Thinking about life insurance can sometimes feel overwhelming, right? With all the different terms flying around—term, whole, universal—it’s easy to get confused about what each one really means and which might be the best fit for you. Don’t worry, you’re not alone! In this article, we’ll break down the basics of life insurance in a simple, friendly way. By the end, you’ll have a clear understanding of term, whole, and universal life insurance, so you can make informed decisions to protect yourself and your loved ones. Let’s dive in!

Table of Contents

- Understanding Term Life Insurance and Who It’s Best For

- Breaking Down Whole Life Insurance Benefits and Costs

- Exploring Universal Life Insurance Flexibility and Features

- Choosing the Right Life Insurance for Your Financial Goals

- Key Takeaways

Understanding Term Life Insurance and Who It’s Best For

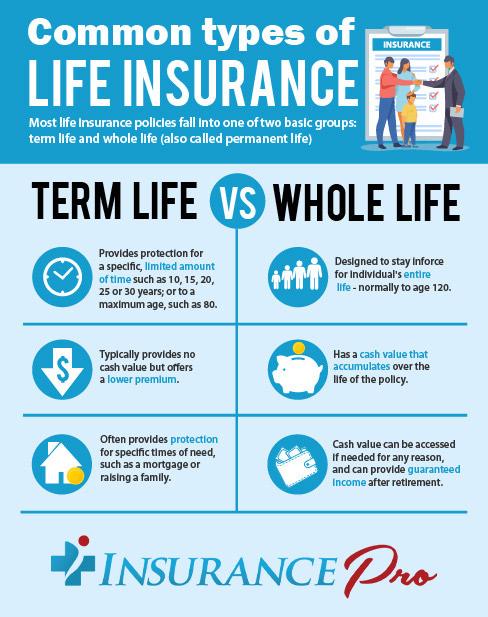

Term life insurance offers straightforward coverage for a set period—typically 10, 20, or 30 years—making it a favorite choice for those seeking budget-friendly protection. Because it only provides a death benefit without any cash value component, the premiums are generally lower compared to other types of life insurance. This simplicity means your loved ones receive a guaranteed payout if you pass away during the term, helping cover expenses like mortgages, education costs, or everyday bills.

This type of insurance is perfect for individuals who:

- Are in good health and looking for affordable coverage.

- Have financial responsibilities that will diminish or end, such as paying off a home loan or raising children.

- Want to supplement an existing permanent policy for additional protection during peak financial obligations.

Breaking Down Whole Life Insurance Benefits and Costs

Whole life insurance offers more than just a death benefit; it acts as both a protective shield and a long-term financial tool. One of its standout advantages is the guaranteed level premiums that remain consistent throughout your lifetime, providing stability in your budgeting. Additionally, it builds cash value over time, which you can borrow against or even use to pay premiums—an appealing feature for those looking for added flexibility in their policies. This cash accumulation happens tax-deferred, making it an attractive option if you want a blend of insurance protection and investment-like growth.

However, it’s important to consider that these benefits come with a price. Whole life insurance premiums tend to be significantly higher than term life policies because of the lifelong coverage and cash value component. This means it might not be the most cost-effective choice for everyone, especially if your main goal is affordable coverage for a specific period. When evaluating costs, also keep in mind that policy fees and other charges could affect the overall value. Ultimately, weighing the long-term financial benefits against the initial investment is key to determining if whole life insurance fits your personal insurance strategy.

Exploring Universal Life Insurance Flexibility and Features

Universal life insurance stands out by offering a remarkable level of flexibility that adapts to your changing needs over time. Unlike term or whole life, it allows you to adjust your premium payments and death benefit amounts within certain limits. This means if your financial situation fluctuates, you aren’t locked into rigid payment schedules or coverage levels. Plus, the policy accumulates cash value based on current interest rates, giving you potential growth alongside protection. Many people appreciate this mix of security and adaptability, making it an appealing option in a world where life circumstances rarely stay the same.

One of the beauties of universal life is how it empowers policyholders with control and strategic options, such as:

- Flexible premium payments: Pay more in good years, less when money is tight.

- Adjustable death benefit: Increase or decrease your coverage to fit life changes like marriage or buying a home.

- Cash value access: Borrow or withdraw funds for emergencies, education, or retirement needs.

- Potential to build cash value: Interest credits can help grow your policy’s savings component over time.

These features make universal life insurance a versatile tool not just for protection but as part of your broader financial planning strategy, offering peace of mind with built-in adaptability.

Choosing the Right Life Insurance for Your Financial Goals

When it comes to securing your financial future, the ideal life insurance policy is one that aligns seamlessly with your long-term goals. Are you looking for straightforward coverage to protect your loved ones during a specific period, or do you want a policy that builds cash value over time? Understanding your priorities—whether it’s affordability, investment growth, or lifelong protection—will guide you in choosing a plan that fits your lifestyle. Term insurance offers simplicity and lower premiums, perfect for temporary needs, while whole life and universal policies provide lifelong coverage with added financial features like cash value accumulation.

To make a confident decision, consider factors such as your current financial responsibilities, future income expectations, and risk tolerance. Ask yourself if you need the policy primarily for income replacement, estate planning, or even supplementing retirement income. Here are a few key points to keep in mind:

- Duration of coverage: How long do you want protection?

- Premium flexibility: Are fixed or adjustable premiums more suitable?

- Cash value importance: Do you want a policy that builds savings?

- Budget considerations: What premium fits comfortably into your finances?

Taking the time to evaluate these aspects will empower you to select a policy that not only safeguards your family but also supports your broader financial ambitions.

Key Takeaways

And there you have it—a friendly rundown of the basics of life insurance: term, whole, and universal. Choosing the right policy doesn’t have to be overwhelming once you understand how each type works and what fits best with your goals and budget. Remember, life insurance is more than just a financial product—it’s a way to protect the people you care about most. So take your time, do a little research, and don’t hesitate to ask questions. Your future self (and your loved ones) will thank you for the peace of mind that thoughtful coverage brings. Here’s to making informed choices and securing a brighter tomorrow!