Choosing the right life insurance can sometimes feel overwhelming, especially when you’re navigating through different options like group life insurance and individual policies. Both have their perks and quirks, but which one truly fits your unique needs? Whether you’re covered through your employer or thinking about taking out a policy on your own, understanding the pros and cons of each can help you make a confident decision. In this post, we’ll break down the basics of group and individual life insurance, so you can figure out what’s best for you and your loved ones. Let’s dive in!

Table of Contents

- Understanding the Basics of Group and Individual Life Insurance

- Key Benefits and Drawbacks to Consider Before Choosing

- How Your Personal Situation Influences the Best Choice for You

- Tips for Making the Most Out of Your Life Insurance Plan

- In Retrospect

Understanding the Basics of Group and Individual Life Insurance

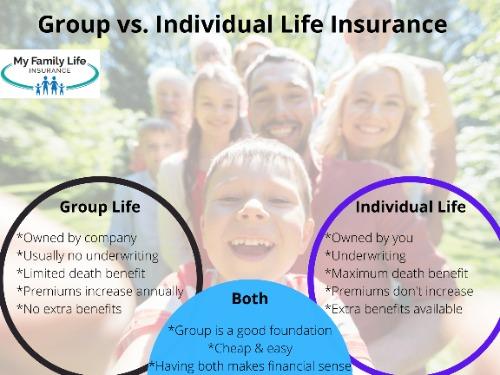

Choosing between group and individual life insurance requires a clear grasp of how each functions and suits different needs. Group life insurance is typically offered through an employer or an organization, providing coverage to a collective pool of members under one policy. This option often comes with lower premiums, simplified application processes, and access to basic life coverage with minimal medical underwriting. However, the downsides include limited customization and the risk of losing coverage if you change jobs or organizations.

In contrast, individual life insurance policies are tailored exclusively to your personal circumstances, allowing you to select coverage amounts, terms, and riders that fit your unique financial goals. This flexibility means you can build a policy that evolves with your life, whether you’re planning for future family needs or wealth transfer. Consider these key factors when making your decision:

- Portability: Group policies are linked to employment, individual policies move with you.

- Coverage Amount: Individual policies often provide higher, customizable limits.

- Cost: Group insurance might be cheaper upfront, but individual policies can be more cost-effective long-term.

Understanding these basics empowers you to select a life insurance plan that aligns with your lifestyle and financial security.

Key Benefits and Drawbacks to Consider Before Choosing

When weighing your options, group life insurance often shines with its affordability and convenience. Since employers typically negotiate these plans for multiple employees, the premiums are usually lower than individual policies. Plus, enrollment is hassle-free—no lengthy health exams or detailed medical histories required for most people. This makes it appealing for those seeking straightforward coverage without breaking the bank. Additionally, some group plans offer basic coverage as part of your employment benefits, providing a safety net at no extra cost.

On the flip side, group plans can be inflexible and may lack portability, meaning if you leave your job, you might lose your coverage. The benefit amounts might also be limited and not tailored to your personal financial needs. With individual life insurance, you get the freedom to customize your policy—choosing coverage levels, riders, and term lengths that fit your long-term goals. However, this customization comes at a higher price and often requires medical underwriting. Here’s a quick snapshot to keep in mind:

- Group Insurance Pros: Lower cost, easy application, immediate coverage.

- Group Insurance Cons: Limited options, coverage ends if employment ends.

- Individual Insurance Pros: Fully customizable, portable, typically offers higher coverage amounts.

- Individual Insurance Cons: Higher premiums, medical exams required, more complex application.

How Your Personal Situation Influences the Best Choice for You

Choosing between group life insurance and an individual policy often comes down to your unique circumstances. For example, if you have a stable job with a benefits package, group coverage might offer a cost-effective and straightforward way to get insured without medical exams. However, if you have specific health issues or require higher coverage limits tailored to your lifestyle, an individual plan gives you more control and flexibility. Your age, family obligations, and financial goals also play a major part in figuring out which option aligns best with your needs.

Consider these factors that can influence your decision:

- Job security: If you plan to stay with your employer long-term, group insurance could provide steady coverage.

- Health status: Pre-existing conditions may limit your options under group plans, making individual insurance more viable.

- Coverage amount: Group policies might have maximum limits that don’t meet your financial protection goals.

- Portability: Individual policies stay with you regardless of employment changes, unlike many group policies.

Tips for Making the Most Out of Your Life Insurance Plan

Getting the most value out of your life insurance plan goes beyond just signing on the dotted line. Regularly reviewing your coverage ensures that your policy continues to meet your evolving needs. Life changes such as marriage, the birth of a child, or even buying a new home can impact the amount of coverage you require. Keep your beneficiary information up to date to guarantee that your loved ones receive the benefits without any unnecessary delays or complications.

Additionally, consider these handy tips to optimize your plan:

- Understand your policy details: Know what is covered, any policy exclusions, and the fine print about payouts.

- Explore riders and add-ons: These can enhance your base policy with benefits like critical illness or disability coverage.

- Maintain healthy habits: Insurers often reward healthy living with lower premiums, so take care of your wellbeing.

- Compare periodically: Market offerings evolve — don’t hesitate to shop around or renegotiate for better terms.

In Retrospect

Choosing between group life insurance and an individual policy really comes down to your unique situation and goals. Group plans offer convenience and often lower costs, especially if your employer provides good coverage. On the other hand, individual policies give you more control and the flexibility to tailor your coverage as your needs change. Hopefully, this breakdown helps you feel more confident in making the decision that fits you best. Remember, whatever path you choose, having some form of life insurance is a smart step toward protecting your loved ones and securing peace of mind. Thanks for reading, and here’s to making the best choice for your future!