When it comes to protecting your vehicle and your financial well-being, choosing the right auto insurance policy is crucial. With so many options available, understanding what to look for can feel overwhelming. Whether you’re a first-time buyer or reviewing your current coverage, this guide will walk you through the essential factors to consider. From assessing your needs and comparing coverage options to understanding policy terms and finding the best value, we’ll help you make an informed decision that keeps you safe on the road and protects your wallet.

Table of Contents

- Understanding Different Types of Auto Insurance Coverage

- Evaluating Your Personal Needs and Budget

- Key Factors to Consider When Comparing Insurance Providers

- Tips for Maximizing Benefits While Minimizing Costs

- The Conclusion

Understanding Different Types of Auto Insurance Coverage

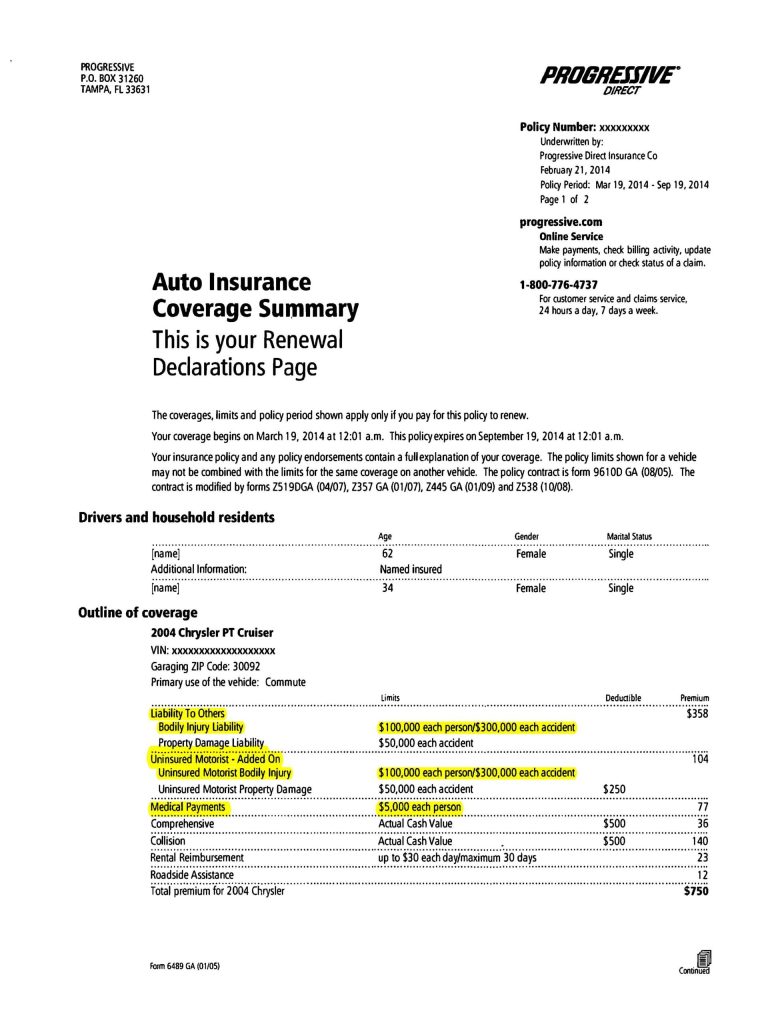

When selecting an auto insurance policy, it’s essential to have a clear understanding of what each type of coverage offers. Liability insurance is a must-have in most states, as it covers damages or injuries you cause to others in an accident. However, it does not cover your own vehicle or medical expenses. On the other hand, collision coverage pays for repairs to your car following a collision, regardless of fault, while comprehensive insurance protects against non-collision incidents like theft, vandalism, or natural disasters.

In addition to these primary forms, there are several optional coverages that can enhance your protection, such as:

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers.

- Uninsured/Underinsured Motorist: Protects you if the other driver lacks sufficient insurance.

- Roadside Assistance: Offers help with breakdowns and emergencies on the road.

Evaluating your personal needs, vehicle value, and risk tolerance will help in tailoring the ideal combination of these coverages for your circumstances.

Evaluating Your Personal Needs and Budget

Understanding your unique circumstances is the cornerstone of selecting an insurance policy that truly fits your lifestyle. Begin by assessing your daily driving habits, the value of your vehicle, and your personal risk tolerance. For instance, if you primarily use your car for short commutes, you might not need extensive coverage geared towards long-distance or commercial driving. Similarly, someone with a newer car might prioritize comprehensive coverage to protect against theft or damage, while an owner of an older vehicle may focus on basic liability insurance.

Financial considerations play a crucial role in this decision-making process. It’s important to balance adequate protection with premiums that won’t strain your budget. To help clarify your options, consider:

- Deductible amounts: Higher deductibles typically lower your monthly premium but increase out-of-pocket costs during a claim.

- Coverage limits: Ensure they align with your assets and potential liabilities.

- Discount opportunities: Check for multi-policy, safe driver, or loyalty discounts that can make coverage more affordable.

By methodically evaluating these elements, you position yourself to choose a policy that delivers peace of mind without compromising financial stability.

Key Factors to Consider When Comparing Insurance Providers

When evaluating different insurance providers, it’s essential to look beyond just the price tags. Consider the financial stability and reputation of the company to ensure they can fulfill claims promptly when needed. Customer reviews and ratings offer insightful glimpses into how responsive and transparent a provider is. Moreover, assess the range of coverage options offered—does the company provide customizable plans or add-ons that cater to your specific needs? Flexibility in policy terms can make a significant difference in long-term satisfaction.

Additionally, pay close attention to the claims process. A provider with a streamlined, hassle-free claims procedure will save you time and stress during an unfortunate event. Look for features such as digital claims filing, 24/7 customer support, and quick settlement times. Don’t forget to evaluate the discounts and perks available. Some insurers offer benefits like safe driver discounts, bundling multiple policies, or accident forgiveness, which could substantially reduce your premium without compromising on coverage quality.

Tips for Maximizing Benefits While Minimizing Costs

Balancing comprehensive coverage with budget-friendly options requires a strategic approach. Start by assessing your individual needs and risk factors, which helps in pinpointing exactly what types of coverage are essential for your situation. Avoid over-insuring by focusing on policies that offer flexible coverage limits and deductibles tailored to your financial comfort. Additionally, explore bundling auto insurance with other policies like home or renters insurance — insurers often reward this consolidation with significant discounts.

Another savvy move is to maintain a clean driving record, as this remains one of the most effective ways to lower premiums. Don’t underestimate the power of shopping around; leverage online comparison tools to analyze quotes across multiple insurers, keeping an eye on customer service ratings and claim response times alongside price. Finally, take advantage of available perks, such as safety device discounts, pay-per-mile options, or loyalty rewards, which can seriously enhance your overall savings without compromising the quality of your coverage.

- Review and adjust your coverage annually to reflect life changes

- Ask about discounts related to your profession or affiliations

- Consider accident forgiveness programs if available

The Conclusion

Choosing the right auto insurance policy doesn’t have to be overwhelming. By understanding your coverage needs, comparing quotes, and evaluating policy terms carefully, you can make an informed decision that protects you on the road without breaking the bank. Remember, the best policy is one that balances affordability with comprehensive protection tailored to your unique situation. Take the time to review your options regularly, and don’t hesitate to reach out to insurance professionals when in doubt. With the right approach, you’ll drive with confidence knowing you’re covered every mile of the way.