Every day, installers—whether in tech, construction, or home services—put their skills and sweat into shaping the world around us. But beneath the surface of every successful project lies a silent risk: the unexpected. One accident, one unforeseen event, can turn a hard-earned career upside down. That’s why protecting your future isn’t just a smart choice—it’s a vital one. Choosing the right insurance isn’t just about ticking boxes; it’s about securing peace of mind, safeguarding your livelihood, and honoring the passion and dedication you pour into your work. In this post, we’ll walk you through how to find the best insurance tailored specifically for installers, so you can build not only with confidence but with security that lasts a lifetime.

Table of Contents

- Understanding the Unique Risks Installers Face Every Day

- How to Identify Insurance Policies That Truly Cover Your Work

- Key Benefits to Look for in Installer Insurance Plans

- Expert Tips for Comparing Coverage and Saving on Premiums

- Final Thoughts

Understanding the Unique Risks Installers Face Every Day

Every day, installers step into environments filled with unseen dangers that test their skills and resilience. Whether working on rooftops, inside cramped spaces, or around heavy machinery, the inherent unpredictability of their work puts them at a higher risk of injury and financial instability. Beyond the physical hazards, installers must also navigate potential liabilities that arise from installation mistakes, property damage, or client dissatisfaction—situations that can quickly escalate into costly legal battles. These challenges underscore the importance of safeguarding not just their tools and livelihood but their peace of mind as well.

When considering protection, installers face a distinctive set of risks:

- Fall hazards: Working at heights increases vulnerability to severe injuries.

- Electrical risks: Exposure to live wires demands constant vigilance.

- Equipment malfunctions: Faulty or malfunctioning tools can lead to accidents.

- Weather conditions: Outdoor projects often take place in adverse weather, heightening dangers.

Each risk demands tailored insurance solutions designed to shield installers from the unexpected, empowering them to focus on the job without the weight of ‘what ifs’ looming over their future.

