Thinking about life insurance but not sure where to start? You’re not alone! Life insurance might sound complicated or even a bit overwhelming, but at its core, it’s all about protecting the people you care about most. In this article, we’re breaking down the basics of life insurance—what it is, how it works, and why it might be a smart move for your financial future. Whether you’re a complete newbie or just looking to brush up on the essentials, consider this your friendly guide to Life Insurance 101. Let’s dive in!

Table of Contents

- Understanding the Basics of Life Insurance and Its Purpose

- Choosing the Right Life Insurance Policy for Your Needs

- How Life Insurance Payouts Work and What They Cover

- Tips for Getting the Best Life Insurance Rates and Coverage

- Wrapping Up

Understanding the Basics of Life Insurance and Its Purpose

At its core, life insurance is a financial safety net designed to protect your loved ones in the event of your untimely passing. It ensures that those who depend on you are not left struggling with unexpected expenses, such as funeral costs, outstanding debts, or daily living expenses. Think of it as a promise that your family’s financial well-being will be safeguarded, even when you’re not there to provide for them. Unlike other investments or savings, life insurance focuses on peace of mind, offering a clear payout to beneficiaries without the usual market jitters.

When exploring life insurance, it’s helpful to understand the different purposes it serves, including:

- Income Replacement: Replacing your income to maintain your family’s lifestyle.

- Debt Coverage: Paying off any mortgages, loans, or credit card balances.

- Education Funding: Securing your children’s future education without financial strain.

- Estate Planning: Helping cover estate taxes or leave a legacy.

Each policy can be tailored to fit your unique needs, whether you want short-term protection or lifelong coverage. The important part is to see life insurance not just as a policy, but as a foundation for financial security and care for the ones you love most.

Choosing the Right Life Insurance Policy for Your Needs

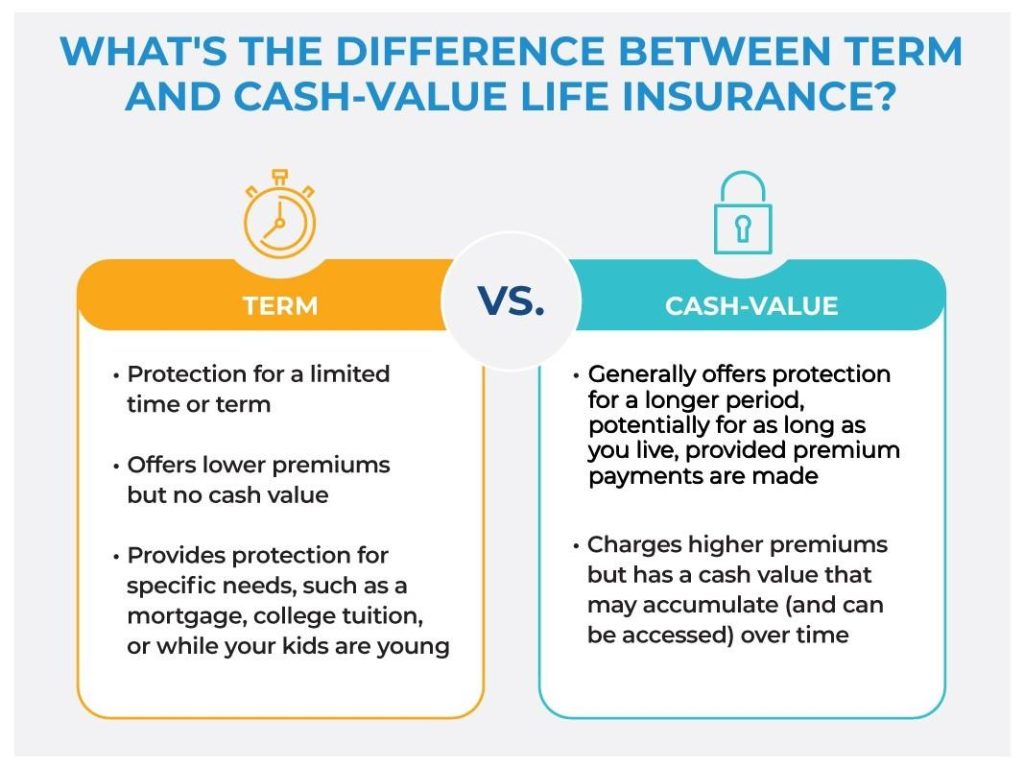

Finding a life insurance policy that truly fits your unique circumstances means considering more than just the price tag. Start by evaluating your financial goals, family needs, and future plans. Are you looking to cover just outstanding debts, or do you want to provide a lasting legacy or college fund? These questions help determine whether term life insurance or whole life insurance suits you better. Term policies offer coverage for a specific number of years and are generally more affordable, while whole life insurance provides lifelong protection with an investment component built in.

Next, pay close attention to policy features that could impact your coverage and peace of mind. Look for benefits such as:

- Convertible terms: Allowing you to switch from term to permanent life insurance without additional health assessments.

- Riders: Add-ons like critical illness coverage or waiver of premium can enhance your policy’s value.

- Cash value accumulation: For permanent policies, this can serve as a financial resource during your lifetime.

By weighing these factors carefully and consulting with a trusted advisor, you can secure a policy that not only safeguards your loved ones but also aligns perfectly with your life’s evolving story.

How Life Insurance Payouts Work and What They Cover

When a life insurance claim is filed, the designated beneficiary typically receives a lump sum payment known as the death benefit. This payment is designed to provide financial security after the insured person’s passing, helping cover expenses like funeral costs, outstanding debts, or everyday living expenses. It’s important to note that the payout process usually requires submitting a death certificate and claim forms, after which the insurance company reviews the claim and disburses the funds—often within a few weeks.

The coverage itself goes beyond just the death benefit, depending on your policy type. Here are some common elements that life insurance payouts can include:

- Coverage for terminal illness: Some policies allow early payouts if the insured is diagnosed with a terminal condition.

- Accidental death benefits: Extra sums paid if death results from an accident rather than natural causes.

- Riders and add-ons: Optional features like critical illness coverage or income protection.

Understanding what your policy covers upfront ensures you can make the most of your life insurance and provide peace of mind for those you care about most.

Tips for Getting the Best Life Insurance Rates and Coverage

Start with a Clear Understanding of Your Needs. Before shopping around, take time to assess your financial situation, family obligations, and future goals. This helps determine how much coverage you genuinely require without overpaying for unnecessary extras. Consider factors such as outstanding debts, mortgage balance, children’s education expenses, and your income replacement needs. Having a defined coverage amount makes it easier to compare policies and avoid confusion during the application process.

Shop Around and Leverage Discounts. Don’t settle for the first life insurance quote you receive. Comparing policies from multiple providers can reveal significant price differences for similar coverage. Additionally, many insurers offer premium discounts for reasons such as being a non-smoker, maintaining a healthy lifestyle, purchasing coverage online, or bundling policies. Ask about available discounts, and be transparent about your health habits, so you can qualify for the best rates possible. Using online tools can simplify this process and help you narrow down the most cost-effective options swiftly.

Wrapping Up

And there you have it—life insurance in a nutshell! While it might seem a bit overwhelming at first, understanding the basics can empower you to make smart choices that protect your loved ones. Remember, life insurance isn’t just about money; it’s about peace of mind and security for the people you care about most. So take your time, explore your options, and don’t hesitate to reach out to a professional if you have questions. Here’s to making informed decisions and looking after your family’s future with confidence!