Thinking about getting life insurance? One of the biggest questions on your mind might be: “Will I have to take a medical exam?” Whether you’re a first-timer or updating your policy, understanding the role of medical exams can take a lot of the mystery out of the process. In this blog post, we’ll break down what these exams usually involve, why insurers ask for them, and what it means for your coverage and premiums. Let’s dive in and get you confidently prepared for the path ahead!

Table of Contents

- Understanding Why Medical Exams Matter for Your Life Insurance Approval

- What to Expect During a Life Insurance Medical Exam and How to Prepare

- Common Health Factors That Can Impact Your Life Insurance Rates

- Tips for Navigating the Process if You Have Preexisting Conditions

- To Conclude

Understanding Why Medical Exams Matter for Your Life Insurance Approval

When applying for life insurance, the medical exam plays a crucial role in providing insurers with an accurate snapshot of your health. This exam helps underwriters assess risk by collecting vital information such as blood pressure, cholesterol levels, and overall physical condition. By understanding your health status, insurers can offer personalized rates that reflect your true risk, ensuring you receive fair premiums based on your unique profile. Additionally, this step helps prevent surprises—for both you and the insurance company—by verifying the information provided in your application.

Beyond the numbers, these exams can also uncover underlying health issues you might not be aware of, potentially prompting you to take proactive steps toward better well-being. Key components of a typical medical exam include:

- Blood tests to check cholesterol, glucose, and other markers

- Blood pressure measurement for cardiovascular health

- Height and weight to evaluate body mass index (BMI)

- Medical history review to understand past and current health conditions

Approaching the process with transparency and understanding can make the path to approval smoother, giving you confidence that your life insurance coverage suits your needs perfectly.

What to Expect During a Life Insurance Medical Exam and How to Prepare

When you schedule your life insurance medical exam, expect a quick and generally straightforward process that serves as a crucial step in assessing your health. Typically lasting between 15 to 30 minutes, the exam involves a licensed paramedical professional visiting your home or office—or you may visit a designated clinic. During this time, they will measure your height, weight, blood pressure, and heart rate, draw blood, and collect a urine sample. The goal is to get a clear picture of your overall health without causing any discomfort. Don’t worry, the nurse or technician is experienced and will guide you through each step, making sure you feel at ease throughout.

Preparation can make a big difference in presenting your best health profile. To get ready, focus on these simple tips prior to your exam:

- Stay hydrated: Drink plenty of water to ensure your blood is easy to draw.

- Avoid caffeine and nicotine: These can temporarily raise your blood pressure and heart rate.

- Skip heavy exercise: Vigorous activity right before the exam may alter your vital signs.

- Wear comfortable clothing: Sleeves that can easily be rolled up will help with blood pressure measurements.

- Bring a list of medications: This helps the examiner accurately understand your medical history.

Feel free to ask questions throughout the exam—understanding each step not only lowers stress but also empowers you in taking charge of your life insurance journey.

Common Health Factors That Can Impact Your Life Insurance Rates

When applying for life insurance, several health elements come under the microscope, ultimately influencing your premium rates. Chronic conditions such as diabetes, high blood pressure, and heart disease often lead to higher costs, as they increase the insurer’s risk. Even lifestyle choices like smoking or excessive alcohol consumption can have a significant impact. Beyond these, insurers also consider your body mass index (BMI), family medical history, and current medications, all of which help create a clearer picture of your overall health.

It’s important to remember that minor health issues or manageable conditions don’t automatically result in sky-high premiums. Insurers typically evaluate:

- Your ability to manage or control existing conditions

- Recent hospitalizations or surgeries

- Your overall fitness and physical activity levels

Being transparent during your medical exam and application process can work in your favor. By providing complete information, you give yourself the best chance at obtaining fair and accurate life insurance rates tailored to your unique health profile.

Tips for Navigating the Process if You Have Preexisting Conditions

Dealing with preexisting conditions when applying for life insurance can feel overwhelming, but being proactive can make a significant difference. Start by gathering all relevant medical documents, including recent test results and treatment history. This transparency helps the insurer get a clearer picture and can speed up the underwriting process. Don’t hesitate to consult your healthcare provider to clarify any complex medical information beforehand — their insights can be invaluable. Honesty is crucial: fully disclose your health history to avoid surprises later that could jeopardize your coverage or lead to claim denials.

Additionally, consider these helpful strategies to improve your chances of securing favorable terms:

- Shop around: Different insurers assess preexisting conditions differently, so getting multiple quotes is wise.

- Work on managing your condition: Demonstrating stable health (like controlled blood pressure or regular therapy attendance) reassures underwriters.

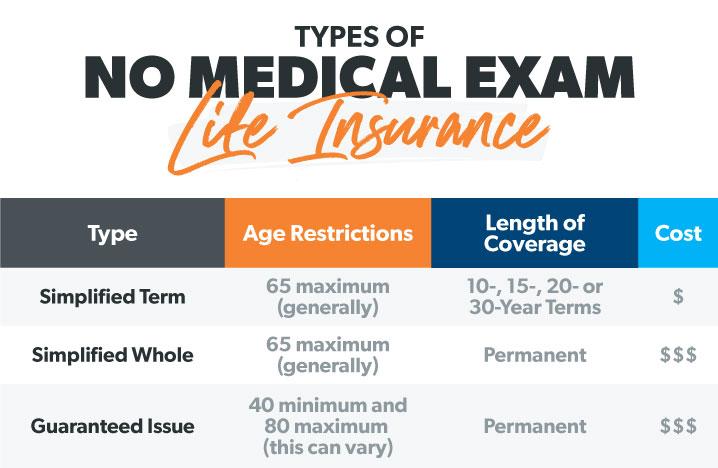

- Explore no-exam policies: While typically pricier, these plans might offer an easier route if medical exams are a barrier.

- Be patient: Underwriting for preexisting conditions often takes longer, but careful preparation can reduce delays.

To Conclude

And there you have it—a quick rundown of everything you need to know about medical exams and life insurance. While the idea of a medical exam might sound a bit daunting, remember it’s just a step towards securing peace of mind for you and your loved ones. Understanding the process makes it less intimidating and helps you feel more in control. Whether you’re shopping around or ready to apply, being informed will always serve you well. So take a deep breath, ask questions, and know that this small step can lead to big protection for your future. Here’s to making smart, confident choices on your life insurance journey!