Planning for the future is something we all think about, especially as we get older. For seniors, life insurance can be a valuable tool to provide peace of mind and financial security for loved ones. But navigating the world of life insurance after a certain age can feel a bit overwhelming. Don’t worry—we’re here to help! In this article, we’ll share some key tips to keep in mind when considering life insurance for seniors, making it easier for you to make informed decisions that suit your unique needs. Let’s dive in and take the mystery out of life insurance!

Table of Contents

- Understanding the Unique Needs of Seniors When Choosing Life Insurance

- How to Assess Different Policy Options for Peace of Mind

- Tips for Getting the Best Rates Despite Age-Related Challenges

- What to Look for in a Policy to Protect Your Loved Ones

- To Conclude

Understanding the Unique Needs of Seniors When Choosing Life Insurance

When it comes to securing life insurance later in life, seniors face a set of unique challenges that differ significantly from younger applicants. Health conditions, lifestyle changes, and retirement income all play a pivotal role in determining the best policy. Unlike younger individuals, many seniors seek coverage not only for income replacement but also to manage final expenses, leave a legacy, or cover estate taxes. This means the approach to life insurance must be tailored with a deep understanding of their evolving financial priorities and health status.

Key considerations include:

- Affordability: Fixed incomes often mean premiums need to be manageable without strain.

- Policy types: Whole life, term life, or guaranteed issue policies each have pros and cons that suit different needs.

- Health factors: Existing medical conditions may affect both eligibility and premium costs.

- Coverage goals: Whether it’s covering medical bills, funeral costs, or passing wealth to heirs, clarity on the purpose helps find the right fit.

How to Assess Different Policy Options for Peace of Mind

When evaluating your policy options, it’s essential to consider factors that go beyond just the premium cost. Start by examining the coverage limits and what types of benefits are included. Policies with broader coverage might provide added security for unforeseen medical needs or final expenses, even if they come at a slightly higher price. Additionally, check the policy’s flexibility — can you adjust your coverage as your needs change, or are you locked into a fixed plan? Understanding these details helps you avoid surprises and ensures your peace of mind.

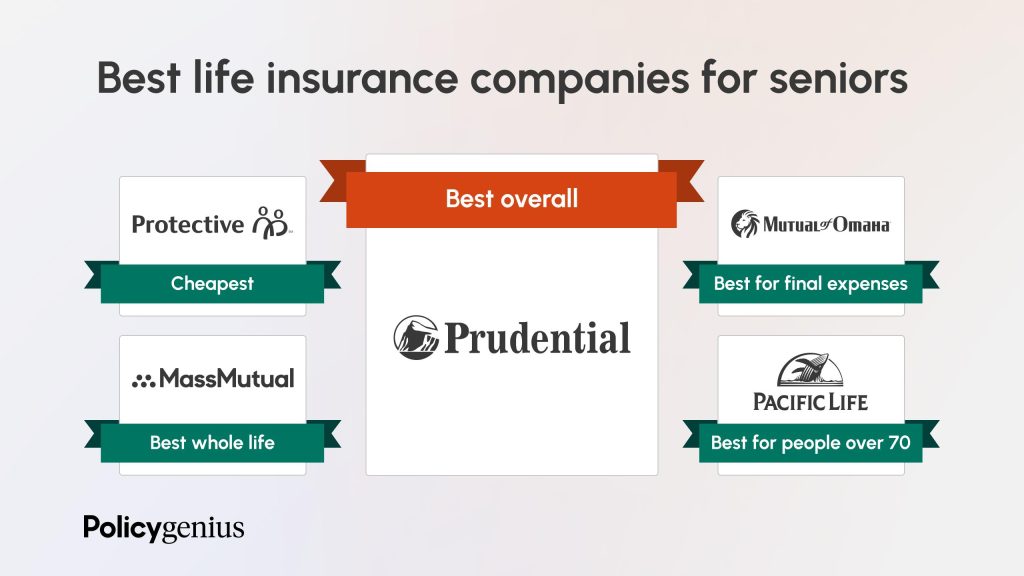

Another crucial element is the reputation and reliability of the insurance provider. Look for companies with strong financial stability and positive customer reviews, especially concerning their claim process for seniors. You might also want to ask about the waiting periods and whether there are any exclusions that could impact your claim eligibility. Creating a simple checklist with these points can make comparing multiple policies easier and more effective:

- Coverage limits and types of benefits

- Premium affordability and payment options

- Policy flexibility and potential for adjustments

- Provider’s reputation and financial strength

- Waiting periods and exclusions

Tips for Getting the Best Rates Despite Age-Related Challenges

Securing affordable life insurance as a senior can feel like navigating a maze, but a few strategic moves can make a significant difference. Start by comparing multiple quotes from various insurers, as premiums can vary widely even for similar coverage. Consider working with an insurance broker who specializes in senior policies—they often have access to exclusive plans and can tailor options to your unique health profile. Also, be transparent about your medical history; providing accurate, up-to-date information can prevent surprises during underwriting and may even reveal opportunities for discounts.

Another key tip is to explore alternative policy types beyond traditional whole or term life insurance. For example, guaranteed issue policies or final expense insurance typically require no medical exams and can be a practical choice if health conditions are a concern. Additionally, maintaining a healthy lifestyle—even small changes like quitting smoking or managing blood pressure—can positively influence your rates over time. Don’t forget to review your policy regularly to adjust coverage as your needs evolve, ensuring you always get the best value for your investment.

What to Look for in a Policy to Protect Your Loved Ones

When choosing a life insurance policy aimed at safeguarding your loved ones, the focus should be on finding coverage that truly aligns with their future needs. Look for policies that offer flexible death benefit options, allowing you to adjust coverage as circumstances change over time. Another vital aspect is the inclusion of living benefits, such as provisions for terminal illness or long-term care, which can provide financial support during challenging times rather than only in the event of death. This feature can significantly ease the burden on your family if health issues arise unexpectedly.

Additionally, pay attention to the premium structure and policy fees. Seniors often benefit from policies with level premiums that won’t increase with age, helping you better manage your budget. It’s also wise to evaluate any restrictions or exclusions that might affect claim payouts. A good policy will be transparent about these details and offer clear, straightforward terms. To sum up, here are a few essentials to consider:

- Flexible coverage amounts and options

- Living benefits and riders tailored for seniors

- Level premiums with no hidden fees

- Clear and fair terms with minimal exclusions

- Reputable insurer with a strong claims history

To Conclude

Wrapping things up, life insurance can be a crucial part of securing peace of mind for you and your loved ones as you enjoy your golden years. By understanding your options, assessing your needs, and planning ahead, you can find a policy that fits your unique situation. Remember, it’s never too late to take charge of your financial future and leave a lasting legacy. Thanks for reading, and here’s to making smart choices that bring you comfort and confidence every step of the way!