Buying and selling used cars can be a rewarding venture, but for many dealers, it also comes with a maze of legal risks and insurance challenges that can feel overwhelming. Whether you’re just starting out or have been in the business for years, understanding how to protect yourself and your dealership is crucial—not just for peace of mind, but for the very survival of your business. In this article, we’ll gently guide you through the key legal pitfalls to watch out for and the insurance options that can help keep your used car dealership safe and secure. Because when it comes to navigating this complex landscape, being informed is your best asset.

Table of Contents

- Understanding Common Legal Challenges Faced by Used Car Dealers

- Assessing the Importance of Comprehensive Insurance Coverage

- Best Practices for Minimizing Liability Risks in Vehicle Sales

- Building Strong Relationships with Legal and Insurance Professionals

- In Retrospect

Understanding Common Legal Challenges Faced by Used Car Dealers

Used car dealers frequently navigate a complex legal framework that demands vigilance and proactive management. One of the most common challenges involves compliance with state and federal regulations, such as the Federal Trade Commission’s Used Car Rule, which mandates clear disclosure of a vehicle’s history and condition to buyers. Failure to adhere to these rules can result in hefty fines and damage to reputation, making it crucial for dealers to maintain transparent sales practices. Additionally, warranty and “as-is” sales contracts often lead to disputes if the terms are not explicitly communicated or documented, creating legal vulnerabilities.

Beyond regulatory compliance, dealers must also contend with issues like title and ownership verification, which can be a minefield of liability if errors lead to wrongful sales or unresolved liens. Challenges also extend to managing consumer complaints regarding vehicle defects or undisclosed damage. To protect their business, many dealers rely on comprehensive insurance policies that cover legal expenses stemming from negligence claims, fraud allegations, and even employee misconduct. Ensuring proper legal consultation and tailored insurance coverage can shield dealers from costly pitfalls, preserving both their operations and customer trust.

