Navigating the world of health insurance can feel pretty overwhelming, especially if you’re new to it. But don’t worry — understanding the basics doesn’t have to be complicated. Whether you’re trying to figure out what health insurance actually means, how it works, or why it’s important, this guide is here to help. In this article, we’ll break down the essentials of health insurance in a simple, friendly way so you can feel confident making smart choices about your coverage. Let’s dive in!

Table of Contents

- Understanding the Basics of Health Insurance and Why It Matters

- Breaking Down Common Health Insurance Terms You Should Know

- Tips for Choosing the Right Health Insurance Plan for Your Needs

- How to Maximize Your Health Insurance Benefits Without Overpaying

- In Conclusion

Understanding the Basics of Health Insurance and Why It Matters

At its core, health insurance is a financial safety net designed to help cover the costs of medical care. Without it, a single hospital visit or unexpected surgery could lead to overwhelming expenses. Health insurance plans typically involve paying a monthly premium in exchange for coverage that helps reduce out-of-pocket costs when you need medical attention. From routine doctor visits and prescription medications to emergency care and specialized treatments, having a plan in place ensures that your health is protected without putting your wallet at risk.

Understanding how these plans work can feel confusing at first, but breaking it down helps. Here are some key components to know about:

- Premiums: The amount you pay regularly to maintain your insurance coverage.

- Deductibles: The initial amount you pay out-of-pocket before insurance kicks in.

- Copayments and Coinsurance: Your share of costs for medical services after meeting the deductible.

- Network: The group of doctors and hospitals your plan works with, often at lower costs.

Grasping these basics empowers you to choose a plan that fits your lifestyle, budget, and healthcare needs, transforming health insurance from a confusing necessity into a valuable resource.

