When it comes to auto insurance, many factors come into play when determining your premium rates. Among the most significant—and often misunderstood—are age and gender. Insurers use these personal characteristics as key indicators of risk, impacting how much you pay for coverage. In this article, we’ll explore how age and gender influence your auto insurance rates, diving into the reasons behind these trends and what they mean for drivers of all demographics. Whether you’re a young driver just starting out or someone looking to understand the nuances of insurance pricing, this guide will shed light on how these factors shape your policy costs.

Table of Contents

- Age as a Key Factor in Determining Auto Insurance Premiums

- The Role of Gender in Shaping Insurance Risk Profiles

- How Young Drivers Can Secure More Affordable Coverage

- Tailored Insurance Tips for Women and Men on the Road

- Concluding Remarks

Age as a Key Factor in Determining Auto Insurance Premiums

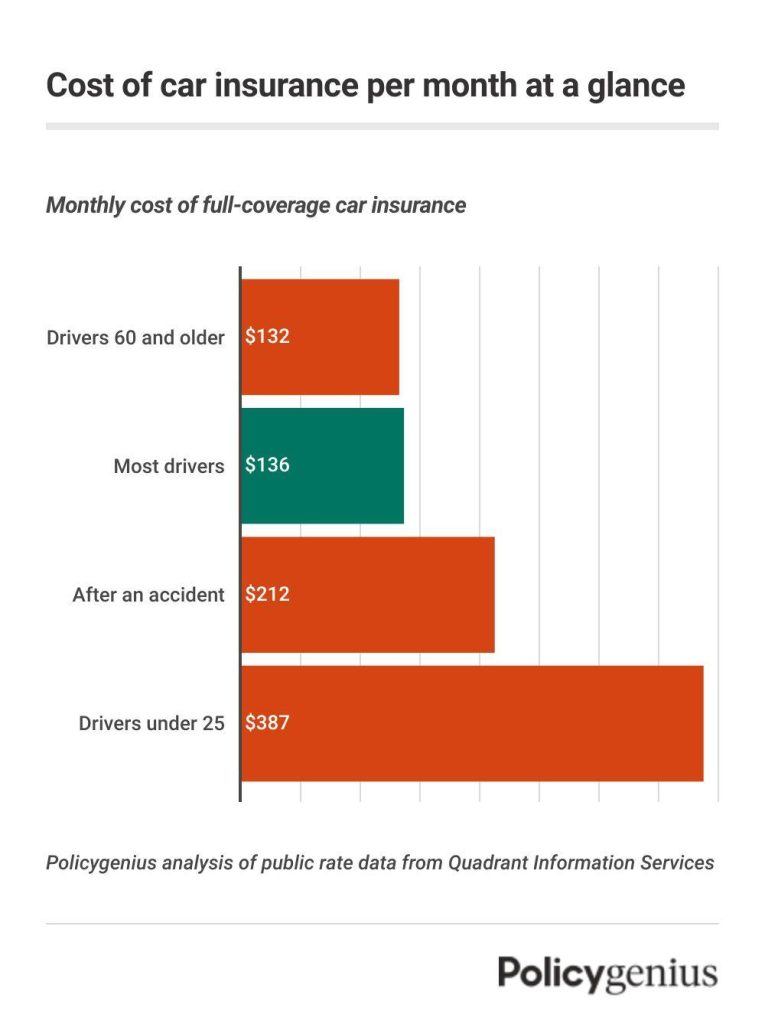

Insurance providers closely examine the age of a driver as a crucial component when calculating auto insurance premiums. Younger drivers, particularly those under 25, often face higher rates due to statistically higher accident frequencies and risk-taking tendencies associated with this age group. Conversely, middle-aged drivers tend to benefit from lower premiums, as their driving experience and typically cautious behavior result in fewer claims. However, as drivers advance into their senior years, some insurers may adjust rates upward again, factoring in potential age-related declines in reaction time or vision.

The impact of age on pricing can be summarized through several key points:

- High-risk youth: Elevated rates reflect risky driving patterns and lack of experience.

