When it comes to running an auto repair shop, towing company, or parking garage, the safety and security of your customers’ vehicles are always top of mind. But even with the best care and attention, accidents and damage can happen. That’s where garagekeepers insurance comes in—a specialized coverage designed to protect your business from the financial fallout if a vehicle in your care, custody, or control is damaged or stolen. In this article, we’ll break down what garagekeepers insurance is, why it matters, and what you need to consider to make sure you’re fully covered. Whether you’re just starting out or looking to review your existing policy, understanding this coverage can provide peace of mind for both you and your customers.

Table of Contents

- Understanding the Basics of Garagekeepers Insurance and Its Importance

- Key Coverage Details That Protect Your Business from Unexpected Risks

- Common Exclusions and How to Navigate Potential Coverage Gaps

- Practical Tips for Choosing the Right Garagekeepers Insurance Policy

- The Way Forward

Understanding the Basics of Garagekeepers Insurance and Its Importance

Garagekeepers insurance serves as a crucial layer of protection for businesses that take custody of vehicles, such as auto repair shops, towing companies, and parking facilities. Unlike standard liability insurance that covers damage to third-party property, this specialized policy safeguards the vehicles stored or repaired on your premises. It covers various risks including theft, vandalism, fire, and even weather-related damage, offering peace of mind that your clients’ property is shielded while under your care. Without it, you could face significant out-of-pocket expenses or legal complications if a customer’s vehicle is damaged while in your possession.

Key benefits of Garagekeepers insurance include:

- Financial security: Protects your business from the high costs associated with vehicle damage claims.

- Customer trust: Builds confidence that their vehicles are in safe hands, enhancing your reputation.

- Legal compliance: Helps meet contractual obligations or state regulations requiring coverage for stored vehicles.

- Customized coverage options: Allows you to tailor protection to fit specific risks related to your business operations.

Understanding this type of coverage not only safeguards your business assets but also assures your customers that their vehicles are well-protected—a vital consideration in the competitive automotive services industry.