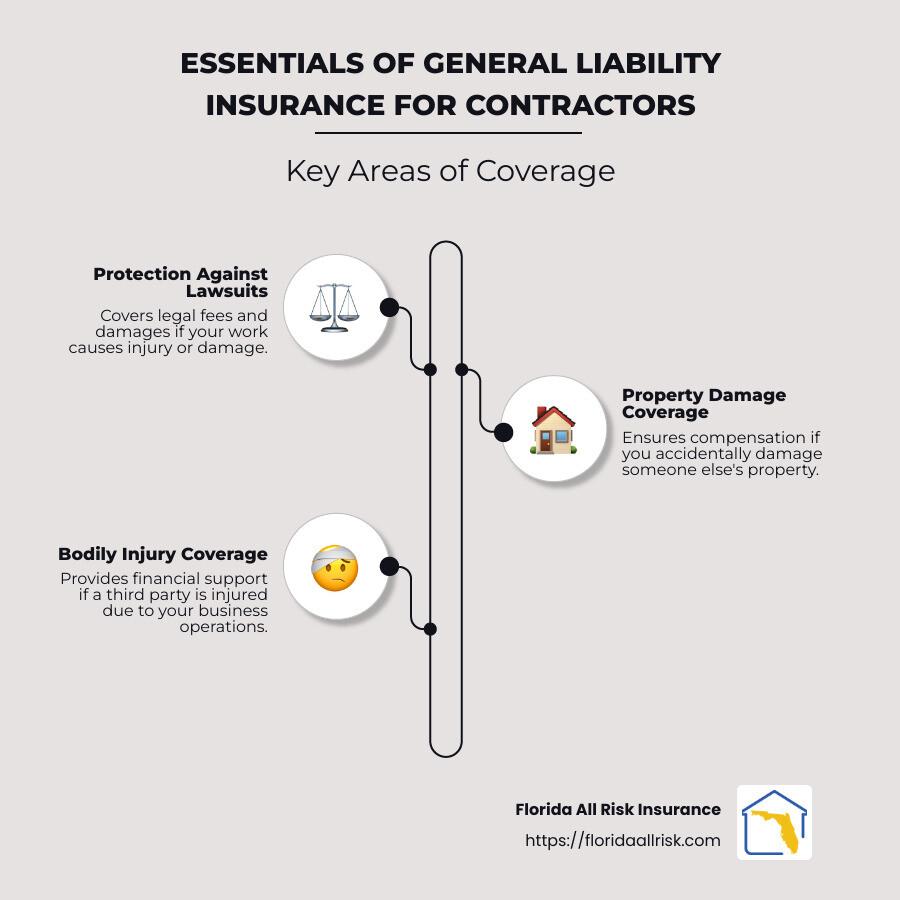

How to Identify Insurance Policies That Truly Cover Your Work

Before committing to an insurance policy, delve deep into the fine print and make sure it aligns closely with the unique risks your installation work faces daily. Not all policies are one-size-fits-all; seek plans that explicitly mention coverage for on-site damages, faulty materials, and third-party liabilities. Ask yourself whether the policy offers protection from unexpected setbacks like equipment theft, accidental property damage during installation, or claims arising from client dissatisfaction. Also, consider the robustness of the policy in covering both physical and financial repercussions — a truly comprehensive plan will shield your livelihood, not just your tools.

Engage with your insurance provider and demand clarity on coverage limits, exclusions, and claims processes, so you’re never left vulnerable due to vague or insufficient terms. Look for policies that include:

- Tailored protections for specific installation scenarios, such as electrical or plumbing work.

- Coverage for subcontractors working under your umbrella, preventing unexpected liabilities.

- Quick claims response with clear, transparent procedures to keep your projects moving.

- Legal defense costs in case of disputes or lawsuits linked to your workmanship.

Choosing an insurance policy on these benchmarks offers you more than a safety net—it becomes a foundation of confidence that empowers you to take on projects with passion and peace of mind.

Key Benefits to Look for in Installer Insurance Plans

When investing in insurance as an installer, prioritize plans that offer comprehensive coverage tailored to your unique risks. Look for policies that protect against unexpected accidents, equipment damage, and on-the-job injuries, giving you peace of mind to focus on what you do best. A strong policy not only covers physical damages but also includes liability protection to shield you from costly legal battles that can threaten both your livelihood and peace of mind.

Additionally, consider plans that provide flexible benefits and quick claims processing. The ability to customize your coverage ensures you only pay for what truly matters to your business, whether that’s tools, transportation, or health expenses. Fast and fair claim handling is crucial during difficult times, enabling you to rebuild swiftly without financial strain. Ultimately, the best insurance acts as a safety net that supports your dedication and hard work, securing your future no matter what challenges arise.

Expert Tips for Comparing Coverage and Saving on Premiums

When selecting an insurance policy as an installer, understanding the nuances of coverage options can mean the difference between peace of mind and unexpected financial strain. Focus on policies that not only cover the basics but also include protection against equipment damage, liability claims, and project delays. Be sure to scrutinize the exclusions and limitations—the smallest overlooked clause could leave you vulnerable when you need support the most.

Saving on premiums doesn’t have to come at the cost of solid protection. Harness strategies like bundling multiple policies, maintaining a claims-free record, and opting for higher deductibles if you can afford it upfront. Remember, being proactive by regularly reviewing and adjusting your coverage as your business grows helps you avoid paying for unnecessary extras.

- Compare quotes from multiple insurers to find competitive rates without sacrificing quality.

- Leverage loyalty discounts and early payment incentives.

- Invest in risk management practices that can lower insurance costs over time.

These steps not only protect your livelihood but also empower you to invest confidently in your future.

Final Thoughts

Choosing the right insurance isn’t just a checkbox on your to-do list — it’s a powerful way to safeguard the future you’re working so hard to build. As an installer, your skill and dedication lay the foundation for success, but without the right protection, everything you’ve invested can feel fragile. Protecting yourself with the best insurance means more than just coverage; it’s peace of mind, security for your loved ones, and the freedom to focus on what you do best. Don’t wait until uncertainty knocks at your door—take control today and invest in a safety net that honors your hard work and commitment. Your future deserves nothing less.