Running a daycare is a rewarding adventure, but let’s be real—managing expenses can sometimes feel like a juggling act. One of the biggest costs that often catches providers off guard is daycare insurance. Thankfully, lowering those insurance bills doesn’t have to be complicated or stressful. In this blog, we’ll share some smart, easy-to-implement tips that can help you cut down your daycare insurance costs without sacrificing the coverage you need. Whether you’re just starting out or looking to save a little extra each month, these practical ideas will put you on the path to smarter spending and greater peace of mind. Let’s dive in!

Table of Contents

- Choosing the Right Coverage Without Overpaying

- How Employee Training Can Slash Your Premiums

- Creating a Safe Environment to Reduce Claims

- Regular Policy Reviews to Keep Costs in Check

- Insights and Conclusions

Choosing the Right Coverage Without Overpaying

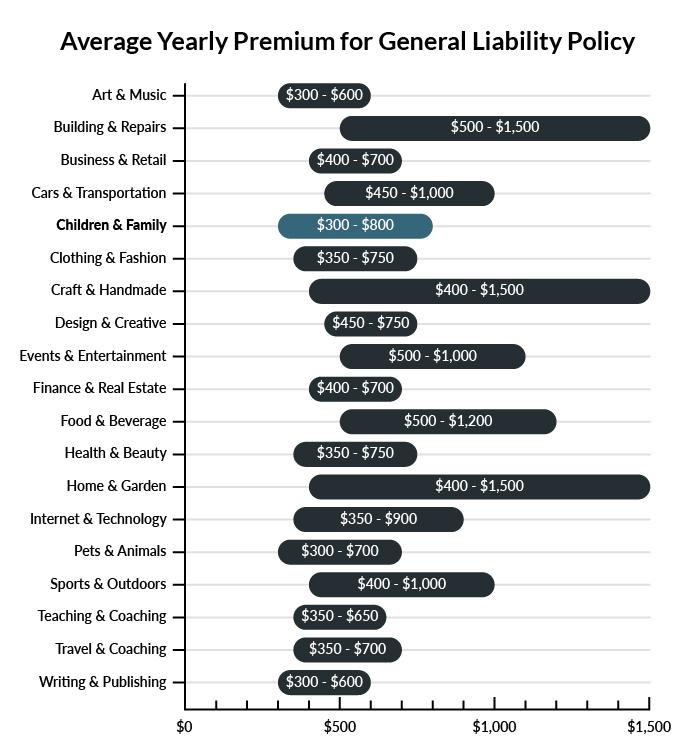

Finding the perfect balance between sufficient protection and affordable premiums can feel like walking a tightrope. Start by evaluating your specific risks: consider the size of your daycare, number of employees, and the kinds of activities children participate in. Tailoring your policy to these realities means you won’t pay for coverage that doesn’t apply to you. For instance, if your daycare focuses on infants and toddlers and limits outdoor play, you might not need as extensive liability coverage as larger facilities with more active play areas.

Tips to fine-tune your policy without overspending:

- Bundle multiple policies from the same insurer to secure discounted rates.

- Ask about higher deductibles to lower your monthly premium costs.

- Regularly review and update your coverage to reflect any operational changes.

- Take advantage of safety training programs offered by your insurer to qualify for discounts.

By approaching your insurance needs with a clear understanding of your daycare’s unique profile, you can avoid unnecessary expenses while maintaining solid protection. Smart choices here translate directly into peace of mind and healthier finances.

How Employee Training Can Slash Your Premiums

Investing in thorough employee training isn’t just about enhancing daycare quality—it’s a strategic move to reduce your insurance premiums. Well-trained staff are more likely to adhere to safety protocols and manage risks effectively, leading to fewer accidents and claims. Insurance providers recognize this proactive approach and often reward businesses that prioritize ongoing education and certification with lower rates. By implementing regular workshops, first aid courses, and child safety training, you demonstrate a commitment to maintaining a secure environment.

Moreover, a trained team helps create consistent routines and clear communication, which greatly minimizes potential hazards. Insurance underwriters value these risk mitigation efforts, making claims less likely and, in turn, slashing your costs. Consider integrating:

- Emergency preparedness drills

- CPR and AED certifications

- Behavior management strategies

- Proper sanitation techniques

These training programs not only boost staff confidence but directly influence your insurance profile, saving you money while promoting a safer childcare experience for everyone.

Creating a Safe Environment to Reduce Claims

Creating a nurturing and secure space not only promotes the well-being of children under your care but also dramatically lowers the risks that can lead to insurance claims. Simple steps like performing routine safety inspections, ensuring all toys and equipment meet safety standards, and maintaining clear emergency procedures make a significant difference. Additionally, organizing regular staff training on child supervision and first aid equips your team to handle unexpected situations calmly and effectively, fostering trust among parents and insurers alike.

Consider implementing these practical measures to enhance safety:

- Install child-proof locks and gates to prevent access to hazardous areas

- Keep detailed documentation of maintenance and safety checks

- Encourage open communication channels between staff and parents regarding any concerns

- Use non-toxic, hypoallergenic cleaning products to protect sensitive young ones

- Regularly update playground surfaces with impact-absorbing materials

These proactive strategies not only help you avoid claims but also create an environment where children thrive happily and parents feel confident, ultimately leading to lower insurance premiums and a stronger reputation for your daycare.

Regular Policy Reviews to Keep Costs in Check

Staying proactive with your insurance plan is key to managing expenses effectively. By scheduling periodic assessments of your policy, you can uncover potential gaps or overlaps that may be costing you extra money. This simple habit ensures your coverage is always tailored to your current needs, avoiding unnecessary premiums for outdated or redundant protections. Regular reviews also keep you in the loop about any new discounts or policy features that might work in your favor.

To make these reviews even more effective, consider:

- Comparing quotes from different providers annually to spot better deals.

- Updating your policy details to reflect changes in enrollment or staffing.

- Discussing risk prevention measures with your agent to qualify for safety discounts.

Taking these small, consistent steps empowers you to keep your daycare insurance costs in check while maintaining the peace of mind essential for running a successful childcare center.

Insights and Conclusions

Lowering your daycare insurance costs doesn’t have to be a daunting task. With a few smart strategies and a bit of proactive planning, you can protect your business and your bottom line at the same time. Remember, the goal is to find the right coverage that keeps your daycare safe without breaking the bank. So take these tips, tailor them to your unique situation, and watch those premiums drop. Here’s to running a thriving, well-insured daycare — and keeping more money where it belongs: in your business!