Navigating health insurance can sometimes feel like decoding a secret language—full of confusing terms and numbers. Two of the most common—and often misunderstood—words you’ll encounter are “deductibles” and “copayments.” Don’t worry, though! In this easy-to-understand guide, we’ll break down exactly what deductibles and copayments mean, how they work, and what they mean for your wallet. Whether you’re new to health insurance or just looking to brush up on the basics, this friendly guide will help you feel confident the next time you’re reviewing your health costs. Let’s dive in!

Table of Contents

- Understanding Deductibles and How They Impact Your Medical Bills

- Breaking Down Copayments and When You’ll Need to Pay Them

- Tips for Choosing the Best Plan Based on Your Deductibles and Copayments

- How to Save Money on Healthcare Costs Without Sacrificing Coverage

- To Wrap It Up

Understanding Deductibles and How They Impact Your Medical Bills

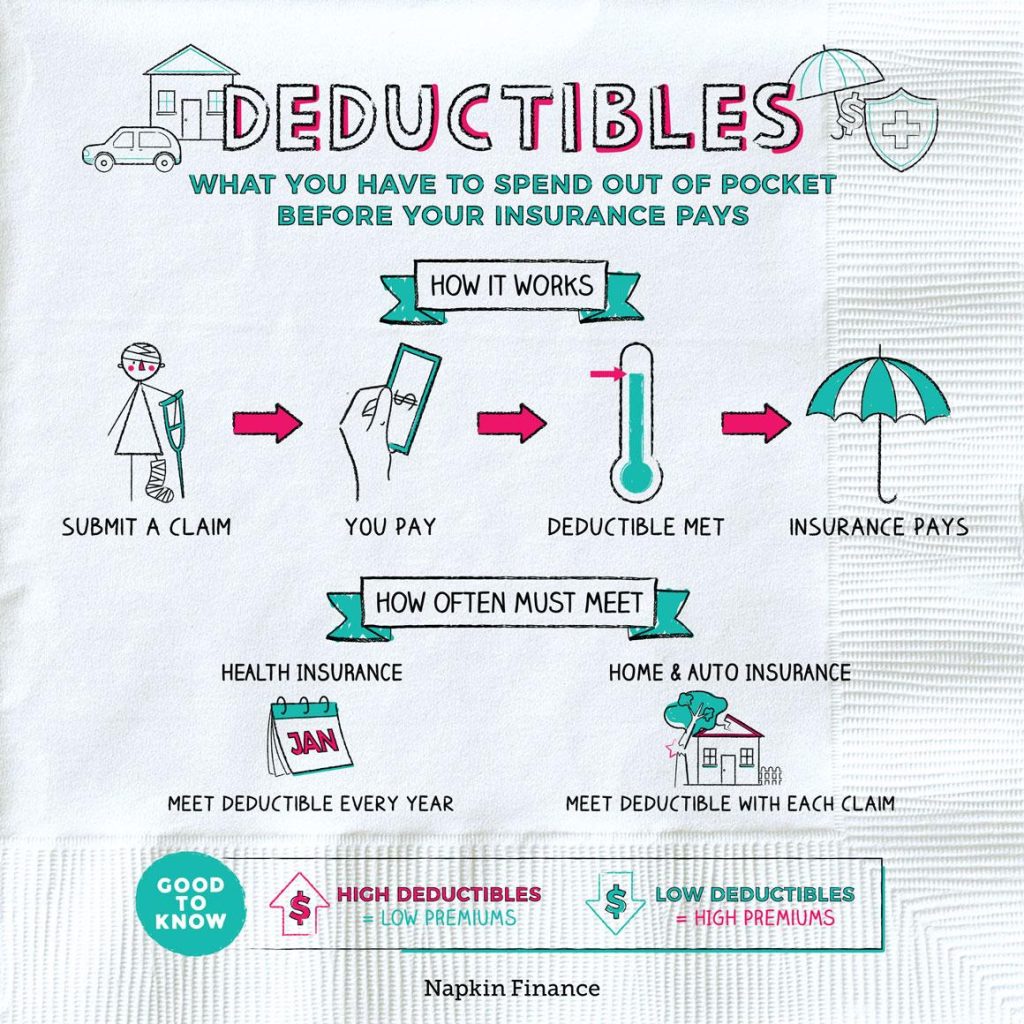

When navigating your medical bills, knowing how deductibles work is essential. A deductible is the amount you must pay out-of-pocket for healthcare services before your insurance starts to cover costs. For example, if your plan has a $1,000 deductible, you’ll pay the first $1,000 of covered services yourself, and only after that does your insurer chip in. This initial expense might seem hefty, but understanding it helps you plan ahead and avoid surprises. Not all services count equally:

- Preventive care like vaccinations and screenings typically don’t apply to the deductible.

