Navigating the world of teen driving can be a daunting experience for many parents—not just because of the learning curve behind the wheel, but also when it comes to insuring your new driver. Teen car insurance often comes with steep premiums, reflecting the higher risk associated with young, inexperienced drivers. However, being a responsible parent doesn’t have to mean breaking the bank. In this article, we’ll explore affordable tips to insure your teen driver wisely, helping you strike the perfect balance between safety, coverage, and cost. Whether you’re a first-time insurer or looking to optimize existing plans, these insights will guide you toward smart, budget-friendly decisions.

Table of Contents

- Understanding Teen Driver Insurance Basics

- Choosing the Right Coverage for Young Drivers

- Leveraging Discounts and Incentives for Savings

- Implementing Safe Driving Habits to Lower Premiums

- The Way Forward

Understanding Teen Driver Insurance Basics

Navigating insurance for a teen driver can often feel like stepping into a labyrinth. Insurance providers typically see teen drivers as high-risk, which can lead to steep premiums. It’s crucial to understand that coverage options and costs vary significantly based on factors such as the teen’s driving history, the type of vehicle insured, and the state’s regulations. Most policies will require a comprehensive coverage plan that includes liability, collision, and comprehensive insurance, ensuring protection against accidents, damages, and theft. Additionally, maintaining a clean driving record and completing approved driver education courses can positively influence your policy rates.

To get the best value for your money, consider leveraging discounts and policy features such as:

- Good Student Discounts: Many insurers reward teens who maintain high grades.

- Safe Driving Programs: Usage-based insurance plans that monitor driving habits can reduce premiums.

- Multi-Car Discounts: Insuring multiple family vehicles with the same provider often yields cost savings.

- Bundling Policies: Combining auto with other insurance policies like home or renters insurance can lower overall costs.

Being informed and proactive about these details will empower you to secure a policy that balances affordability with comprehensive protection.

Choosing the Right Coverage for Young Drivers

When selecting auto insurance for a young driver, it’s crucial to balance affordability with adequate protection. Start by considering a policy that offers a combination of liability, comprehensive, and collision coverage, tailored to their driving habits and needs. While liability coverage is mandatory, adding comprehensive and collision protection can safeguard against damages from accidents, theft, or natural events, reducing out-of-pocket expenses later. Additionally, examine policy limits and deductibles carefully—higher deductibles often lower premiums but require more payment when making a claim.

Leverage discounts specifically designed for young drivers to optimize coverage costs. Many insurers provide incentives for good grades, driver’s education completion, or installing safety devices in the vehicle. Encourage your teen to maintain a clean driving record to qualify for further reductions over time. Important considerations include:

- Utilizing usage-based insurance programs that track driving behavior and can lower premiums for safe drivers.

- Choosing a car with high safety ratings and low theft risk to influence insurance rates positively.

- Exploring multi-policy discounts if you bundle auto coverage with home or other insurances.

Leveraging Discounts and Incentives for Savings

Exploring every available discount can significantly lower your teen driver’s insurance costs without compromising coverage quality. Many insurers offer special savings for students who maintain a strong academic record, so be sure to ask about a good student discount. Additionally, bundling your teen’s policy with other insurance types like auto and home can provide cost-effective benefits through package deals. Consider enrolling your teen in a state-approved driver safety course since completion often qualifies for attractive premium reductions.

Incentives don’t stop at discounts alone—some insurance companies reward responsible driving habits. By utilizing telematics or usage-based programs, your teen’s safe driving behavior can be monitored, often resulting in progressive savings over time. Encourage your teen to drive with care and stay accident-free, as many providers offer loyalty or claims-free discounts that grow with each passing year. Don’t forget to check if your insurer has seasonal promotions or sign-up bonuses, which can also contribute to lowering your overall insurance expense.

Implementing Safe Driving Habits to Lower Premiums

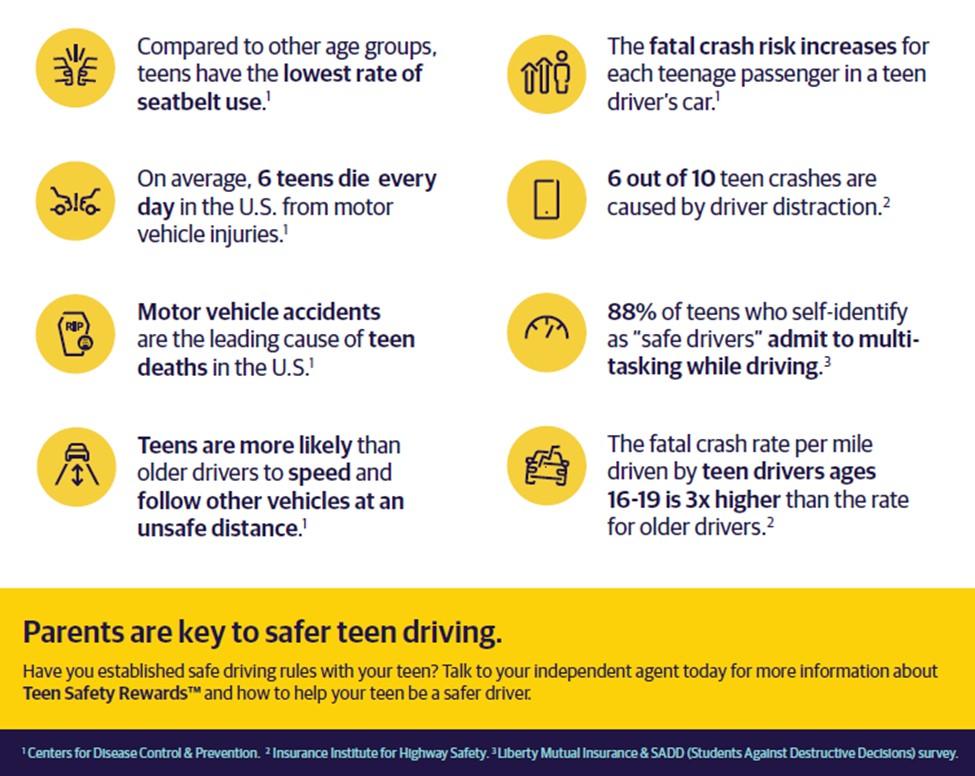

Establishing responsible driving behaviors early on can significantly impact your teen’s insurance costs. Encourage consistent adherence to traffic laws, avoiding distractions such as texting or eating while driving, and maintaining a clean driving record. Many insurers offer premium discounts for drivers who complete certified defensive driving courses, so enrolling your teen in one not only sharpens their skills but also helps you save money. Regularly reviewing and discussing safe driving practices reinforces good habits and minimizes accident risks that could otherwise increase premiums.

Beyond the basics, cultivating an environment where safety is prioritized includes setting clear family rules:

- Limit nighttime driving, as this is often when accident rates are higher for young drivers.

- Restrict the number of passengers to reduce distractions and temptations to speed.

- Encourage the use of seat belts at all times, emphasizing its role in preventing fatal injuries.

These thoughtful strategies not only promote safety but can also demonstrate to insurers that your teen is a lower risk, potentially qualifying you for discounts and more affordable premium rates.

The Way Forward

Insuring your teen driver doesn’t have to break the bank or cause unnecessary stress. By exploring discounts, comparing quotes, and encouraging safe driving habits, you can find affordable options that provide solid coverage and peace of mind. Remember, a well-informed approach not only protects your teen on the road but also helps you manage insurance costs wisely. Keep these tips in mind, and you’ll be better equipped to navigate the world of teen auto insurance with confidence. Safe driving!