Choosing the right health insurance plan can feel like navigating a maze — with so many options, terms, and fine print, it’s easy to get overwhelmed. Two of the most common types you’ll encounter are PPOs (Preferred Provider Organizations) and HMOs (Health Maintenance Organizations). But what do these acronyms really mean, and how do you know which one fits your lifestyle and healthcare needs best? In this post, we’ll break down the basics of PPOs and HMOs in a friendly, easy-to-understand way — helping you make a confident choice when it comes to your health coverage. Let’s dive in!

Table of Contents

- Understanding the Basics of PPOs and HMOs What Sets These Plans Apart

- How Flexibility and Coverage Impact Your Healthcare Choices

- Cost Considerations to Keep in Mind When Choosing Your Plan

- Tips for Picking the Right Plan Based on Your Lifestyle and Health Needs

- In Summary

Understanding the Basics of PPOs and HMOs What Sets These Plans Apart

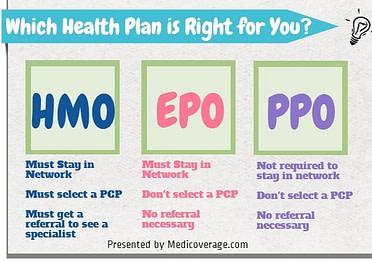

Navigating the world of health insurance can quickly get overwhelming, but breaking down the core differences between PPOs (Preferred Provider Organizations) and HMOs (Health Maintenance Organizations) makes the decision a bit simpler. PPOs offer greater flexibility by allowing you to visit any healthcare provider, including specialists, without a referral. This means you have the freedom to choose your doctors and hospitals both in-network and out-of-network, though staying in-network usually saves you money. On the flip side, PPO plans often come with higher premiums and out-of-pocket costs, which is something to keep in mind when balancing your budget.

HMOs, meanwhile, emphasize coordinated care through a primary care physician (PCP) who manages your overall health. This setup requires referrals to see specialists, which helps control costs but can feel more restrictive if you prefer direct access to multiple providers. By focusing on in-network care, HMOs often have lower premiums and smaller copayments. Here’s a quick rundown of what sets them apart:

- Flexibility: PPOs allow out-of-network visits; HMOs usually do not.

- Cost: HMOs tend to be more affordable upfront with lower deductibles.

- Care Coordination: HMOs require a PCP and referrals; PPOs do not.

- Provider Choice: PPOs offer a broader network, HMOs have a more limited network.

How Flexibility and Coverage Impact Your Healthcare Choices

Navigating the maze of health plans can feel overwhelming, but understanding how flexibility and coverage come into play can dramatically simplify your decision. PPO plans tend to offer greater flexibility, allowing you to see specialists and out-of-network doctors without a referral. This means if you value the freedom to choose your healthcare providers or anticipate needing specialized care, a PPO might be the better fit. On the other hand, HMOs often require you to select a primary care physician and get referrals before seeing specialists, which might feel restrictive but often leads to more coordinated care and lower premiums.

Coverage isn’t just about who you can see—it’s also about what services are included and how costs are shared. Here are some key points to consider:

- Out-of-network care: PPOs typically cover some costs for out-of-network care, whereas HMOs may not.

- Cost-sharing: HMOs usually have fixed copays and lower deductibles, while PPOs can involve higher deductibles but more provider choices.

- Special programs: Some HMOs offer wellness programs or case management that can provide extra support for chronic conditions.

By weighing these elements against your healthcare needs and lifestyle, you can make a choice that keeps your health and budget balanced.

Cost Considerations to Keep in Mind When Choosing Your Plan

When weighing your options between PPOs and HMOs, it’s crucial to factor in the variety of costs associated with each plan beyond just the monthly premium. Out-of-pocket expenses such as copayments, deductibles, and coinsurance can vary widely and impact your overall healthcare budget. PPOs typically come with higher premiums but offer greater flexibility, including coverage for out-of-network care, which can be a lifesaver if you prefer seeing specialists without referrals. On the other hand, HMOs generally have lower premiums and out-of-pocket costs but expect you to stay within their network for most services, which might save money but restrict choice.

Don’t forget to examine additional fees that might catch you off guard. These can include charges for prescription drugs, emergency room visits, or specialist consultations. To help make sense of it all, keep these quick tips in mind:

- Check annual limits: Understand how much you could potentially spend per year in the worst-case scenario.

- Consider your healthcare frequency: If you regularly visit doctors or need prescriptions, a plan with lower copays might be more cost-effective.

- Network restrictions: Verify if your preferred doctors and hospitals are included to avoid surprise bills.

Tips for Picking the Right Plan Based on Your Lifestyle and Health Needs

Choosing a health plan starts with evaluating how you live day-to-day and what your medical needs look like. If you value flexibility—like the freedom to see any doctor or specialist without referrals—a PPO plan could be your best bet. It’s ideal for those who travel frequently, have ongoing medical conditions requiring multiple specialists, or simply want a broad network to choose from. On the flip side, if you prefer a more structured approach with lower premiums and copays, especially for routine care and wellness visits, an HMO often fills that role nicely. Keep in mind that HMOs usually require you to select a primary care physician who coordinates your care, which works great if you are comfortable with a more managed system.

When deciding, it helps to ask yourself some key questions:

- How often do I visit doctors or specialists? Frequent visits might make a PPO more cost-effective despite higher premiums.

- Do I want the freedom to see out-of-network providers? PPOs offer this, HMOs do not.

- What’s my budget for monthly premiums and out-of-pocket costs? HMOs typically offer lower upfront costs, which works well if you want predictable expenses.

- Am I comfortable with a primary care doctor who manages all my healthcare referrals? If yes, HMOs are designed for this style of care coordination.

Ultimately, your lifestyle and health priorities guide the choice. Whether it’s the flexibility of a PPO or the cost-efficiency of an HMO, understanding these personal factors ensures you pick a plan that fits you seamlessly, not just on paper but in your daily life.

In Summary

Choosing between a PPO and an HMO ultimately comes down to your unique health needs, budget, and personal preferences. While PPOs offer more flexibility and a broader network, HMOs provide a more affordable, coordinated approach to care. Hopefully, this breakdown has helped clarify the differences so you can make an informed decision that fits your lifestyle. Remember, the best health plan is the one that keeps you healthy, happy, and hassle-free. Got questions or experiences to share? Drop a comment below—we’d love to hear from you!