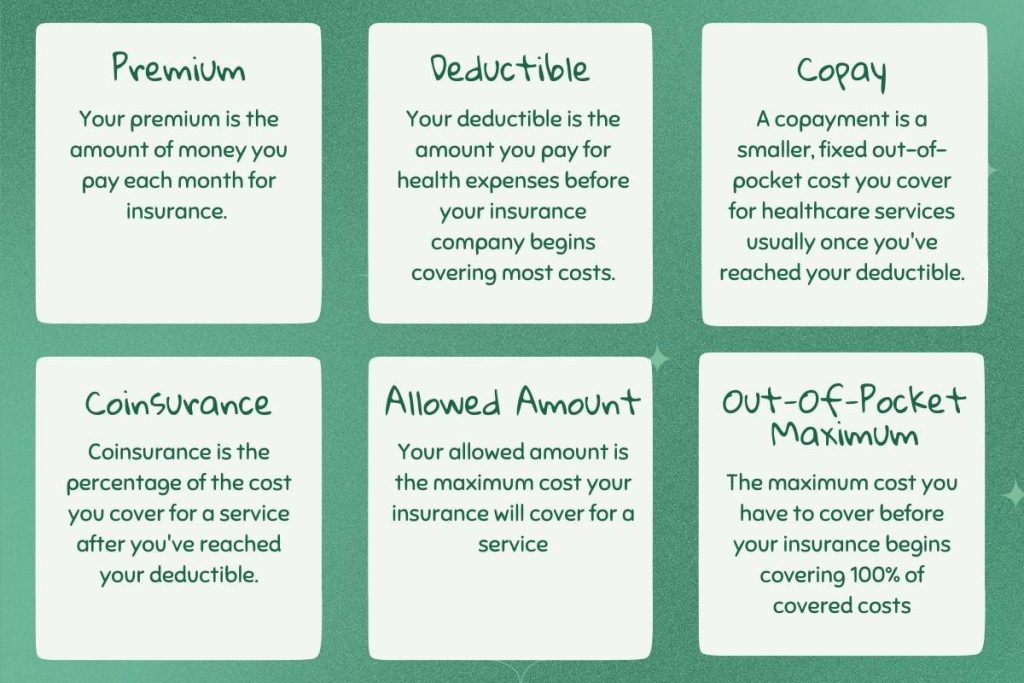

Breaking Down Common Health Insurance Terms You Should Know

Understanding the language of health insurance can feel like decoding a secret code, but once you get the hang of the basics, it becomes a lot less intimidating. For starters, premium is the monthly fee you pay to keep your insurance active, much like a subscription. Then there’s the deductible, which is the amount you pay out-of-pocket before your insurance starts pitching in. After meeting this deductible, your plan might require you to pay a copayment or coinsurance, which are smaller shares of the cost you split with your insurer when you get medical care. Each of these terms plays a key role in how much you pay and when — getting familiar with them empowers you to make smarter decisions about your coverage.

- Out-of-pocket maximum: The cap on what you pay annually. Once reached, your plan covers 100% of covered expenses.

- Network: The group of doctors, hospitals, and providers your plan works with, often resulting in lower costs.

- Pre-existing condition: Any health issue you had before your coverage started, which in most cases insurers can no longer deny coverage for.

- Explanation of Benefits (EOB): A detailed statement from your insurer explaining what was covered and what you owe after a visit or treatment.

By breaking down these terms into bite-sized nuggets, you take control of your health insurance experience. Remember, it’s not just about paying bills but maximizing your benefits to support your well-being. Familiarity with these concepts can turn frustrating fine print into a clear, actionable guide for your healthcare journey.

Tips for Choosing the Right Health Insurance Plan for Your Needs

Finding the perfect health insurance plan starts with understanding your personal healthcare needs and budget. Consider your typical medical expenses, including doctor visits, prescription medications, and any ongoing treatments. Also, take a close look at the plan’s network of providers—choosing a plan that includes your preferred doctors and nearby hospitals can save you both time and money. Another important factor is to evaluate the plan’s deductible, copays, and coinsurance to make sure you’re comfortable with how costs are shared between you and the insurer.

Next, pay attention to what additional benefits and coverage options the plan offers. Some plans might include useful extras like wellness programs, telehealth services, or coverage for alternative treatments. Don’t forget to review the fine print for any exclusions or limitations that could affect you down the road. To make this easier, here are a few quick checklist items:

- Assess your healthcare usage—past year and anticipated needs

- Check network flexibility—are your providers covered?

- Understand cost-sharing—deductibles, copays, coinsurance

- Review coverage details—including prescription and specialist care

- Look for wellness perks—preventive care, telemedicine, discounts

How to Maximize Your Health Insurance Benefits Without Overpaying

Getting the most out of your health insurance means understanding the details hidden in your policy. Start by reviewing your benefits annually; insurance offerings can change, and staying informed ensures you don’t miss out on new perks or services. Next, take advantage of preventive care services like vaccinations, screenings, and annual check-ups, which are often covered at no additional cost. Consider using in-network providers to avoid unnecessary out-of-pocket expenses—insurance companies negotiate rates with these providers, usually resulting in more affordable care for you.

Another smart move is to leverage your flexible spending accounts (FSAs) or health savings accounts (HSAs). Contributions to these accounts are tax-advantaged and can be used to cover eligible medical expenses, reducing your overall healthcare costs. Don’t hesitate to ask your insurer for a clear breakdown of what’s covered and what isn’t; sometimes preventive treatments or wellness programs go unnoticed but can save you money. Lastly, make it a habit to compare prescription drug prices, as costs can vary widely even within the same insurance plan. Armed with this knowledge, you can confidently navigate your health insurance without overpaying.

In Conclusion

Wrapping up, understanding health insurance doesn’t have to be confusing or overwhelming. It’s all about having a safety net that helps you manage healthcare costs and access the care you need without breaking the bank. By knowing the basics—what health insurance is, how it works, and the key terms involved—you’re already one step closer to making informed decisions that protect your health and wallet. Remember, everyone’s situation is unique, so take the time to explore your options and choose a plan that fits your lifestyle. Here’s to being empowered and confident in navigating your health insurance journey!