When it comes to protecting your vehicle, understanding the ins and outs of auto insurance can feel overwhelming. Among the many coverage options available, comprehensive auto insurance stands out as a key component for safeguarding against a wide range of risks beyond just collisions. But what exactly does comprehensive coverage include, and how do you know if it’s worth adding to your policy? In this article, we’ll break down what comprehensive auto insurance covers, explore its benefits, and help you determine whether this type of protection is a smart choice for you and your vehicle. Whether you’re a new driver or a seasoned car owner, getting clear on comprehensive coverage can give you peace of mind on the road.

Table of Contents

- Understanding the Scope of Comprehensive Auto Insurance Coverage

- Key Scenarios Where Comprehensive Insurance Provides Crucial Protection

- Assessing Your Risk Factors to Determine the Need for Comprehensive Coverage

- Expert Tips for Choosing the Right Comprehensive Auto Insurance Policy

- Final Thoughts

Understanding the Scope of Comprehensive Auto Insurance Coverage

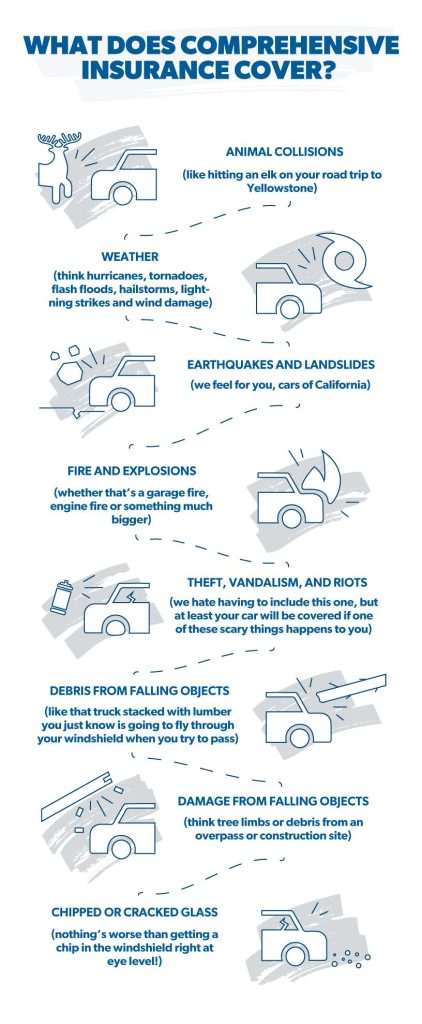

Comprehensive auto insurance extends far beyond the typical collision coverage, providing protection against a wide array of non-collision related damages. This type of insurance primarily covers incidents that are unforeseen and often out of your control, such as theft, vandalism, natural disasters, and fire. It also includes damage caused by animals, falling objects, and even windshield repairs. By safeguarding your vehicle against these unpredictable scenarios, comprehensive coverage offers peace of mind that your investment is shielded from more than just accidents on the road.

Understanding what is encompassed within this policy is crucial for informed decision-making. Some of the key benefits typically included are:

- Protection from severe weather events like hailstorms, floods, and hurricanes

- Coverage for stolen or damaged personal accessories inside the vehicle

- Reimbursement for repairs from animal collisions, such as hitting a deer

- Costs associated with car vandalism or broken windows

By recognizing these coverage elements, drivers can better assess whether comprehensive auto insurance aligns with their lifestyle, risk factors, and overall budget.

Key Scenarios Where Comprehensive Insurance Provides Crucial Protection

When unexpected events like natural disasters or theft strike, having comprehensive insurance can be a game-changer. This coverage steps in to protect your vehicle from damages not caused by collisions, such as hailstorms, floods, vandalism, or even falling objects. Imagine waking up to find your car scratched by a stray branch after a severe storm or discovering it’s missing after a break-in—comprehensive insurance offers peace of mind by shouldering the repair or replacement costs in these unpredictable situations.

Beyond natural and criminal incidents, comprehensive insurance also shines in scenarios involving animal-related accidents and windshield repairs. Whether your car collides with a deer or suffers damage from a stray rock, this coverage mitigates financial strain. Additionally, many policies cover glass damage without the hefty deductible typically tied to collision claims. Here are a few key examples where comprehensive coverage proves invaluable:

- Theft or Vandalism: Protection when your car is stolen or intentionally damaged.

- Natural Disasters: Coverage against damages caused by events like flooding, hail, or earthquakes.

- Animal Collisions: Repairs after accidents involving wildlife.

- Glass Damage: Coverage for cracked or shattered windshields without large out-of-pocket costs.

- Falling Objects: Protection when debris like tree limbs causes damage.

Assessing Your Risk Factors to Determine the Need for Comprehensive Coverage

Before deciding to invest in comprehensive auto insurance, it’s essential to evaluate your personal risk profile carefully. Consider factors such as where you park your vehicle, your daily commute, and your exposure to natural elements. For example, if you live in an area prone to hailstorms, flooding, or frequent vandalism, comprehensive coverage can provide peace of mind by covering damages that standard policies often exclude. Likewise, if your car is parked on the street overnight regularly, the chances of theft or accidental damage increase, making this policy a wise choice.

Other important considerations include your vehicle’s current value and your financial ability to absorb unexpected costs. Comprehensive insurance generally proves most beneficial if you drive a newer or higher-value car, where repair or replacement costs could be substantial. Here are a few key risk factors to reflect on before committing to coverage:

- Frequency of driving in high-risk areas such as urban centers or undeveloped locations

- Exposure to natural disasters common in your geographic location

- Likelihood of theft or vandalism based on neighborhood crime rates

- Financial impact of potential repairs relative to your disposable income

Expert Tips for Choosing the Right Comprehensive Auto Insurance Policy

When selecting a comprehensive auto insurance policy, it’s vital to evaluate your unique driving habits and environment. Consider factors such as the frequency of driving in high-risk areas, the value of your vehicle, and typical weather conditions. Look for policies with flexible coverage options that allow you to tailor protection against risks like theft, vandalism, natural disasters, and animal collisions. Additionally, closely review the policy limits and deductibles to ensure they align with your financial comfort zone without leaving you underinsured.

Don’t overlook the importance of carrier reputation and customer service quality. A policy is only as good as the insurer behind it, so research claims processing times and customer satisfaction ratings. Here are some key points to keep in mind:

- Transparency: Ensure all coverage details, exclusions, and fees are clearly explained.

- Discounts: Check if you qualify for multi-policy or safe driver discounts to reduce premiums.

- Customization: Opt for add-ons that make sense for your lifestyle, such as rental car coverage or glass repair.

- Claims Support: Verify the insurer offers 24/7 claims assistance and a seamless digital claims process.

Final Thoughts

In today’s fast-paced world, understanding your auto insurance options is more important than ever. Comprehensive auto insurance offers a valuable layer of protection that goes beyond standard coverage, safeguarding you against a wide range of unexpected events. Whether you face natural disasters, theft, or vandalism, this type of insurance can provide peace of mind and financial security. Ultimately, deciding if comprehensive coverage is right for you depends on your vehicle, location, and personal risk tolerance. By weighing the benefits and costs carefully, you can make an informed choice that keeps you and your vehicle protected on the road ahead.