When it comes to securing your family’s future, estate planning is often at the top of the to-do list. But did you know that life insurance can be a powerful tool in making your estate plan even stronger? Beyond just providing a financial safety net, life insurance can help you manage taxes, cover debts, and ensure your loved ones are taken care of exactly the way you want. In this article, we’ll explore how life insurance can boost your estate planning strategy — in a clear, friendly way — so you can feel confident your legacy is protected. Let’s dive in!

Table of Contents

- Understanding the Role of Life Insurance in Protecting Your Assets

- Maximizing Wealth Transfer Through Strategic Life Insurance Policies

- Choosing the Right Life Insurance to Complement Your Estate Plan

- Tips for Integrating Life Insurance Smoothly Into Your Financial Goals

- Concluding Remarks

Understanding the Role of Life Insurance in Protecting Your Assets

Life insurance plays a pivotal role beyond mere financial security; it acts as a strategic tool that safeguards your hard-earned assets and ensures your legacy remains intact. By thoughtfully integrating a life insurance policy into your estate plan, you can provide your beneficiaries with immediate liquidity to cover estate taxes, debts, and final expenses — all without the need to sell off precious property or investments under less-than-ideal conditions. This ensures that your estate’s true value is preserved and transferred according to your wishes, offering peace of mind during emotionally difficult times.

Moreover, life insurance can add a layer of flexibility and tax efficiency to your estate planning. It allows you to:

- Supplement wealth transfer strategies by creating a tax-free inheritance for heirs.

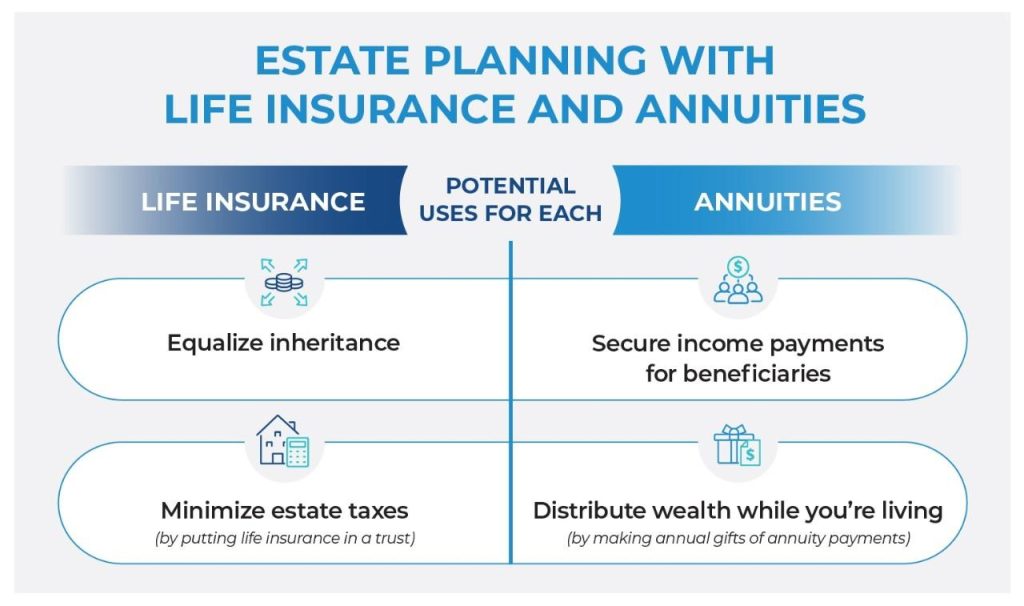

- Equalize inheritances among beneficiaries who may not receive physical assets.

- Protect business interests through buy-sell agreements funded by life insurance proceeds.

Ultimately, leveraging life insurance empowers you to protect your estate’s value and supports a smoother transition for your loved ones, turning complex financial planning into a compassionate gesture for generations to come.