Key Coverage Details That Protect Your Business from Unexpected Risks

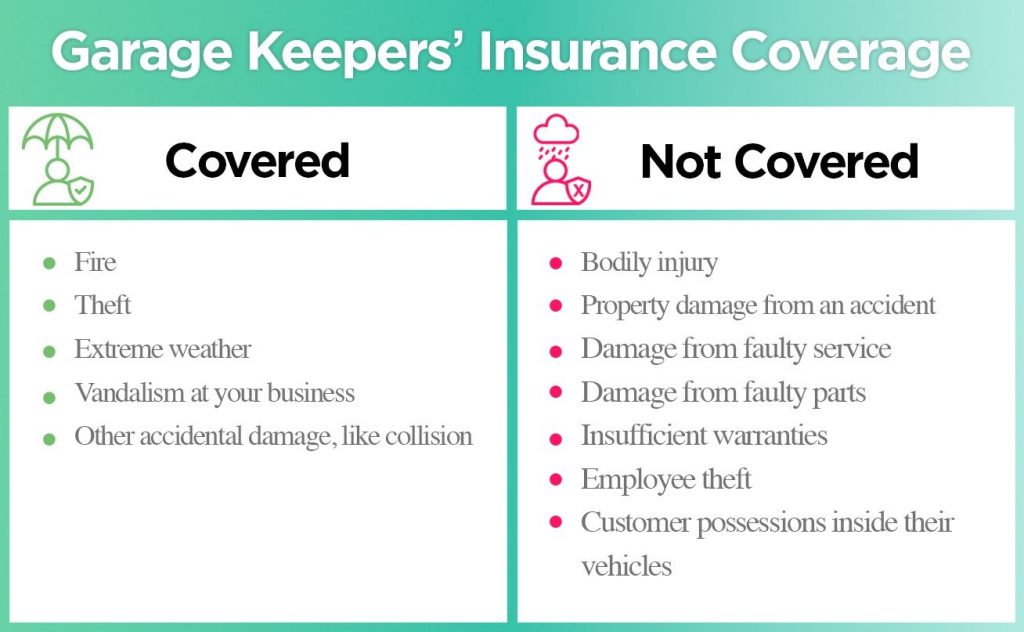

Garagekeepers insurance offers vital protection for businesses storing or servicing customers’ vehicles, shielding them from unpredictable events that could cause significant financial strain. This coverage typically includes protection against damage due to fire, theft, vandalism, and natural disasters. It also safeguards against accidental damage while the vehicle is in your care, custody, or control, filling a crucial gap that standard commercial policies often overlook. Having this coverage means you can focus on providing reliable service knowing your business and clients’ valuable assets are well protected.

Key elements to look for when assessing this insurance include:

- Physical damage coverage: Protects customer vehicles from collision, theft, or vandalism while on your property or being repaired.

- Liability for damage to customer property: Covers repair costs if your employees accidentally cause damage.

- Comprehensive scenarios covered: Ensures coverage extends to fire, flooding, and other natural perils that could impact your business.

- Flexible policy limits: Tailored limits that reflect the value and number of vehicles you handle regularly.

Choosing the right coverage means minimizing unexpected financial burdens and building trust with your clients through responsible business practices.

Common Exclusions and How to Navigate Potential Coverage Gaps

While garagekeepers insurance is designed to protect against a variety of risks, it’s important to understand that not everything is automatically covered. Some typical exclusions can catch businesses off guard and leave them vulnerable. For example, damages caused by natural disasters like floods or earthquakes often require separate policies or endorsements. Additionally, intentional damage, employee theft, or losses resulting from mechanical breakdowns generally fall outside the scope of standard coverage.

To proactively address these potential gaps, it’s essential to carefully review your policy’s fine print and negotiate with your insurer to tailor coverage specifically to your business needs. Consider supplementing your garagekeepers insurance with:

- Business interruption insurance to protect against income loss during unexpected closures.

- Comprehensive endorsements that include natural calamities or specific perils relevant to your location.

- Employee dishonesty coverage to safeguard against internal risks.

Open communication with a knowledgeable insurance broker can also help you identify and fill these coverage voids. By staying informed and vigilant, you can ensure your garage operations remain protected under even the most unforeseen circumstances.

Practical Tips for Choosing the Right Garagekeepers Insurance Policy

When selecting a garagekeepers insurance policy, it’s crucial to carefully assess the specific needs of your business and the level of protection you require for customers’ vehicles. Start by evaluating the types of coverage offered—whether it includes comprehensive protection against theft, vandalism, or damage during repairs. Understanding exclusions and limits is equally vital to avoid unwelcome surprises when a claim arises. Make sure that the policy’s deductible aligns with your budget and risk tolerance, striking a balance between premium costs and out-of-pocket expenses.

Another important step is to consider the reputation and reliability of the insurance provider. Look for companies with a strong track record of responsive claims handling and solid customer support. You might also find it helpful to connect with other garage owners or industry professionals to gather insights based on their real-world experiences. Keep in mind these practical tips as well:

- Customize coverage options to reflect the types of vehicles and services your garage handles.

- Review policy updates regularly to maintain adequacy as your business evolves.

- Compare multiple quotes to ensure competitive pricing without sacrificing essential benefits.

- Ask about bundled packages that might combine garagekeepers with other necessary business insurances.

The Way Forward

Navigating the world of garagekeepers insurance can feel overwhelming, but understanding its core purpose is crucial for anyone in the automotive industry. This coverage acts as a vital safety net, offering protection and peace of mind when unexpected incidents occur while vehicles are in your care. By taking the time to learn what garagekeepers insurance entails, you’re not just safeguarding your business—you’re demonstrating a commitment to your customers and their valuable property. Remember, the right insurance can make all the difference when it comes to protecting your livelihood and maintaining trust. Stay informed, ask questions, and choose coverage that truly fits your needs. Your garage, and those who rely on you, deserve nothing less.