- Prime-age drivers: Often enjoy discounted premiums due to proven driving records and lower claims.

- Senior adjustments: Some carriers increase rates after a certain age to account for health and safety concerns.

Understanding these dynamics helps drivers anticipate how their premiums might evolve over time and identify opportunities to maintain affordable coverage by mitigating associated risks.

The Role of Gender in Shaping Insurance Risk Profiles

When assessing auto insurance premiums, insurers often incorporate gender as a significant factor due to variations in driving behaviors typically observed between men and women. Statistically, men, especially younger ones, are more likely to engage in risky driving practices, such as speeding or aggressive maneuvers, which can lead to higher claim rates. Conversely, women tend to exhibit more cautious driving habits, resulting in fewer accidents and claims. This differentiation influences insurers’ actuarial models, leading to distinct risk profiles based on gender. However, it’s important to note that such generalizations may not apply universally, and individual driving history and lifestyle still play a crucial role in rate determination.

Some key considerations involving gender and insurance risk include:

- Claim Frequency: Men typically file more claims, impacting their risk rating.

- Severity of Accidents: Male drivers are often involved in accidents with higher severity.

- Vehicle Type and Usage: Preferences in vehicle models and usage patterns can differ by gender, affecting risk assessments.

- Legal and Regulatory Changes: Some regions are moving toward gender-neutral pricing, reflecting evolving societal norms.

How Young Drivers Can Secure More Affordable Coverage

Young drivers often face steep insurance premiums due to perceived higher risk, but there are effective strategies to reduce these costs without sacrificing coverage. One key approach is to maintain a clean driving record, as insurers reward responsible behavior with lower rates. Additionally, enrolling in defensive driving courses can demonstrate commitment to safety, often qualifying young drivers for discounts. Another practical tip is to consider vehicles with strong safety ratings and lower repair costs, as insurers factor in the type of car when calculating premiums.

Leveraging policy customization can also make coverage more affordable. Young drivers should explore options like increasing deductibles or bundling auto insurance with other policies, such as renters or student insurance, to unlock multi-policy discounts. Moreover, taking advantage of telematics programs, where driving habits are monitored through apps or devices, can lead to personalized premiums based on actual behavior rather than just age and gender. Ultimately, proactive measures and smart choices can transform the landscape of auto insurance for young drivers, making protection both effective and economical.

- Maintain a clean driving record to qualify for safe driver discounts

- Complete approved defensive driving courses for premium reductions

- Choose cars with high safety ratings to lower insurance costs

- Increase deductibles to decrease monthly premiums

- Bundle policies for additional discounts

- Utilize telematics programs to personalize rates

Tailored Insurance Tips for Women and Men on the Road

When it comes to auto insurance, understanding how your age and gender affect your rates can empower you to make smarter financial decisions. Statistically, young male drivers often face higher premiums due to a greater likelihood of risky driving behaviors and accidents. In contrast, young women typically benefit from lower rates during their initial years behind the wheel. However, as drivers move into their 30s and beyond, these discrepancies tend to level out, with other factors like driving history and vehicle type taking precedence.

To optimize your insurance costs, consider the following tailored strategies:

- Young men: Enroll in defensive driving courses and maintain a clean record to qualify for discounts.

- Women of all ages: Take advantage of safe driver programs and choose vehicles with advanced safety features.

- Mature drivers: Regularly review and compare policies since some insurers offer loyalty bonuses or better rates for experienced drivers.

Remember, insurance providers use complex algorithms that weigh gender and age alongside other factors. Being proactive and informed can help you navigate these nuances and secure the best possible coverage for your unique driving profile.

Concluding Remarks

Understanding how age and gender impact your auto insurance rates can empower you to make smarter decisions when shopping for coverage. While younger drivers and certain gender groups may face higher premiums due to statistical risk factors, being informed helps you explore discounts, choose the right policy, and ultimately save money. Remember, your individual driving history and other personal factors also play significant roles in determining rates, so it pays to shop around and ask plenty of questions. Stay proactive, and you’ll be better equipped to find an insurance plan that fits both your budget and your needs.