Running a business comes with its fair share of challenges, and one unexpected equipment failure can throw a wrench into your operations — and your budget. That’s where equipment breakdown insurance steps in as a true game-changer. More than just a safety net, this coverage helps protect your business from costly repairs, lost income, and downtime, giving you peace of mind to focus on growth and success. In this article, we’ll explore the many benefits of equipment breakdown insurance and why it’s a smart investment for every business owner looking to safeguard their hard work and keep things running smoothly.

Table of Contents

- Understanding Equipment Breakdown Insurance and Why It Matters

- Key Benefits That Safeguard Your Business Finances and Operations

- How to Choose the Right Equipment Breakdown Insurance for Your Needs

- Expert Tips to Maximize Your Coverage and Minimize Downtime

- To Conclude

Understanding Equipment Breakdown Insurance and Why It Matters

Every business relies on equipment to keep operations running smoothly—from manufacturing machines and HVAC systems to computer networks and refrigeration units. When this equipment unexpectedly fails, the consequences can be severe, causing costly downtime, repairs, and lost revenue. This is where Equipment Breakdown Insurance steps in, offering a safety net that goes beyond standard property policies. It covers the cost of repairing or replacing damaged equipment, minimizing disruption and allowing your business to bounce back quickly.

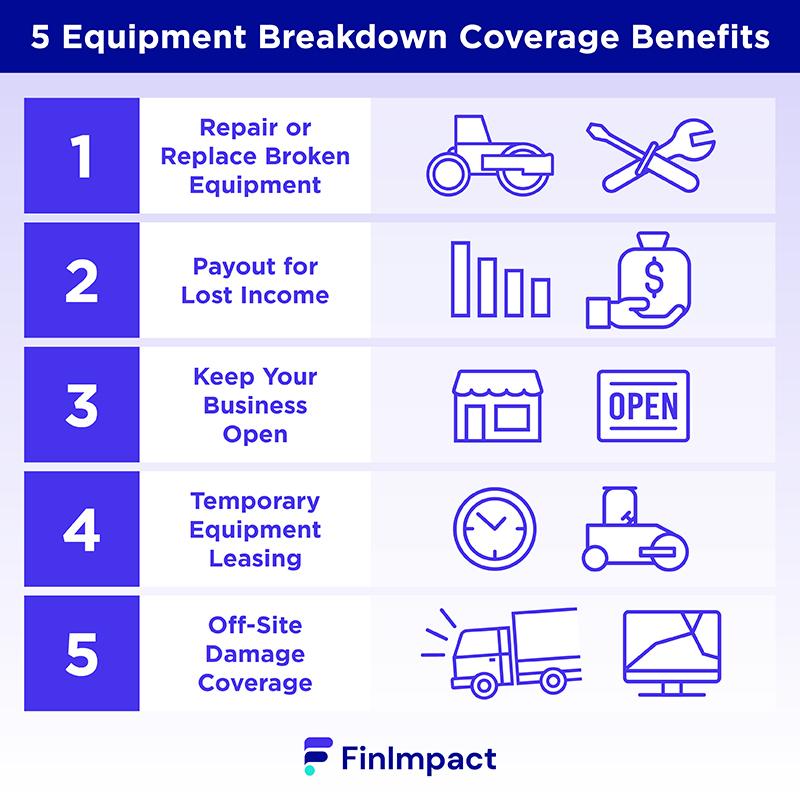

By investing in this specialized coverage, businesses can enjoy a range of practical benefits, including:

- Financial protection against unexpected repair bills

- Coverage for electrical and mechanical breakdowns often excluded from basic insurance

- Replacement of spoiled inventory due to equipment failure

- Coverage for business income loss during the repair period

Understanding these advantages can empower business owners to safeguard their assets and maintain operational continuity, transforming potentially devastating equipment failures into manageable incidents.

Key Benefits That Safeguard Your Business Finances and Operations

Equipment Breakdown Insurance serves as a financial shield, ensuring that unexpected mechanical failures or electrical malfunctions don’t derail your business operations. When critical equipment like HVAC systems, computers, or manufacturing machinery suddenly stop working, this coverage steps in to cover repair or replacement costs. This means you can avoid hefty out-of-pocket expenses and maintain steady cash flow, even during unforeseen disruptions. By minimizing downtime, your business can continue fulfilling orders, meeting client deadlines, and sustaining productivity without scrambling financially.

Beyond simply covering repair costs, the insurance often includes benefits like data restoration, spoilage protection for perishable goods, and reimbursement for income lost due to breakdown-related shutdowns. This comprehensive approach empowers you with peace of mind—even in the face of equipment calamities. With these protections in place, you can confidently focus on growth strategies, knowing your assets and finances are safeguarded from surprises that might otherwise cripple your operations.

- Cost-effective repairs and replacements to protect your budget

- Reduced downtime to maintain operational continuity

- Protection against secondary losses such as data or inventory damage

- Income loss coverage to stabilize finances during outages

How to Choose the Right Equipment Breakdown Insurance for Your Needs

When selecting equipment breakdown insurance, it’s crucial to start by assessing the specific risks and assets your business faces. Consider the type, age, and condition of your machinery, as well as the impact any downtime would have on your operations. Look for policies that offer comprehensive coverage including repair costs, replacement parts, and business interruption losses. A tailored plan not only protects your equipment but also ensures your cash flow remains steady during unexpected disruptions.

Next, evaluate the policy terms and customer support offered by insurers. Seek out coverage that includes 24/7 claims assistance and quick turnaround times, so you’re never left waiting when urgent repairs are needed. Additionally, pay attention to exclusions and deductibles to avoid surprises later on. Some companies may offer value-added services like preventative maintenance or risk assessments, which can help you minimize breakdowns before they happen — a proactive way to safeguard your investment and boost operational resilience.

- Assess your equipment’s unique risks and needs.

- Choose policies that cover both repairs and business interruption.

- Prioritize insurers with responsive claims support.

- Watch for exclusions and deductibles that suit your budget.

- Explore added perks like maintenance and risk evaluation.

Expert Tips to Maximize Your Coverage and Minimize Downtime

Maximizing your coverage starts with a clear understanding of your equipment’s value and vulnerabilities. Conducting a thorough inventory and risk assessment can help identify which machines are critical to your operations and may need enhanced protection. Don’t hesitate to discuss specific scenarios with your insurer—customizing your policy ensures you’re not paying for unnecessary coverage or leaving gaps that could lead to costly downtime. Regularly updating your policy to reflect new equipment purchases or upgrades keeps your coverage aligned with your business growth.

Minimizing downtime depends heavily on proactive maintenance and prompt response plans. Establish a relationship with trusted repair contractors and keep their contact information handy to speed up any emergency fixes. Consider incorporating equipment breakdown insurance that also offers coverage for business interruption – this can provide financial support to keep your business afloat while repairs are underway.

- Leverage technology like monitoring systems to catch issues early.

- Implement routine inspections and maintenance protocols.

- Train staff on emergency procedures related to equipment failure.

These expert strategies combined ensure your business stays resilient, cutting downtime to a minimum and protecting your bottom line.

To Conclude

In today’s fast-paced business world, unexpected equipment breakdowns can bring operations to a halt—and that’s where equipment breakdown insurance steps in as a true game-changer. By protecting your essential machinery and technology, this coverage not only safeguards your bottom line but also gives you peace of mind to focus on what you do best: growing your business. Investing in equipment breakdown insurance is more than just a safety net; it’s a strategic move toward resilience and long-term success. So, take the proactive step today and shield your business from costly disruptions—because every entrepreneur deserves the confidence to keep moving forward, no matter what challenges arise.