Thinking about getting life insurance but wondering if you can have more than one policy at the same time? You’re not alone! Many people ask, “Can you have multiple life insurance policies?” Whether you want extra coverage for different needs or just want to feel extra secure about your family’s future, understanding how multiple policies work can be a game-changer. In this article, we’ll break down everything you need to know in a straightforward, friendly way—no confusing insurance jargon here. Let’s dive in and clear up the mystery so you can make the best choices for your peace of mind!

Table of Contents

- Understanding Why People Choose Multiple Life Insurance Policies

- Key Factors to Consider Before Getting More Than One Policy

- How to Manage and Coordinate Multiple Life Insurance Coverage

- Tips for Choosing the Right Policies to Meet Your Financial Goals

- In Summary

Understanding Why People Choose Multiple Life Insurance Policies

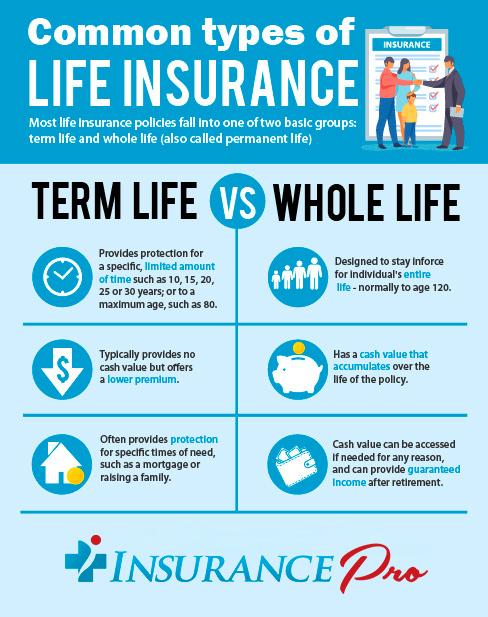

People often choose to have multiple life insurance policies to maximize their financial security in different areas of their lives. For instance, one policy might specifically cover their mortgage, while another takes care of long-term financial goals like college tuition for their children or retirement planning. This layered approach allows policyholders to tailor their coverage according to changing needs without having to over-insure or under-insure with a single policy. Additionally, some individuals like to diversify by combining various types of policies, such as term and whole life insurance, to balance affordability with long-term investment benefits.

Another reason for holding multiple policies is the flexibility and control it provides over insurance payouts. Having separate policies can help in:

- Designating specific beneficiaries for different needs, ensuring funds are allocated exactly where intended.

- Maintaining coverage even if one policy lapses or becomes unaffordable over time.

- Leveraging existing policies to secure additional coverage through riders or group insurance.

This strategic use of multiple life insurance policies often offers peace of mind, making it easier to adapt coverage as life circumstances evolve.

Key Factors to Consider Before Getting More Than One Policy

Before diving into multiple life insurance policies, it’s crucial to evaluate your overall financial goals and obligations. Ask yourself if your current coverage sufficiently protects your family’s future or if additional policies fill gaps like differing policy terms or varied payout structures. Keep in mind that managing several policies requires careful tracking of premiums and beneficiaries. It’s also essential to ensure that the combined coverage amount isn’t excessive, which could lead to unnecessarily high premiums or policy lapses.

Consider how multiple policies might affect your financial planning by weighing:

- The total cost: Premiums for multiple policies add up quickly, so budget accordingly.

- Policy overlap: Avoid duplication of coverage that doesn’t provide extra value.

- Medical underwriting: Stacking policies means multiple health assessments, which could complicate approvals.

- Beneficiary coordination: Managing payouts across policies requires clear communication to prevent confusion.

How to Manage and Coordinate Multiple Life Insurance Coverage

Juggling multiple life insurance policies can feel overwhelming, but with some organization, it’s entirely manageable. Start by creating a detailed inventory of all your policies, including the insurer’s contact info, policy number, coverage amount, and beneficiaries. Keeping all this information consolidated in one secure place — whether a digital document or a physical binder — can save you from last-minute scrambles during a claim or review. It also helps you track premium due dates and ensures you’re not paying redundant fees.

Another key step is coordinating your coverage to avoid gaps or excessive overlap. Consult with a financial advisor or insurance specialist who can assess your combined coverage in relation to your financial goals and family needs. They can help you identify policies that might be merged, adjusted, or even canceled to streamline your protection while maximizing value. Remember, clear communication with your beneficiaries about your multiple policies is just as important—they should know what’s in place and who to contact to make the claim process as smooth as possible.

- Maintain a centralized file with all policy documents and contact details.

- Review your combined coverage regularly to ensure it suits your current life circumstances.

- Notify your beneficiaries about each policy and how to access them.

- Work with an expert to optimize your overall insurance strategy.

Tips for Choosing the Right Policies to Meet Your Financial Goals

Choosing life insurance policies that align with your financial goals requires a thoughtful blend of strategy and self-awareness. Start by evaluating your current financial situation and long-term aspirations. Are you looking to protect your family’s daily living expenses, cover outstanding debts, or leave a legacy? Pinpointing your primary needs clarifies which type of policy—term, whole, or universal life—best suits your plan. Consider policies that offer flexibility, such as riders for critical illness or disability, to ensure your coverage adapts as your life changes.

Keep these pointers in mind as you decide:

- Assess coverage limits: Ensure the sum insured factors in inflation and future expenses.

- Analyze premium affordability: Your premium should fit comfortably within your budget without compromising other financial goals.

- Explore policy durations: Match the term length with major financial commitments, like mortgage or education costs.

- Review insurer reputation: Choose reliable companies with solid customer service and claim settlement records.

By combining informed choices and regular policy reviews, you can build a life insurance portfolio that not only safeguards your loved ones but also grows harmoniously with your financial journey.

In Summary

Having multiple life insurance policies can definitely be a smart move—if done thoughtfully. Whether you’re considering extra coverage for different needs or want to ensure your loved ones are fully protected, there’s no one-size-fits-all answer. The key is understanding how each policy works together and making sure it fits your unique situation. If you’re feeling a bit overwhelmed, don’t worry! Talking to a trusted financial advisor or insurance professional can help you navigate your options and create a plan that gives you peace of mind. Remember, when it comes to protecting your family’s future, it’s all about making informed choices that feel right for you. Thanks for reading, and here’s to a secure tomorrow!