When it comes to protecting yourself and your loved ones, life insurance is a topic that often comes up — but with so many options, it can feel overwhelming. Two popular choices you might have heard of are group life insurance and individual life insurance. So, which one is the right fit for you? In this blog, we’ll break down the key differences, benefits, and things to consider with each type, helping you make an informed decision that suits your unique needs and lifestyle. Let’s dive in!

Table of Contents

- Understanding the Basics of Group and Individual Life Insurance

- Key Benefits and Drawbacks to Consider for Your Needs

- How Your Lifestyle and Job Influence the Best Choice

- Tips for Choosing the Right Policy to Protect Your Loved Ones

- Concluding Remarks

Understanding the Basics of Group and Individual Life Insurance

When choosing between group and individual life insurance, it helps to know what each involves. Group life insurance is typically offered by employers or organizations and covers a pool of individuals under one policy. This type of plan usually provides a basic level of coverage without the need for medical exams, making it convenient and cost-effective. However, coverage amounts are often fixed and may not fully meet unique personal needs. Plus, the policy usually ends when you leave the company or organization, which can leave you needing to find new coverage later.

On the other hand, individual life insurance lets you tailor your coverage to suit your specific financial goals and family circumstances. You own the policy directly, which means it stays with you regardless of your employment status. While rates might be higher and underwriting more detailed, individual policies offer flexibility in choosing coverage amounts, term lengths, and riders such as critical illness or disability protection. Here’s a quick look at their key features:

- Group Life Insurance: Employer-sponsored, no medical exam often, coverage ends with employment.

- Individual Life Insurance: Personal ownership, customizable coverage, permanent or term options.

Key Benefits and Drawbacks to Consider for Your Needs

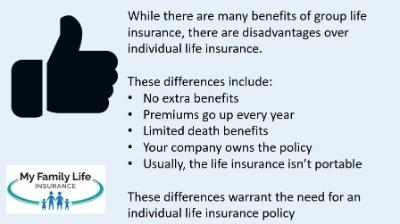

Group life insurance often appeals because of its convenience and cost-effectiveness. Many employers offer these plans as part of their benefits package, which means there’s usually no need for a medical exam and premiums can be lower due to the risk being spread across many individuals. It’s a straightforward way to gain coverage without a lengthy application process, and you can often continue the coverage if you leave your job by converting to an individual plan. However, the main drawback is the lack of control — coverage amounts can be limited and may not fully match your individual financial needs or family situation. If you change jobs, losing employer coverage can also leave gaps in your protection.

With individual life insurance, you gain the freedom to tailor a policy that fits your unique circumstances perfectly, from the coverage amount to the type of plan you want (term, whole, or universal life). This customization means you’re in control of building a legacy, covering debts, or securing your family’s future exactly how you envision. But this flexibility comes with the responsibility of underwriting, which typically means a medical exam and higher premiums, especially if you purchase coverage later in life or have health issues. Additionally, managing an individual policy means staying on top of payments and policy details, something that might feel overwhelming if you prefer set-it-and-forget-it options.

- Group Life Pros: Lower cost, no medical exam, easy enrollment

- Group Life Cons: Limited coverage, dependency on employer, less control

- Individual Life Pros: Customizable coverage, permanent protection options, transferable

- Individual Life Cons: Higher premiums, medical underwriting, requires active management

How Your Lifestyle and Job Influence the Best Choice

When considering insurance options, your daily routine and career path play crucial roles in determining the best fit. For instance, individuals with jobs that provide comprehensive employee benefits may find group life insurance more convenient and cost-effective. This coverage often comes at a lower premium and requires minimal medical underwriting, making it ideal for those who prefer a hassle-free experience or who might otherwise face high premiums due to health conditions. Moreover, if you work in a collaborative environment where group coverage is part of the package, sticking with group insurance streamlines your benefits under one umbrella.

On the other hand, if your lifestyle is more dynamic or you’re self-employed, individual life insurance might be the perfect match. This option offers flexibility to tailor your policy to your specific needs, financial goals, and longevity plans. Freelancers, entrepreneurs, or those with unique health concerns often benefit from customizable policies that can be adjusted as life changes—whether that’s marriage, having children, or purchasing a home. Consider these key lifestyle factors when choosing your coverage:

- Job stability and benefits: Do you have access to employer-sponsored group plans?

- Health status: Are you looking to lock in coverage regardless of future medical changes?

- Financial independence: Are you seeking personalized coverage to match your assets and obligations?

Tips for Choosing the Right Policy to Protect Your Loved Ones

Choosing the right insurance policy to safeguard your family can feel overwhelming, but focusing on what truly matters will ease the decision-making process. Start by evaluating your financial responsibilities and long-term goals. Are you looking for affordability with basic coverage, or do you prefer a customizable plan tailored to your specific needs? Group life insurance, often offered through employers, provides cost-effective, straightforward protection but may lack flexibility and portability. Individual policies, on the other hand, give you the freedom to choose coverage amounts, riders, and benefits that align perfectly with your situation, giving your loved ones a more secure financial future.

Consider these key factors to guide your choice:

- Budget: Group plans usually have lower premiums, ideal if you want to keep costs minimal.

- Coverage Needs: Individual policies offer higher coverage limits and more customization options.

- Job Stability: Group life benefits often end if you leave your job, while individual policies stay with you.

- Health Status: Individual policies require underwriting, so your health may impact eligibility and premiums.

By weighing these points thoughtfully, you’ll find a path that makes protecting your loved ones feel less like a chore and more like a natural extension of your care for their future.

Concluding Remarks

Choosing between group life and individual life insurance doesn’t have to feel overwhelming. It all comes down to your unique needs, lifestyle, and long-term goals. While group life insurance can be a convenient and often affordable option through your employer, individual life insurance offers flexibility and control tailored just for you. Take a moment to weigh the pros and cons we’ve discussed, and consider consulting with a financial advisor to find the perfect fit. Remember, the right life insurance policy is the one that gives you peace of mind knowing your loved ones are protected—no matter what life throws your way. Happy planning!