Thinking about life insurance can feel overwhelming, especially when you’re trying to figure out how much coverage you really need. One common question that pops up is, “Can you have multiple life insurance policies?” The short answer: yes, you absolutely can! But there’s more to it than just signing up for as many policies as you want. In this article, we’ll break down how having multiple life insurance policies works, why people choose to do it, and what you should consider before adding another policy to your financial plan. Whether you’re new to life insurance or looking to expand your coverage, this friendly guide has got you covered!

Table of Contents

- Can You Really Hold More Than One Life Insurance Policy

- Why Having Multiple Policies Might Be a Smart Financial Move

- How to Choose the Right Combination of Life Insurance Plans

- Tips for Managing and Keeping Track of Multiple Life Insurance Policies

- Final Thoughts

Can You Really Hold More Than One Life Insurance Policy

Absolutely, holding more than one life insurance policy is not only possible but can also be a smart financial strategy depending on your needs. Many people purchase multiple policies to cover different financial goals—such as one policy to pay off a mortgage and another to ensure college expenses for children are met. When combining policies, you can tailor each one with specific coverage amounts, terms, and premiums that fit distinct parts of your financial plan.

However, it’s important to keep a few key considerations in mind:

- You must be able to justify the total coverage amount to insurers, proving it’s appropriate based on your income and financial obligations.

- Make sure to coordinate your beneficiaries across policies to avoid confusion or potential disputes.

- Remember that underwriting may be stricter when applying for multiple policies within a short timeframe.

Overall, multiple life insurance policies can provide layered protection and flexibility, giving you peace of mind that your loved ones are financially secure no matter what happens.

Why Having Multiple Policies Might Be a Smart Financial Move

Having more than one life insurance policy can actually offer greater flexibility and financial coverage tailored to your evolving needs. For instance, you might choose a term policy to cover specific debts like a mortgage while also holding a permanent policy that builds cash value over time. This layered approach ensures that you are protected in various ways, providing peace of mind that extends beyond just a single benefit payout.

Besides enhancing your overall safety net, multiple policies can also serve as strategic tools for wealth management and legacy planning. Some reasons people opt for several life policies include:

- Targeting different life stages or financial responsibilities without overcommitting to one expensive plan.

- Maximizing tax advantages through various policy types.

- Ensuring enough coverage when your financial obligations grow, such as expanding a family or business partnerships.

How to Choose the Right Combination of Life Insurance Plans

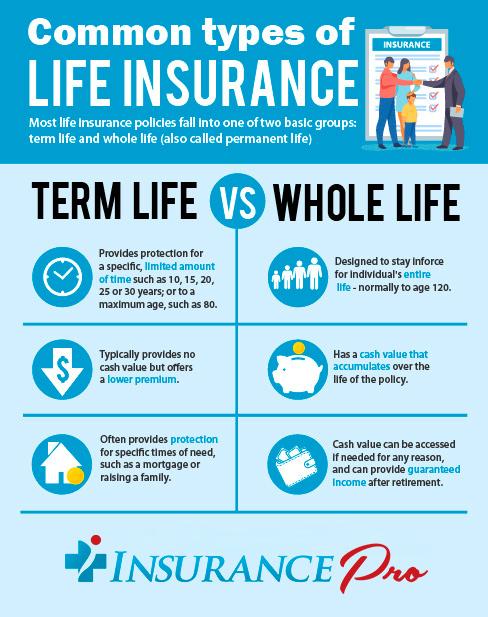

Selecting the perfect mix of life insurance plans means balancing your current financial situation with your future goals. Start by evaluating your coverage needs — consider debts, living expenses, education costs, and any other long-term financial commitments. It’s also important to think about the duration for which you want coverage. For example, term life insurance is excellent for covering specific periods like mortgage years, while permanent life insurance can provide lifelong protection and a cash value component. Combining different types can give you a blend of affordable protection and long-term benefits.

Another factor to consider is your budget and risk tolerance. You might want to explore options such as:

- Term life insurance for high coverage at a low cost

- Whole life insurance for guaranteed benefits and cash value growth

- Universal life insurance for flexible premiums and adaptable coverage

Remember, combining policies is about creating a tailored shield that fits your life’s nuances — and consulting a professional can help tailor that blend to your unique financial landscape.

Tips for Managing and Keeping Track of Multiple Life Insurance Policies

When juggling multiple life insurance policies, staying organized is key. Start by maintaining a dedicated file—physical or digital—that holds all policy documents, premium receipts, and contact information. Utilize apps or spreadsheets to track payment dates and coverage amounts, ensuring no policy lapses unintentionally. Reviewing your policies annually can help you gauge if each one still aligns with your current financial goals and family needs.

Effective management also means seamless communication. Inform your beneficiaries about each policy, specifying the type and insurer, so they know where to turn when the time comes. Consider consolidating coverage or liaising with your financial advisor to optimize benefits and avoid over-insurance. Remember, clear records and proactive reviews can turn the complex web of multiple policies into a well-organized safety net.

Final Thoughts

And there you have it! Having multiple life insurance policies is definitely possible—and sometimes even a smart move—depending on your unique needs and goals. Whether you’re looking to cover different financial responsibilities or just want that extra peace of mind, it’s all about finding the right balance. Just remember to assess your overall coverage, keep track of premiums, and be honest during your application process. If in doubt, chatting with a trusted financial advisor can help you navigate your options. Here’s to making informed decisions that protect what matters most to you and your loved ones!