Assessing the Importance of Comprehensive Insurance Coverage

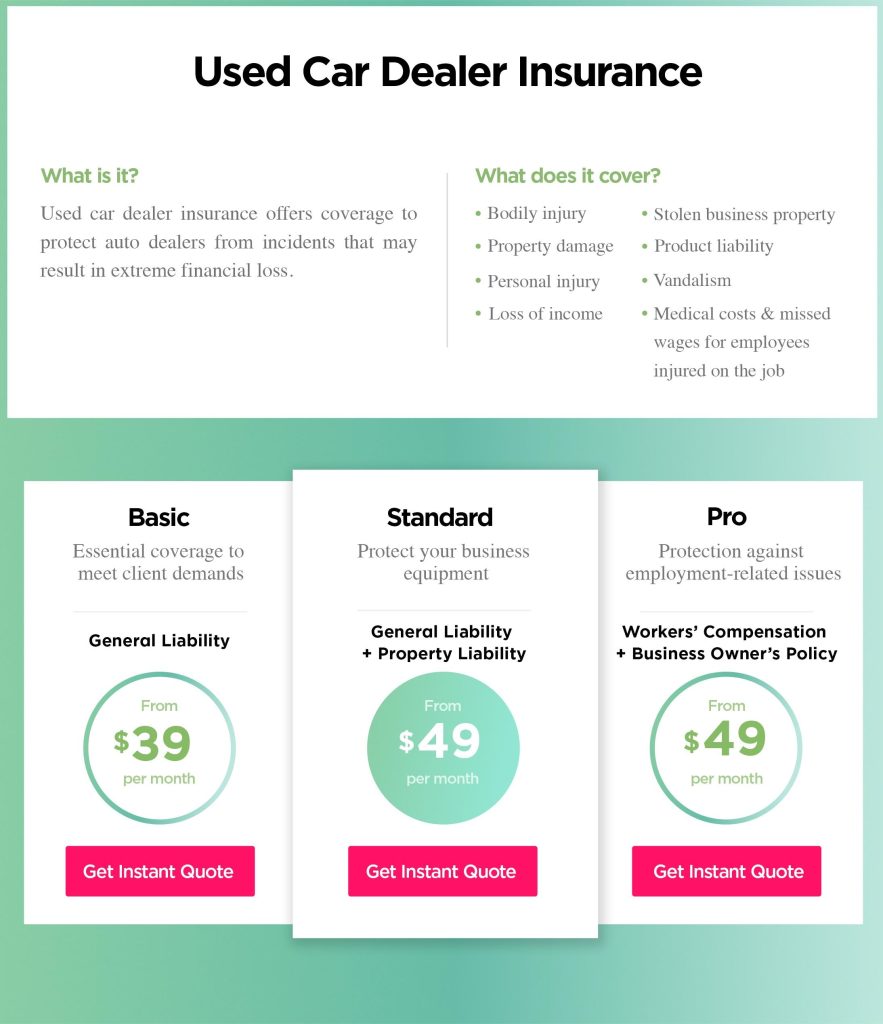

For used car dealers, the stakes are high when it comes to protecting their business from unexpected legal claims and liabilities. Comprehensive insurance coverage acts as a critical safety net, safeguarding dealers against a wide range of risks—from accidents on the lot to disputes arising from vehicle defects or fraudulent claims. Without this layer of protection, a single incident could result in substantial financial loss, harming not only profitability but also reputation and customer trust. Prioritizing thorough policies ensures that dealers remain resilient, no matter what challenges arise.

Key coverage components that should never be overlooked include:

- General Liability Insurance: Protects against bodily injury and property damage claims made by third parties.

- Inventory Coverage: Shields vehicles and parts from theft, fire, or natural disasters.

- Errors & Omissions Insurance: Covers legal costs related to mistakes or omissions in sales contracts and warranties.

- Workers’ Compensation: Essential for safeguarding employees and meeting regulatory requirements.

Investing in a comprehensive insurance plan is more than just ticking a box—it’s about fortifying your business foundation against the unpredictable stresses of the automotive industry.

Best Practices for Minimizing Liability Risks in Vehicle Sales

Ensuring thorough documentation is one of the most effective strategies to shield your dealership from unexpected liability claims. Each transaction should be accompanied by clearly written contracts that detail the condition of the vehicle, any existing warranties, and disclosures of known defects. Additionally, keeping meticulous maintenance and inspection records not only promotes transparency but also demonstrates your commitment to accountability. This diligence provides invaluable protection in case disputes arise, proving that you acted in good faith and upheld industry standards.

Implementing a robust employee training program can significantly reduce risks associated with omissions or misinformation during sales. Make sure your team is well-versed in regulatory compliance, consumer rights, and proper disclosure protocols. Incorporating regular legal updates and role-playing scenarios helps employees stay sharp and responsible. Furthermore, leveraging digital tools for tracking sales processes and customer communications ensures consistency and provides an audit trail—two critical defenses when facing liability issues.

- Use clear, legally vetted sales agreements.

- Disclose all known vehicle defects transparently.

- Maintain detailed service and inspection logs.

- Train staff regularly on compliance and ethical sales.

- Utilize digital tools for record-keeping and customer interactions.

Building Strong Relationships with Legal and Insurance Professionals

Establishing a trusted network with legal and insurance professionals is essential for used car dealers aiming to safeguard their business against unforeseen challenges. Collaborating closely with attorneys who specialize in automotive law can help you navigate complex regulations, draft airtight contracts, and address disputes proactively before they escalate. Similarly, insurance agents familiar with the unique risks faced by dealerships can tailor coverage options that align specifically with your operational needs, offering protection that goes beyond generic policies.

Consider these key practices to strengthen your professional relationships:

- Schedule regular consultations to stay ahead of industry changes and update your risk management strategies accordingly.

- Invite experts to provide staff training on compliance, claims handling, and legal rights to foster a well-informed team.

- Maintain open communication channels to swiftly address emerging issues and ensure all parties are aligned on expectations.

- Document all agreements meticulously with legal input to minimize misunderstandings and protect your interests.

In Retrospect

Navigating the complex legal landscape and insurance requirements as a used car dealer can feel overwhelming, but it’s a crucial part of protecting your business and maintaining customer trust. By staying informed, seeking expert advice, and proactively managing risks, you not only safeguard your dealership from potential pitfalls but also create a foundation for long-term success. Remember, every challenge presents an opportunity to build resilience—so take these steps seriously, and continue driving your business forward with confidence and care.