In the highly competitive world of trucking, managing costs is essential to maintaining profitability and long-term success. One of the most significant expenses for trucking companies and owner-operators alike is insurance premiums. With rising rates and complex coverage options, finding ways to lower these costs without compromising protection can feel overwhelming. In this article, we will explore effective strategies that can help trucking professionals reduce their insurance premiums, improve risk management, and ultimately keep their businesses on the road with greater financial confidence.

Table of Contents

- Understanding Risk Factors That Influence Trucking Insurance Costs

- Implementing Comprehensive Safety Programs to Reduce Claims

- Leveraging Technology to Enhance Fleet Management and Lower Premiums

- Negotiating Coverage and Exploring Alternative Insurance Options

- Concluding Remarks

Understanding Risk Factors That Influence Trucking Insurance Costs

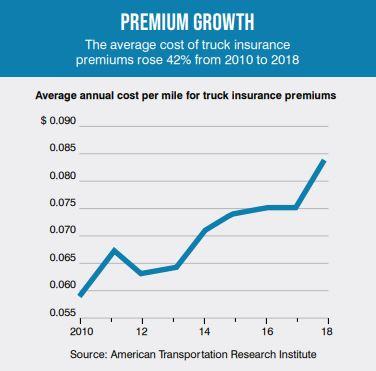

Trucking insurance premiums are heavily influenced by a variety of risk factors that carriers must take seriously. Driver experience and safety records rank at the top, as insurers closely evaluate the history of accidents, violations, and claims. Older fleets or vehicles that aren’t regularly maintained also present higher risk, leading to increased costs. Additionally, the type of cargo—especially if it’s hazardous or high-value—plays a critical role in premium calculations. Geographic routes and exposure to high-crime or extreme weather areas can further raise premiums, reflecting the insurer’s anticipation of possible claims.

Other crucial elements that insurers consider include:

- Company safety programs: A robust approach to training and compliance can lower perceived risk.

- Claims history: A track record with frequent or high-cost claims signals increased risk.

- Regulatory compliance: Adherence to DOT regulations mitigates penalties and helps keep premiums down.

- Annual mileage: The more miles driven, the higher the statistical likelihood of incidents.

Understanding these factors is essential for trucking businesses aiming to implement effective cost-control measures on their insurance premiums.

Implementing Comprehensive Safety Programs to Reduce Claims

Developing a robust safety initiative is essential when aiming to curb the frequency and severity of insurance claims. Start by integrating regular driver training sessions focused on defensive driving techniques and compliance with federal and state regulations. These sessions should emphasize hazard recognition, vehicle maintenance routines, and fatigue management to ensure drivers are alert behind the wheel. Implementing a clear, easily accessible policy manual that outlines safety expectations also fosters a culture where accountability thrives, reducing the likelihood of accidents caused by negligence or oversight.

Additionally, leveraging technology can significantly enhance your safety protocols. Equip trucks with telematics and GPS tracking systems to monitor driving habits and vehicle performance in real-time, allowing for immediate corrective action where needed. Encourage participation in safety incentive programs that reward drivers for maintaining clean records and adhering to company policies. Key components of a successful safety program include:

- Consistent safety audits and performance reviews

- Use of electronic logging devices (ELDs) to ensure proper hours of service

- Emergency preparedness drills and response plans

- Regular vehicle inspections and preventative maintenance schedules

Leveraging Technology to Enhance Fleet Management and Lower Premiums

Integrating advanced technology solutions into fleet operations is transforming the way trucking companies manage risk and control costs. Tools such as telematics and GPS tracking provide real-time data on vehicle performance, driver behavior, and route efficiency. This data empowers fleet managers to implement proactive safety measures, identify risky driving patterns early, and optimize maintenance schedules, which collectively contribute to reducing insurance claims. Insurers increasingly view fleets equipped with such technology as lower-risk clients, often rewarding them with preferential premium rates.

Harnessing technology also allows for improved communication and compliance management, ensuring drivers adhere to hours-of-service regulations and minimize violations. Additionally, the usage of AI-driven analytics helps forecast potential hazards by analyzing vast data sets, enabling preventative strategies that further decrease liability exposure. Key technological investments that directly influence premium reductions include:

- Dashcams and in-cab monitoring systems to deter unsafe driving and provide evidence in accident disputes

- Automated maintenance alerts to prevent mechanical failures

- Route optimization software to reduce fuel consumption and avoid high-risk areas

Negotiating Coverage and Exploring Alternative Insurance Options

When it comes to securing the best trucking insurance rates, don’t hesitate to actively negotiate coverage terms with your provider. Insurance companies often offer a range of packages that can be tailored to fit your specific risk profile and business needs. By presenting a clear picture of your operational safety records, maintenance schedules, and driver training programs, you can leverage these factors to request discounts or reduced premiums. Remember, a proactive approach in discussions often reveals hidden opportunities such as bundling policies for multi-vehicle fleets or adjusting deductibles to find the best balance between cost and coverage.

Exploring alternative insurance options beyond traditional carriers can also lead to significant savings. Consider joining industry-specific insurance pools or cooperatives that aggregate risk among trucking companies. Additionally, seek out specialized insurers that focus on niche trucking sectors or offer pay-as-you-drive policies, which align premiums more closely with actual usage. These alternatives might provide more flexible terms or better pricing structures tailored to your unique business model. Key points to explore include:

- Captive Insurance Programs – owned and managed by groups of businesses in the trucking industry.

- Self-Insurance Trusts – allowing qualified companies to retain some risk with potential financial benefits.

- Telematics-Based Insurance – where premiums are adjusted based on real-time driving behavior data.

Concluding Remarks

Lowering trucking insurance premiums is not just about finding the cheapest policy—it’s about implementing smart, proactive strategies that enhance safety, reduce risk, and build strong relationships with insurers. By focusing on driver training, maintaining up-to-date compliance, leveraging technology, and regularly reviewing your coverage, you can significantly bring down costs without sacrificing the protection your fleet needs. Remember, the goal is sustainable savings paired with peace of mind on the road. Take these strategies seriously, and you’ll not only see your premiums drop, but also create a safer, more efficient operation overall.