Hey there! If you’re a senior thinking about life insurance, you’re in the right place. Navigating the world of life insurance can feel a bit overwhelming, especially with so many options and terms thrown around. But don’t worry—we’re here to break it down in a simple, friendly way. Whether you’re looking to protect your loved ones, cover final expenses, or just gain some peace of mind, these easy-to-follow tips will help you find the life insurance plan that fits your needs and budget. Let’s dive in and make this a stress-free journey!

Table of Contents

- Choosing the Right Type of Life Insurance for Your Senior Years

- Understanding the Benefits of Guaranteed Acceptance Policies

- Tips for Comparing Premiums and Coverage Options

- How to Maximize Your Life Insurance Value on a Fixed Income

- Key Takeaways

Choosing the Right Type of Life Insurance for Your Senior Years

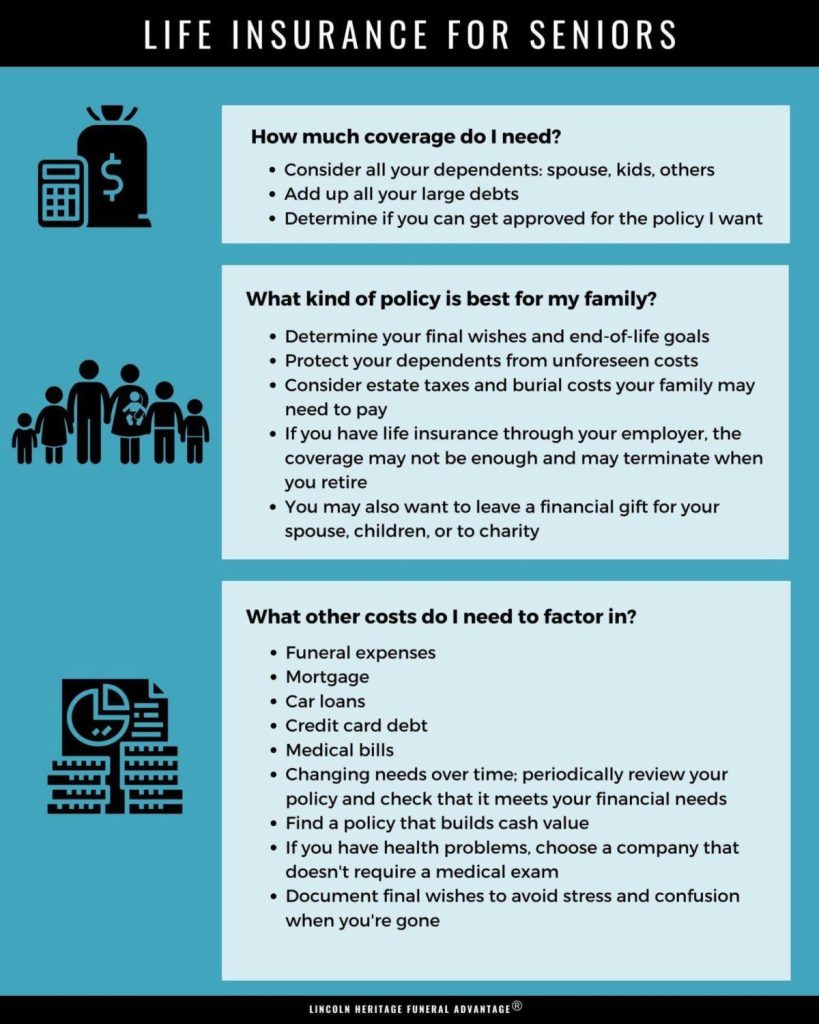

When evaluating your options, it’s essential to consider how each type of life insurance aligns with your unique needs and financial goals. Term life insurance often appeals to seniors seeking affordable coverage for a specific period, such as until retirement funds are fully secured or a mortgage is paid off. However, it’s important to note that term policies usually doesn’t last indefinitely and may become more expensive to renew as you age. On the other hand, whole life insurance offers lifelong protection with the added benefit of accumulating cash value, which can sometimes be borrowed against in emergencies. While premiums are generally higher, many find the stability and predictability comforting during their golden years.

