When it comes to auto insurance, not all drivers are viewed equally by insurers. Among the many factors that influence your premium, age and gender stand out as two of the most significant—and sometimes surprising—elements. Understanding how these personal characteristics impact your insurance rates can help you make smarter decisions on coverage and potentially save money. In this article, we’ll explore why age and gender matter to insurers, how they affect your premiums, and what you can do to ensure you’re getting a fair deal on your auto insurance.

Table of Contents

- Understanding the Influence of Age on Auto Insurance Premiums

- Exploring Gender Differences in Auto Insurance Risk Assessment

- Strategies to Lower Your Auto Insurance Costs Based on Age and Gender

- Expert Tips for Choosing the Right Coverage as Your Profile Changes

- Concluding Remarks

Understanding the Influence of Age on Auto Insurance Premiums

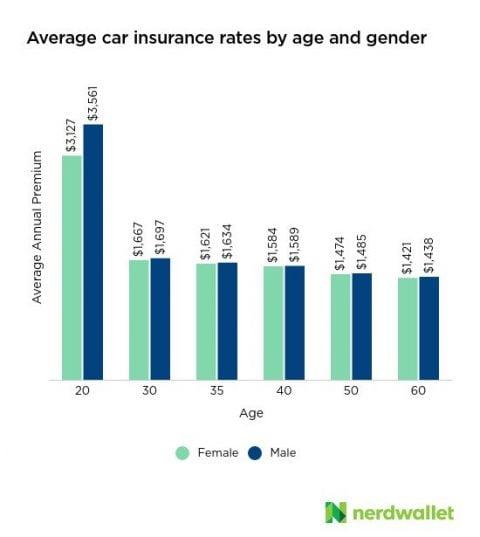

Age plays a significant role in determining auto insurance premiums because insurers use statistical data to assess risk profiles. Younger drivers, particularly those under 25, are often categorized as high-risk due to their relative inexperience and higher likelihood of being involved in accidents. This results in steeper premiums for younger age groups. Conversely, mature and senior drivers generally benefit from lower rates, provided they maintain a clean driving record. However, premiums can increase again for elderly drivers past a certain age due to concerns about slower reaction times and health-related driving limitations.

Insurance companies also consider how age correlates with driving behavior and claim frequency. For example, the following attributes often influence pricing:

- Risk propensity: Younger drivers tend to engage in riskier driving habits.

- Accident rates: Statistically higher among teens and early twenties.

- Experience level: Older drivers usually have more years behind the wheel.

- Health and alertness: Relevant for senior drivers over 65.

Recognizing these patterns helps insurers tailor rates that accurately reflect the potential risk, making age a pivotal factor in the pricing equation for auto insurance.

Exploring Gender Differences in Auto Insurance Risk Assessment

Insurance providers often analyze gender as a significant factor when calculating auto insurance premiums, attributing different risk profiles to male and female drivers. Statistically, younger male drivers tend to exhibit higher accident rates, prompting insurers to charge higher rates for this demographic. Conversely, females, particularly those under 25, generally have fewer claims, which can translate into more favorable insurance rates. However, these generalizations are evolving as driving patterns and behaviors shift over time.

Beyond raw statistics, insurers also consider factors such as:

- Driving history and claim records, which often provide a clearer picture than gender alone.

- Vehicle type and usage patterns, since certain cars and mileage levels carry different risk implications.

- Local accident trends and regulations, affecting risk assessment at a community level.

Ultimately, while gender remains a component in risk evaluation, many insurers are adopting more nuanced models that emphasize individual driving behavior over broad demographic categories.

Strategies to Lower Your Auto Insurance Costs Based on Age and Gender

Understanding how your age and gender influence your auto insurance premiums is the first step toward customizing strategies that can help you save. For younger drivers, especially males who statistically face higher rates due to increased risk, focusing on building a clean driving record is paramount. Engaging in defensive driving courses or utilizing telematics programs that reward safe driving habits can result in significant discounts. Additionally, consider opting for a higher deductible if your financial situation allows, as this can lower monthly premiums without compromising coverage.

Older drivers benefit from demonstrating maintained driving competency and health, which many insurers factor into their calculations. Women, on average, often enjoy lower premiums, but they can still capitalize on savings by bundling policies such as combining auto and home insurance. Another effective approach across all age groups includes shopping around regularly and negotiating with insurers, as competition often leads to better offers tailored to individual profiles. Employing these targeted tactics based on your demographic profile ensures smarter spending without sacrificing protection.

- Take advantage of safe driver discounts through practical courses or apps

- Bundle multiple insurance policies for multi-policy discounts

- Review and raise deductibles carefully to reduce premium costs

- Maintain a solid driving history and regularly update your insurer

Expert Tips for Choosing the Right Coverage as Your Profile Changes

As your age and life circumstances evolve, so should your auto insurance coverage. Younger drivers, especially those under 25, often face higher premiums due to statistically higher accident rates. However, as you gain experience and maintain a clean driving record, insurers typically offer better rates and more flexible coverage options. It’s essential to reassess your policy periodically to ensure you’re not underinsured or overpaying for protections that no longer fit your lifestyle.

Gender can also influence your insurance profile, but focus primarily on the coverage that aligns with your current needs rather than solely relying on demographic factors. Consider these expert tips to tailor your coverage effectively:

- Adjust your liability limits as you acquire more assets or face increased financial responsibilities.

- Evaluate comprehensive and collision coverage based on your vehicle’s value and usage patterns.

- Explore discounts targeted to your age group or driving habits, such as safe driver or low mileage incentives.

- Review add-ons like roadside assistance or rental car reimbursement to match your lifestyle needs.

Concluding Remarks

In conclusion, understanding how age and gender influence your auto insurance rates is key to making informed decisions and finding the best coverage for your needs. While younger drivers—and often males—may face higher premiums due to statistically greater risk factors, it’s important to remember that insurers consider a variety of elements when calculating rates. By staying informed and exploring options tailored to your profile, you can navigate the complex world of auto insurance with greater confidence and potentially secure more affordable, customized policies. Remember, knowledge is your best tool when it comes to protecting both your wallet and your peace of mind on the road.