protection through additional coverage options that better suit their needs. Popular add-ons include:

- Collision insurance, which covers damage to your own vehicle in an accident, regardless of fault.

- Comprehensive insurance, protecting against non-collision-related damages such as theft, vandalism, or natural disasters.

- Gap insurance, valuable for those financing or leasing a car, which covers the difference between the car’s market value and the amount owed.

Choosing the right combination of mandatory and optional coverages can save you from unexpected financial burdens and provide peace of mind on the road.

How to Navigate State-Specific Discounts and Penalties for Auto Insurance

When exploring auto insurance options, understanding the unique state-specific discounts and penalties can significantly impact your premium costs. Many states offer incentives like safe driver discounts, multi-policy bundling, and even loyalty rewards that can reduce your annual premium. Conversely, some states impose penalties for factors such as late payments, traffic violations, or lapses in coverage, which directly affect your insurance rates. It’s essential to research your state’s regulations or consult with a local agent to take full advantage of available discounts while avoiding costly pitfalls.

To navigate these complexities effectively, consider the following strategies:

- Leverage your vehicle’s safety features: Many states offer discounts for cars equipped with anti-theft devices or advanced safety technology.

- Maintain a clean driving record: Penalties increase with violations like DUIs or multiple speeding tickets, but some states have forgiveness programs.

- Review policy payment options: Opting for automatic payments or paying your premium in full annually can unlock savings.

- Stay informed about state legislative changes: Auto insurance rules evolve, so staying updated ensures you don’t miss new benefits or avoid new penalties.

Future Outlook

Navigating the complexities of auto insurance laws can feel overwhelming, especially when regulations vary significantly from state to state. By understanding the key requirements and nuances in your area, you not only ensure compliance but also position yourself to secure the coverage that best fits your needs. Whether you’re a new driver or looking to update your policy, staying informed is your best tool for protecting yourself and your vehicle on the road. Keep this guide handy as a starting point, and don’t hesitate to consult with local experts to make smart, confident decisions about your auto insurance. Safe driving!