Other alternatives like guaranteed universal life insurance or final expense policies can suit those who prioritize fixed premiums or need to cover specific end-of-life costs without medical exams. When making your choice, think about:

- Your budget: What monthly premium feels sustainable?

- Coverage duration: Are you looking for a policy that lasts a lifetime or just a set term?

- Health considerations: Some policies don’t require medical exams, which might be preferable.

- Legacy goals: Is passing on a financial gift to loved ones a priority?

Taking the time to weigh these factors carefully will help you select a policy that feels reassuring and practical, giving you peace of mind every step of the way.

Understanding the Benefits of Guaranteed Acceptance Policies

One of the most reassuring aspects of certain life insurance options for seniors is the assurance of coverage without the hassle of medical exams or health questions. These policies are designed to provide peace of mind by offering guaranteed acceptance regardless of pre-existing conditions. This means that even if you have chronic illnesses or past health concerns, you can still secure a plan that protects your loved ones from unexpected financial burdens.

Moreover, guaranteed acceptance policies often come with simple application processes and quick approvals, making them a practical choice for many seniors. While premiums might be slightly higher compared to traditional plans, the benefits include:

- Easy qualification without health screenings

- Consistent coverage no matter your medical history

- Flexible use of benefits for final expenses or other needs

By choosing a plan with guaranteed acceptance, seniors can confidently plan their life insurance strategy knowing they won’t be turned away when they need coverage most.

Tips for Comparing Premiums and Coverage Options

When evaluating different life insurance policies, it’s essential to look beyond just the monthly or annual premiums. Focus on what the policy actually covers and how it aligns with your unique needs. For seniors, features like guaranteed renewable options, coverage for chronic illnesses, or a fixed premium that doesn’t spike with age can make a significant difference. Always check the fine print for exclusions and waiting periods, as these can impact when and how much your beneficiaries receive.

To make your comparison easier and more effective, create a simple checklist that includes:

- Premium amounts and payment terms

- Coverage limits and benefit types

- Additional riders or perks (like accelerated death benefits)

- Company reputation and financial stability

This approach helps you weigh the value each policy offers against its cost, ensuring you get the best protection without surprises down the road.

How to Maximize Your Life Insurance Value on a Fixed Income

When living on a fixed income, every dollar must stretch further, making it essential to get the most out of your life insurance policy. Start by reviewing your coverage to ensure it aligns with your current financial needs—sometimes downsizing your policy can free up funds without sacrificing essential benefits. Consider converting whole life insurance to a term policy if your priority is affordable premiums for a set period. Additionally, explore options like accelerated death benefits, which allow you to access a portion of the policy’s value if you experience a qualifying illness—this can ease financial strain without waiting until the policy matures.

Another smart approach is to leverage the cash value of permanent life insurance policies. If your policy has accumulated cash value, you might be able to borrow against it or request a withdrawal to help cover unexpected expenses. However, be mindful that these actions can reduce the death benefit if not repaid. Here are some strategies to consider:

- Shop around: Regularly compare rates and features to ensure you’re getting the best deal possible.

- Bundle policies: Some insurers offer discounts when you combine life insurance with other coverage like health or auto insurance.

- Stay healthy: Maintain a healthy lifestyle to potentially qualify for lower premiums upon policy renewal.

Key Takeaways

Thanks for sticking with me through these friendly tips on life insurance for seniors! Choosing the right policy doesn’t have to be overwhelming—whether you’re looking to cover final expenses, leave a legacy, or simply bring peace of mind to your loved ones, there’s an option out there that fits your unique needs. Remember, the best time to review your life insurance is when you feel ready and informed. If you have questions, don’t hesitate to reach out to a trusted advisor who can guide you through the process. Here’s to making smart, stress-free choices that protect what matters most. Until next time, take care and stay well!