When hitting the open road in your recreational vehicle (RV), peace of mind comes not just from planning your route but also from having the right insurance coverage in place. Understanding what RV insurance typically includes is essential for every owner, whether you’re a full-time traveler or a weekend adventurer. In this article, we’ll break down the key components of RV insurance coverage, helping you make informed decisions to protect your investment, your belongings, and your journey ahead. Whether you’re new to RV ownership or looking to review your current policy, read on to discover everything you need to know about RV insurance coverage.

Table of Contents

- Understanding the Core Components of RV Insurance Coverage

- How Liability Protection Safeguards You on the Road

- Comprehensive and Collision Coverage Explained in Detail

- Tips for Choosing the Right RV Insurance Policy for Your Needs

- Insights and Conclusions

Understanding the Core Components of RV Insurance Coverage

When it comes to protecting your recreational vehicle, insurance policies are designed with several fundamental elements that ensure comprehensive coverage. At the heart of an RV insurance plan is liability coverage, which safeguards you against costs arising from injuries or property damage to others while operating your RV. Alongside this, collision coverage typically covers repairs to your RV after an accident, regardless of fault, while comprehensive coverage handles damages from non-collision events such as theft, vandalism, or natural disasters. Understanding these core protections helps you identify how well your policy will defend you financially in different scenarios.

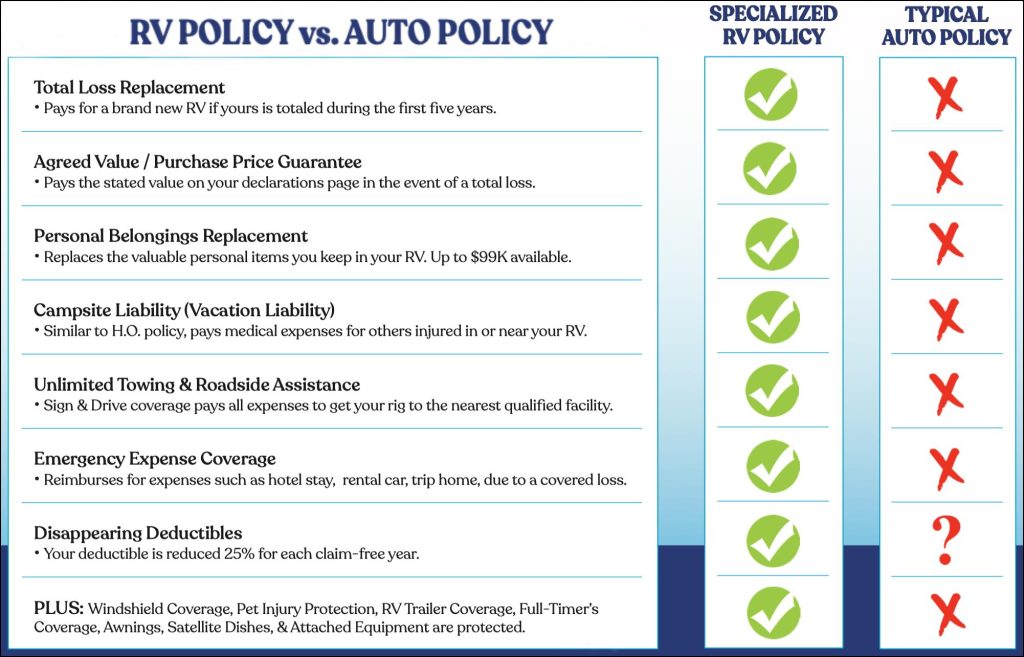

Beyond these essential protections, many RV insurance policies also include coverages that address the unique nature of recreational travel. For instance, personal belongings coverage can reimburse you for lost or damaged items inside your RV, and roadside assistance offers peace of mind with emergency towing or tire changes when you’re stranded. Additionally, some policies provide vacation liability protection to cover accidents that occur while you’re parked and enjoying your campsite. Knowing these components lets you tailor your policy to fit your specific lifestyle and travel habits, ensuring you have the right balance of protection without paying for extraneous coverage.

- Liability Coverage: Protects others and their property.

