Choosing the right life insurance coverage can feel a bit overwhelming—after all, it’s about protecting the people you love and securing their future. But don’t worry! Figuring out your perfect life insurance plan doesn’t have to be complicated. In this blog, we’ll walk you through simple steps to help you understand what coverage suits your unique needs and lifestyle. Whether you’re just starting your family, planning for big life changes, or simply want peace of mind, this guide is here to make the process clear, approachable, and even a little fun. Let’s dive in!

Table of Contents

- Understanding Your Financial Needs and Goals

- Evaluating Different Types of Life Insurance Policies

- Calculating the Right Coverage Amount for Your Family

- Tips for Choosing the Best Life Insurance Provider

- Key Takeaways

Understanding Your Financial Needs and Goals

Before diving into life insurance options, it’s crucial to take a step back and honestly assess where you stand financially. Consider your current income, existing debts, and ongoing expenses. Think about future financial obligations as well, such as your children’s education, mortgage payments, or aging parents’ care. This groundwork helps in determining how much coverage you truly need, ensuring your policy supports both immediate and long-term priorities without overextending your budget.

When setting goals for life insurance, ask yourself what you want your policy to achieve. Are you looking to replace lost income, pay off outstanding debts, or leave a legacy for your loved ones? Some key factors to weigh include:

- Income Replacement: Protect your family’s lifestyle if you are no longer there to provide.

- Debt Coverage: Ensure major loans or credit card balances don’t become their burden.

- Future Expenses: Plan for big costs on the horizon like college tuition or retirement funds.

- Final Costs: Cover funeral and other immediate expenses so your family isn’t hit financially in a difficult time.

Evaluating Different Types of Life Insurance Policies

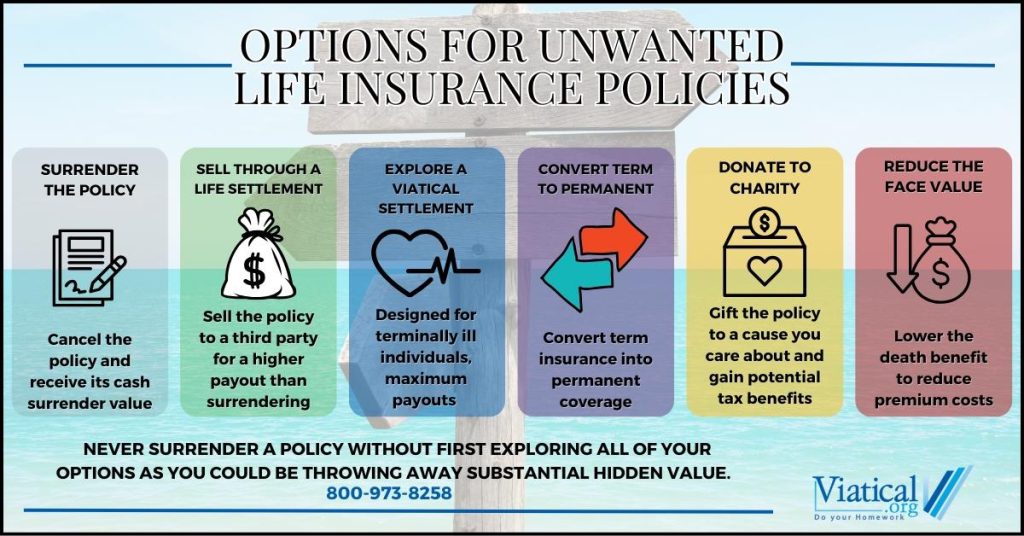

When selecting life insurance, understanding the different policy types is crucial to tailor coverage that fits your unique needs. Term life insurance offers straightforward, affordable protection for a specific period, making it perfect for covering temporary financial obligations like a mortgage or education expenses. On the other hand, whole life insurance provides lifelong coverage with a cash value component that grows over time, serving as both protection and an investment vehicle. For those seeking flexibility, universal life insurance allows policyholders to adjust premiums and death benefits, accommodating changing financial situations.

Beyond these main categories, there are variations designed to meet specific goals. Consider these features when weighing your options:

- Convertible policies: Start with term coverage but have the option to convert to permanent insurance without a medical exam.

- Riders: Additional benefits like accelerated death benefits or waiver of premium can enhance your policy.

- Group plans: Often offered through employers, offering convenience but limited customization.

Carefully evaluating these characteristics—cost, coverage length, flexibility, and potential growth—will help you pinpoint the policy that perfectly aligns with your life goals and financial future.

Calculating the Right Coverage Amount for Your Family

Determining the ideal amount of life insurance is a personal journey that depends on various factors unique to your family’s needs. Start by considering your current debts, such as mortgage, car loans, and credit cards, ensuring these would be covered without financial strain. Then, factor in ongoing expenses like daily living costs, education fees, and future healthcare needs for your loved ones. Don’t forget to account for potential future earnings you’d want to replace, so your family can maintain their lifestyle comfortably.

It’s also helpful to create a simple list of priorities when calculating the coverage amount. Think about:

- Immediate financial needs like funeral costs and outstanding debts.

- Long-term goals such as college tuition or retirement funds for your spouse.

- Emergency savings to cover unforeseen expenses or job loss.

By breaking down these elements, you’ll gain a clearer picture of what coverage truly fits your family’s future. Remember, it’s better to overestimate a bit than to leave gaps that might cause stress down the road.

Tips for Choosing the Best Life Insurance Provider

When searching for a life insurance provider, it’s essential to look beyond just the premium rates. Reputation and financial stability should top your checklist. Companies with strong credit ratings and positive customer reviews often deliver faster claim settlements and reliable service. Don’t hesitate to explore independent rating agencies like A.M. Best or Moody’s to gauge a provider’s financial health before committing. Additionally, take advantage of online forums and social media groups to hear real-life experiences from current policyholders.

Another key factor is the range of policy options and flexibility offered. The best providers allow you to tailor your coverage without hidden restrictions or excessive fees. Look for features such as riders for critical illness or waiver of premium, which can add value to your plan. Also, assess the clarity of their communication—transparent terms, prompt responses to inquiries, and accessible customer support can make a world of difference when managing your policy over the years.

- Check customer service responsiveness and claims process efficiency

- Confirm the provider’s history of paying claims without hassle

- Compare policy options to fit your changing needs

- Request a personalized quote instead of relying on generic rates

Key Takeaways

Finding your perfect life insurance coverage might seem overwhelming at first, but with the right information and a little introspection, it’s totally manageable. Remember, the goal is to protect your loved ones and give yourself peace of mind knowing you’ve got a solid financial safety net in place. Take your time to assess your needs, compare your options, and don’t hesitate to ask questions along the way. Your perfect coverage is out there—waiting to bring you that reassuring sense of security. Here’s to making smart choices that support your peace of mind and your family’s future!