Maximizing Wealth Transfer Through Strategic Life Insurance Policies

Life insurance policies, when carefully tailored, serve as powerful tools to ensure your wealth transitions smoothly and tax-efficiently to the next generation. Beyond the traditional role of providing financial security, these policies offer unique advantages such as liquidity at death, which helps cover estate taxes and debts without forcing heirs to liquidate assets hastily. By incorporating life insurance into your estate planning, you guarantee that your legacy is preserved in line with your wishes while minimizing potential financial burdens on your loved ones.

To make the most of life insurance within your estate strategy, consider these key approaches:

- Irrevocable Life Insurance Trusts (ILITs): Shield the death benefit from estate taxes by placing the policy in a trust.

- Policy Ownership Transfers: Transfer ownership to beneficiaries during your lifetime to reduce taxable estate value.

- Supplementing Inheritance: Use life insurance proceeds to equalize inheritances among heirs with differing asset types.

By strategically integrating these techniques, you not only safeguard your financial legacy but also provide flexibility and clarity to heirs navigating complex wealth transfer decisions.

Choosing the Right Life Insurance to Complement Your Estate Plan

Integrating life insurance into your estate plan means more than just selecting a policy—it’s about tailoring a solution that fits your unique financial landscape and legacy goals. Start by evaluating your current estate value, outstanding debts, and future financial needs of your beneficiaries. Look beyond the premium costs and consider how different policy types—like term life, whole life, or universal life—can offer varying levels of flexibility, cash value accumulation, and tax benefits. This strategic alignment ensures that the death benefit can cover estate taxes, provide liquidity, and protect your heirs’ inheritance without forcing asset sales or undue financial stress.

- Understand your estate’s liquidity needs: Life insurance proceeds can provide immediate cash flow for estate settlement costs.

- Consider policy ownership and beneficiary designations: Proper structuring can help avoid probate and reduce estate tax exposure.

- Leverage riders for added protection: Some policies offer riders that complement long-term care or disability needs, adding layers to your overall plan.

Choosing the right life insurance policy is not a one-size-fits-all task. Collaborating with an estate planning attorney or financial advisor can help you pinpoint the product that best complements your assets and future vision. Remember, a well-chosen policy doesn’t just replace income; it acts as a linchpin for preserving wealth, empowering your legacy, and providing peace of mind for you and your loved ones.

Tips for Integrating Life Insurance Smoothly Into Your Financial Goals

Seamlessly incorporating life insurance into your broader financial strategy starts with understanding how it complements your existing assets. Begin by assessing your current financial situation, including debts, savings, and other investments. This clarity helps you determine the appropriate coverage needed to protect your loved ones and ensure your estate is well-managed. Remember, life insurance is not just about protection—it can serve as a powerful financial tool to provide liquidity for estate taxes or to equalize inheritance among heirs, offering peace of mind as you plan your legacy.

To make the integration process smoother, consider these practical tips:

- Align your policy with long-term goals: Choose coverage that matches the timeframe of your financial plans and potential life events like retirement or funding a child’s education.

- Review your beneficiary designations regularly: Life changes such as marriage, divorce, or new family members mean it’s important to keep your policy beneficiaries up-to-date.

- Collaborate with professionals: Engage financial advisors, estate planners, and insurance experts to craft a cohesive plan that maximizes benefits and minimizes gaps.

These steps ensure your life insurance not only protects but actively enhances your estate planning strategy, leaving a lasting legacy tailored to your unique dreams and priorities.

Concluding Remarks

Wrapping it all up, incorporating life insurance into your estate planning strategy isn’t just a smart move—it’s a way to bring peace of mind to you and your loved ones. By providing a financial safety net, life insurance helps ensure your legacy is protected, debts are covered, and your heirs receive the support they deserve. Whether you’re just starting to think about your estate or looking to strengthen an existing plan, adding life insurance can make a meaningful difference. So, take a moment to explore your options and chat with a trusted advisor—your future self (and your family) will thank you!