Dealing with a denied health insurance claim can be frustrating and overwhelming—but don’t worry, you’re not alone! Many people face this challenge, and the good news is that appealing a denied claim is often easier than you might think. In this post, we’ll walk you through simple, practical steps to help you navigate the appeal process with confidence. Whether it’s a surprise denial or you just need a little extra guidance, our friendly tips will empower you to get the coverage you deserve—without the headache. Let’s dive in!

Table of Contents

- Understanding Why Your Health Insurance Claim Was Denied

- Gathering Essential Documents and Evidence for Your Appeal

- Crafting a Clear and Persuasive Appeal Letter

- Working with Your Insurance Company Throughout the Appeal Process

- In Summary

Understanding Why Your Health Insurance Claim Was Denied

Insurance companies often deny claims for a variety of reasons, ranging from simple paperwork errors to more complex policy coverage issues. It’s important to carefully review the denial letter provided, as it typically outlines the specific reason your claim was rejected. Common causes include missing information, services not covered under your plan, or claims submitted after deadlines. Understanding these reasons will not only help clarify the situation but also guide you toward the necessary steps to challenge the decision effectively.

When you dig into the details, you might find that the issue is as straightforward as a billing code mistake or as nuanced as a pre-existing condition exclusion. Before assuming the worst, take note of the following:

- Request a copy of your medical records to confirm that all submitted details match what’s on file.

- Check your insurance policy’s fine print to verify coverage specifics.

- Consult with your healthcare provider’s billing department to spot any discrepancies or errors.

- Keep detailed records of all communications with your insurer.

Armed with these insights, you’ll be better equipped to craft a compelling appeal that addresses the insurer’s concerns directly and increases your chances of a successful outcome.

Gathering Essential Documents and Evidence for Your Appeal

Before diving into your appeal, it’s crucial to assemble a rock-solid collection of documents that clearly supports your case. Start by gathering a copy of the original insurance denial letter, as it provides specific reasons why your claim was rejected. Next, include any relevant medical records, doctors’ notes, test results, and treatment plans that demonstrate the necessity of the services you received. Don’t forget to add your original claim form and any correspondence between you and your insurance company—these often hold key details that can help strengthen your argument.

To stay organized, create a checklist featuring:

- Insurance denial and claim forms

- Medical reports and test results

- Doctor’s letters explaining the treatment

- Receipts and billing statements

- Correspondence with your insurance provider

Having this documentation at your fingertips not only clarifies your appeal but also shows the insurance company that you’re serious and well-prepared. This makes it easier for the reviewers to understand your situation—boosting your chances of a successful appeal!

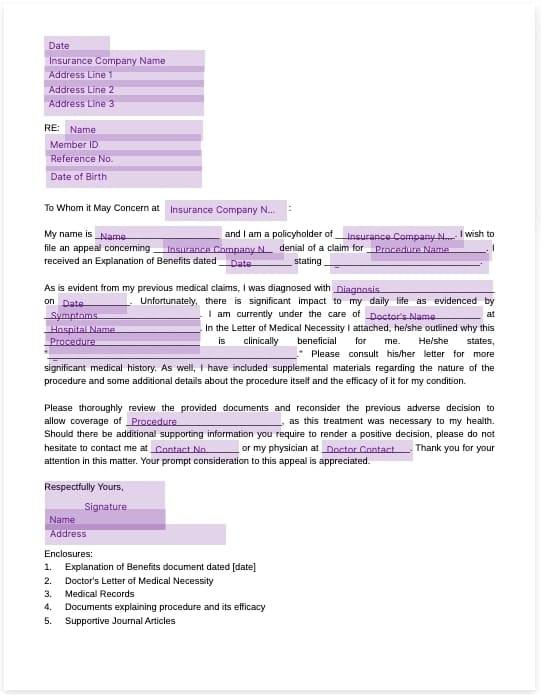

Crafting a Clear and Persuasive Appeal Letter

When writing your appeal letter, clarity and persuasiveness are your best allies. Start by clearly stating your purpose—mention your name, policy number, and the denied claim details right at the top to avoid any confusion. Use simple language and keep your tone respectful yet confident. Don’t hesitate to highlight key facts and evidence that support why the denial was unjustified. For instance, referencing your doctor’s notes, medical records, or specific policy terms can make a powerful impression on the reviewer.

To make your letter stand out, structure it with these essential elements:

- A concise summary of the issue and what you want to achieve.

- Detailed explanation of why the claim should be approved based on your documentation.

- Appeal to fairness by mentioning any errors or misunderstandings in the initial denial.

- Call to action inviting the insurance provider to review your case promptly.

Remember, your appeal letter is your chance to turn a no into a yes by clearly communicating your position and backing it up with solid proof. Taking the time to meticulously craft your letter shows you’re serious and well-prepared—qualities that can make all the difference.

Working with Your Insurance Company Throughout the Appeal Process

Navigating the appeal process with your insurance company can feel overwhelming, but keeping organized and proactive makes all the difference. Start by thoroughly reviewing the denial letter to understand exactly why your claim was rejected. This insight allows you to gather the necessary documentation, such as medical records or a letter from your healthcare provider, that specifically addresses the insurer’s concerns. It’s helpful to maintain clear communication by taking notes during phone calls, asking for the names and titles of the representatives you speak with, and requesting written confirmation of any agreements or next steps.

Remember, you’re not alone in this process. Insurance companies often have dedicated appeal departments, and there are resources available to help you. When submitting your appeal, consider including:

- A detailed cover letter explaining why you believe the claim should be approved

- Supporting medical documentation that reinforces your case

- Copies of all previous correspondence related to the claim

Consistency and persistence are key. Follow up regularly, and don’t hesitate to escalate your appeal if necessary. By staying informed and organized, you’ll boost your chances of turning that denial into an approval.

In Summary

Navigating a denied health insurance claim can feel overwhelming, but remember, it’s not the end of the road. With a clear understanding of your rights, a bit of patience, and the steps we’ve outlined, you can confidently appeal that decision and get the coverage you deserve. Don’t be afraid to ask for help, stay organized, and keep advocating for your health. After all, you know your situation best – and sometimes, all it takes is a well-crafted appeal to turn a “no” into a “yes.” Good luck, and here’s to smoother healthcare experiences ahead!