Going through a divorce or separation is never easy, and amidst all the emotional and financial challenges, life insurance often gets overlooked. But believe it or not, life insurance can actually play a pretty important role during this complicated time. Whether it’s protecting children, securing alimony payments, or dividing assets, understanding how life insurance fits into the picture can make a big difference. In this post, we’ll explore why life insurance matters when relationships change, and how it can help provide peace of mind when you need it most.

Table of Contents

- Understanding the Importance of Life Insurance When Facing Divorce

- How Life Insurance Can Protect Spousal and Child Support Obligations

- Navigating Policy Ownership and Beneficiary Changes After Separation

- Practical Tips for Updating Your Life Insurance During Divorce Proceedings

- Insights and Conclusions

Understanding the Importance of Life Insurance When Facing Divorce

When couples make the difficult decision to separate, managing financial obligations becomes a top priority. Life insurance often emerges as a vital tool in this process since it can protect both parties from unforeseen financial hardships. For instance, it can guarantee that any agreed-upon support—like child support or alimony—continues uninterrupted if one spouse passes away unexpectedly. Beyond that, life insurance can serve as collateral to secure settlements, providing peace of mind that future obligations will be met without burdening the other party.

Key reasons life insurance matters during divorce include:

- Ensuring financial security for children or a dependent spouse.

- Protecting alimony or support payments against unexpected events.

- Equitably dividing assets when other assets are illiquid or difficult to value.

- Minimizing future disputes by establishing clear financial safeguards.

How Life Insurance Can Protect Spousal and Child Support Obligations

When it comes to ensuring ongoing financial stability for your former spouse and children, life insurance offers a powerful safety net. By naming your ex-spouse or children as beneficiaries, a life insurance policy guarantees that essential support continues even if the unexpected happens. This is particularly crucial when court-ordered spousal or child support payments are involved. Without such a policy in place, the surviving family members may face financial hardship, especially if the primary provider passes away suddenly. Life insurance can therefore act as a reliable fallback, offering peace of mind to all parties involved.

There are several ways to structure these policies to align with your support obligations, including:

- Term life insurance that covers the length of the support agreement, ensuring funds are available exactly when needed.

- Permanent life insurance providing lifelong protection and potential cash value benefits, useful for long-term child support planning.

- Joint policies that can ensure coverage on both parties, simplifying beneficiary changes and premium payments post-divorce.

By integrating life insurance thoughtfully into your divorce settlement, you can safeguard your loved ones’ financial futures without the worry of interruptions in crucial support payments.

Navigating Policy Ownership and Beneficiary Changes After Separation

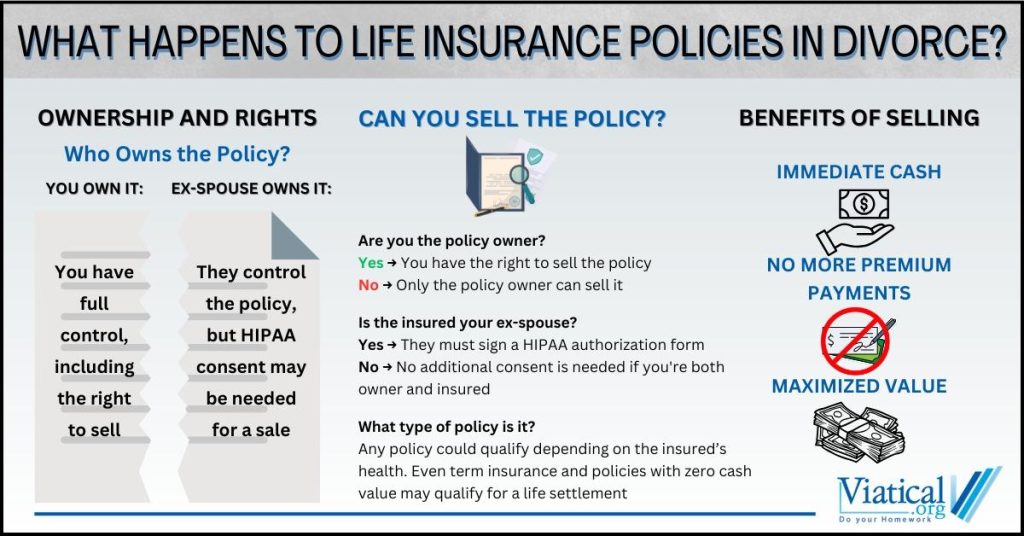

When couples decide to separate, one of the essential, yet often overlooked, tasks is reviewing and updating life insurance policies. Ownership of the policy may need to be transferred, especially if the policy was initially in one spouse’s name but was intended to provide benefits to the other during the marriage. It’s crucial to understand that simply divorcing doesn’t automatically change the ownership or beneficiary designations on a life insurance policy. Often, these policies remain as they were unless actively reviewed, which can lead to unintended beneficiaries or disputes in the future.

To avoid complications, it’s wise to consider these steps:

- Review the beneficiary designation: Make sure the named beneficiaries reflect your current wishes post-separation.

- Update the policy ownership if necessary: Transferring ownership might require completing specific forms through your insurer or insurance agent.

- Consult legal advice: Especially if the policy is part of divorce settlements, a lawyer can help ensure these changes align with court orders.

- Notify all relevant parties: Keep your insurance provider and any involved family members informed to avoid surprises later.

These proactive steps help ensure that life insurance serves its intended purpose, providing financial security without adding unnecessary stress during an already challenging transition.

Practical Tips for Updating Your Life Insurance During Divorce Proceedings

When navigating the complexities of divorce, life insurance policies often need a thorough review to align with new legal and financial realities. Start by gathering all relevant policy documents and understanding the current beneficiaries listed. It’s crucial to evaluate whether your ex-spouse remains an appropriate beneficiary or if it’s time to designate children, a trust, or a new partner instead. Additionally, consult with your attorney and insurance agent to explore options—whether that means updating policy ownership, adjusting coverage amounts, or setting up irrevocable beneficiary designations to comply with court agreements.

Here are some practical pointers to keep the process smooth and legally sound:

- Communicate clearly: Discuss changes with your ex-spouse to avoid surprises and potential disputes.

- Document every update: Keep copies of updated beneficiary forms and any agreements related to your life insurance.

- Review policy terms: Some policies have limitations or require consent for changes—know your contract.

- Consider timing: Coordinate updates with final divorce decrees or settlement deadlines.

- Update related accounts: Remember to reflect changes in wills, trusts, and other estate planning tools.

Insights and Conclusions

Navigating divorce or separation is never easy, and amidst the emotional and financial upheaval, life insurance often becomes an overlooked but crucial piece of the puzzle. Whether it’s protecting your children’s future, ensuring alimony or child support obligations are met, or simply providing peace of mind during uncertain times, life insurance can offer a layer of security when you need it most. If you’re going through a separation or considering one, take the time to review your policies, update beneficiaries, and consult with a financial advisor or attorney. After all, a little planning today can make a world of difference tomorrow. Thanks for reading, and here’s to making informed decisions that protect you and your loved ones every step of the way!