- Some treatments require copayments even before meeting your deductible.

- Prescription drugs may have separate deductibles or copay structures.

By grasping how these costs stack up, you can make smarter healthcare choices. Think of the deductible as a financial threshold—once crossed, insurance shoulders a bigger share of the cost. This structure encourages more prudent use of medical services and helps you forecast your healthcare budget with confidence.

Breaking Down Copayments and When You’ll Need to Pay Them

Copayments are the fixed amounts you pay for specific healthcare services, usually at the time of your visit. Think of them as your *co-share* in the cost of a doctor’s appointment, specialist consultation, prescription medications, or even urgent care visits. The beauty of copays is their predictability—you generally know exactly what you’ll owe without any surprises later. Unlike deductibles that must be met annually before insurance kicks in, copays come into play almost immediately, making them an essential part of your out-of-pocket expenses.

You’ll typically encounter copay requirements for:

- Primary care visits

- Specialist appointments

- Prescription drugs

- Emergency room visits

Keep in mind that the amount of your copayment can vary depending on your plan and the type of service. Some plans may have lower copays for telehealth sessions or generic medications, while others may charge more for brand-name drugs or out-of-network care. Understanding when and how much you need to pay helps you plan better and avoid unexpected bills.

Tips for Choosing the Best Plan Based on Your Deductibles and Copayments

When evaluating health insurance options, it’s essential to consider how deductibles and copayments align with your healthcare usage and financial comfort. If you usually have minor medical needs throughout the year, a plan with a lower deductible and slightly higher premiums might save you money in the long run by reducing your out-of-pocket burden. Conversely, if you’re healthy and rarely visit the doctor, a plan with a higher deductible but lower monthly premiums can help you save monthly, with the understanding you’ll pay more upfront if unexpected care is needed.

To make the best choice, focus on these key points:

- Estimate your annual healthcare costs—think about prescriptions, doctor’s visits, and any anticipated procedures.

- Compare copayment amounts for common services like primary care and specialist visits to know what you’ll pay at the time of your care.

- Review out-of-pocket maximums to understand the financial safety net if you face high medical expenses.

- Consider your cash flow—would you rather pay higher premiums steadily or risk paying more at once in deductible costs?

How to Save Money on Healthcare Costs Without Sacrificing Coverage

Understanding where your healthcare dollars go is the first step to keeping more of them. One way to do this is by choosing a plan with flexible deductibles that you can afford each year. Lower deductibles often mean higher monthly premiums, but this trade-off can save money if you anticipate frequent doctor visits. Alternatively, if you’re healthy with minimal medical needs, a plan with a higher deductible can reduce monthly costs while keeping you covered for significant emergencies. Pairing this with a health savings account (HSA) allows you to set aside pre-tax money for medical expenses, essentially giving you a discount on paying out of pocket.

Another smart move is being savvy with copayments by selecting services strategically. For example, many plans offer lower copays for generic medications or preventive care like vaccinations and screenings, which are often covered at 100%. Additionally, shopping around for labs or imaging services can drastically cut costs, as prices vary widely even within the same network. Simple habits can also make a difference, such as using telemedicine when appropriate or scheduling annual check-ups that catch issues early, reducing the need for more expensive treatments later.

- Choose a deductible and premium balance based on your health needs

- Utilize HSAs to save pre-tax dollars for medical expenses

- Opt for generic drugs to lower copayment amounts

- Compare prices for medical tests within and outside your network

- Take advantage of telehealth and preventive care benefits

To Wrap It Up

And there you have it—a simple breakdown of deductibles and copayments to help you navigate your health costs with more confidence. Understanding these terms can take the guesswork out of medical bills and empower you to make smarter healthcare choices. Remember, the more you know, the easier it is to stay on top of your health and your budget. Here’s to making health expenses a little less confusing and a lot more manageable! Thanks for reading, and stay healthy!