- Collision Coverage: Repairs from vehicular accidents.

- Comprehensive Coverage: Non-collision-related damages.

- Personal Belongings Coverage: Replacement for lost/stolen items.

- Roadside Assistance: On-the-go emergency help.

- Vacation Liability Protection: Accidents while parked.

How Liability Protection Safeguards You on the Road

Liability protection is a cornerstone of RV insurance, designed to shield you from the financial fallout of accidents where you are found at fault. When you’re behind the wheel of your RV, any damage caused to another vehicle or property, as well as injuries sustained by others, can lead to significant legal and medical expenses. Liability coverage steps in to cover these costs, ensuring you aren’t personally liable for hefty bills. This means peace of mind knowing that your savings and assets are protected from lawsuits or claims that could arise from unexpected accidents.

This coverage typically includes:

- Bodily injury liability: Covers medical expenses, lost wages, and legal fees if someone is injured in an accident you caused.

- Property damage liability: Pays for repairs or replacement of other people’s property damaged by your vehicle.

- Legal defense costs: Protects you against the cost of defending yourself in court if you are sued.

By including liability protection in your RV insurance policy, you are essentially investing in a safety net that safeguards not just your financial stability but also your ability to enjoy the open road without constant worry about potential accidents.

Comprehensive and Collision Coverage Explained in Detail

When it comes to protecting your recreational vehicle, understanding the nuances between comprehensive and collision coverage is essential. Comprehensive coverage is designed to safeguard your RV against damages not caused by a collision. This means if your vehicle suffers from vandalism, theft, fire, falling objects, or natural disasters like hail or floods, comprehensive insurance steps in to cover the repair or replacement costs. It’s essentially a safety net for those unpredictable scenarios that can take a serious toll on your investment while your RV is parked or in use.

On the other hand, collision coverage specifically covers damages resulting from a collision, whether it’s with another vehicle, a stationary object, or even a rollover accident. This type of coverage focuses on restoring your RV to its pre-accident condition after an impact. Typically, collision insurance includes repairs from incidents such as hitting a tree branch during travel or a minor fender bender in a parking lot. Both coverages are optional but highly recommended to fully shield your RV from a wide range of potential risks, ensuring peace of mind wherever the road takes you.

- Comprehensive Coverage: Theft, vandalism, weather-related damages, fire, and animal collisions.

- Collision Coverage: Repairs due to accidents involving other vehicles or objects.

- Combined Protection: Helps avoid out-of-pocket expenses for expensive repairs after accidents or unexpected damage.

Tips for Choosing the Right RV Insurance Policy for Your Needs

Choosing the ideal RV insurance policy requires a deep understanding of your specific travel habits and lifestyle. Start by assessing how often and where you plan to use your RV. If you take frequent cross-country trips, you’ll want a policy with extensive roadside assistance and comprehensive coverage that spans multiple states. Conversely, if your RV is mostly stationary or used seasonally, consider policies that emphasize storage or limited mileage coverage to save on premiums. Additionally, evaluate the value of your RV and any upgrades or contents you have inside, as not all policies automatically cover personal belongings or after-market additions.

When comparing policies, pay close attention to the coverage limits and deductibles. Lower deductibles mean less out-of-pocket expense after a claim, but usually come with higher monthly premiums. Also, look for add-ons that can enhance your coverage, such as emergency expense reimbursement, vacation liability, or full replacement cost endorsements. Don’t hesitate to ask your insurer about discounts for safe driving, multi-policy bundling, or membership in RV clubs. By tailoring your coverage to your individual needs and understanding the fine print, you can avoid costly surprises and hit the road with confidence.

Insights and Conclusions

Understanding the ins and outs of RV insurance coverage is essential for any owner hitting the road with confidence. By knowing what’s typically included—liability, comprehensive, collision, and additional protections like roadside assistance—you can tailor your policy to fit your unique needs and safeguard your investment. Remember, the right coverage not only protects your vehicle but also ensures peace of mind during every adventure. Before you set off on your next journey, take the time to review your options and consult with an insurance professional to find the best plan for you. Safe travels and happy camping!