Looking to secure life insurance but dread the idea of a medical exam? You’re not alone! No-medical-exam life insurance has become a popular option for many people who want coverage without the hassle of needles, lab tests, or doctor visits. But is it the right choice for you? In this article, we’ll break down what no-medical-exam life insurance really means, how it works, and the pros and cons to help you decide if this quick and convenient option fits your needs. Let’s dive in!

Table of Contents

- Understanding How No-Medical-Exam Life Insurance Works

- Who Benefits Most from No-Medical-Exam Policies

- Comparing Costs and Coverage With Traditional Plans

- Tips for Choosing the Best No-Medical-Exam Life Insurance for Your Needs

- Concluding Remarks

Understanding How No-Medical-Exam Life Insurance Works

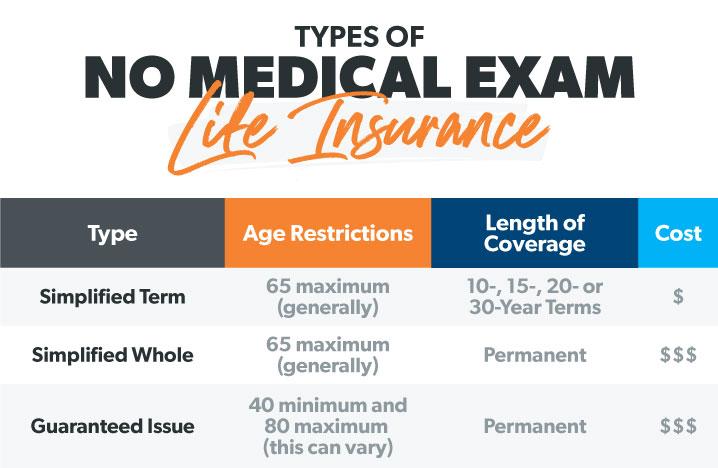

Life insurance typically involves detailed health assessments, blood tests, and sometimes even medical records reviews. However, no-medical-exam policies change the game by allowing you to secure coverage without these invasive steps. Instead, insurance providers rely on answers to health-related questions and information from databases to assess risk. This quicker, more convenient process can get you covered within days, making it a practical choice for those who want insurance without the hassle of medical appointments or who may have conditions that would complicate traditional underwriting.

Here’s what sets no-medical-exam policies apart:

- Speed: Application and approval are streamlined, often completed in a fraction of the time.

- Accessibility: Ideal for individuals who dislike needles, have busy schedules, or face medical challenges.

- Higher Premiums: Because insurers take on more risk without medical exams, rates can be higher than traditional policies.

- Coverage Limits: Sometimes these policies have maximum coverage amounts to limit exposure.

Understanding these factors helps you decide if the convenience outweighs the cost differences. For many, the ease and speed make no-medical-exam life insurance an appealing option — especially when getting coverage quickly is a priority.

Who Benefits Most from No-Medical-Exam Policies

These policies are especially appealing to individuals seeking a hassle-free and speedy application process. If you’ve had recent health concerns or simply want to avoid the uncertainty and often intimidating medical exam, opting for a no-medical-exam plan can be a smart choice. It’s also ideal for those who value convenience—busy professionals, parents juggling multiple responsibilities, or people who prefer keeping their health information private find this option incredibly beneficial.

Additionally, certain groups are prime candidates for no-medical-exam life insurance, including:

- Individuals aged 50 and above who want coverage without the stress of medical tests

- People with minor or manageable health conditions that could delay traditional approval

- Anyone who needs life insurance quickly—perhaps for a new mortgage or to secure a financial commitment

- Those who have avoided regular checkups but now want protection for their loved ones

Comparing Costs and Coverage With Traditional Plans

When evaluating your options, it’s important to recognize that no-medical-exam life insurance often comes at a premium compared to traditional plans. Insurers assume higher risk without detailed health information, so prices might be slightly higher to account for this uncertainty. However, the convenience and speed of approval can be a huge benefit for those who want coverage quickly or have health conditions that complicate standard underwriting processes. Traditional policies, on the other hand, usually require a thorough health review but can provide better rates for healthier individuals.

Coverage options can also differ significantly between the two types. With traditional plans, you typically have more flexibility in policy amounts and types, including term and whole life insurance. No-medical-exam policies tend to focus on simpler, straightforward coverage amounts, often with limits on the maximum benefit. Here’s what to consider when comparing them:

- Cost-effectiveness: Traditional plans usually reward healthy applicants with lower premiums.

- Approval time: No-medical-exam policies speed up the process, sometimes approving within days.

- Coverage limits: Traditional plans often offer higher maximum coverage amounts.

- Risk assessment: Traditional underwriting provides a customized rate based on detailed health information.

Balancing these factors will help you decide whether the ease of no-exam coverage outweighs the potential cost savings and benefits that a traditional plan might offer.

Tips for Choosing the Best No-Medical-Exam Life Insurance for Your Needs

When searching for a no-medical-exam life insurance policy, it’s essential to focus on what truly matters for your unique circumstances. Start by evaluating the coverage amount and term—make sure it aligns with your financial goals, whether you’re protecting your family’s future, paying off debts, or leaving a legacy. Keep in mind that faster approvals often mean higher premiums, so balance convenience with affordability. Research different insurers’ reputations as well, because a reliable company with strong customer service can make a big difference when it’s time to file a claim.

Next, consider the policy features apart from the absence of a medical exam. Look for flexible premium payment options and any riders that increase your coverage or add benefits, such as accelerated death benefits or waiver of premium during disability. Additionally, check for any waiting periods or age limits that could impact your eligibility. Here are a few quick tips to keep in mind:

- Compare quotes from multiple providers to find the best value.

- Read the fine print for exclusions or limitations on coverage.

- Understand cash value accumulation if you’re choosing a whole life or universal life policy.

Concluding Remarks

Choosing the right life insurance is a personal journey, and no-medical-exam policies offer a convenient option for many. While they provide quick approval and less hassle, it’s important to weigh the pros and cons based on your health, budget, and coverage needs. Hopefully, this guide has helped you get a clearer picture of whether a no-medical-exam life insurance plan fits your lifestyle. Remember, the best policy is the one that gives you peace of mind and protects what matters most. Happy planning!