When it comes to protecting your loved ones, life insurance is a vital safety net. But what happens if your claim gets denied just when your family needs it most? Unfortunately, claim denials happen more often than you might think, and they can leave families struggling during difficult times. In this article, we’ll dive into the top reasons why life insurance claims get denied—and, more importantly, how you can avoid these pitfalls. Whether you’re a new policyholder or looking to update an existing plan, understanding these key issues can help ensure your coverage truly delivers when it matters most. Let’s get started!

Table of Contents

- Common Pitfalls That Lead to Life Insurance Claim Denials

- How Incomplete or Incorrect Paperwork Can Sabotage Your Claim

- The Importance of Full Disclosure and Honest Communication

- Tips to Ensure a Smooth and Successful Life Insurance Claim Process

- In Retrospect

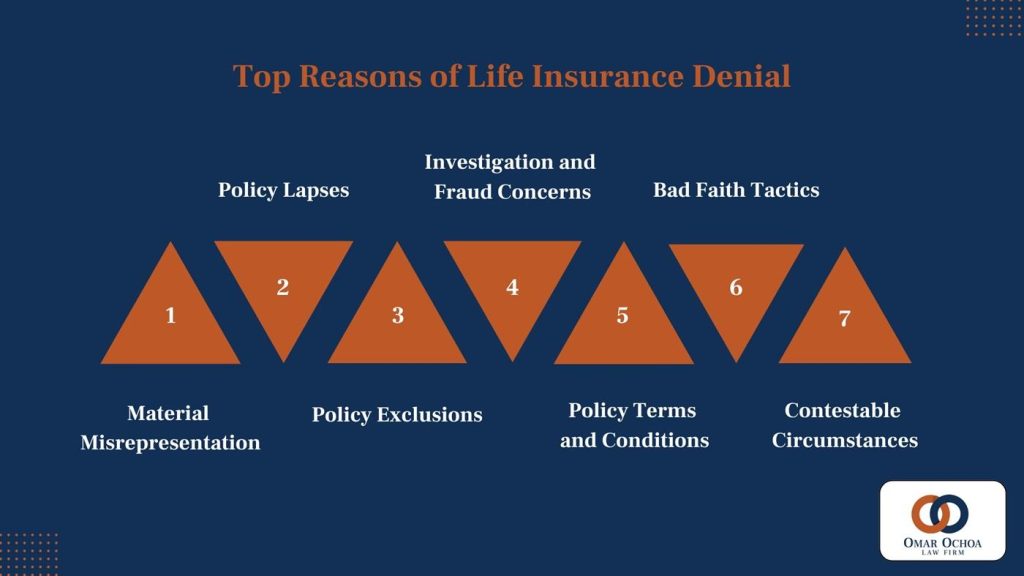

Common Pitfalls That Lead to Life Insurance Claim Denials

One of the most frequent stumbling blocks in life insurance claims arises from incomplete or inaccurate information provided during the application process. Insurance companies thoroughly review medical records and personal history, and any discrepancies—intentional or accidental—can be grounds for denial. For example, failing to disclose pre-existing conditions, omitting details about risky hobbies, or underreporting tobacco use might seem minor but can seriously affect the validity of your claim. It’s essential to be transparent and detailed when filling out your application; even small oversights can trigger a claim investigation that delays or denies your benefits.

Another common pitfall involves missing critical deadlines or paperwork. Many claim denials occur simply because beneficiaries or policyholders didn’t submit required documents on time or failed to respond promptly to insurer requests. Insurance companies have strict timelines for claim submissions and supporting evidence, such as death certificates, medical records, or beneficiary identification. Keeping organized records and communicating proactively with your insurer can smooth the process and prevent unnecessary denials. Remember, staying on top of these administrative details is just as important as having the right coverage.

How Incomplete or Incorrect Paperwork Can Sabotage Your Claim

When it comes to filing a life insurance claim, the devil is truly in the details. Missing signatures, incomplete forms, mismatched information, or forgetting to attach necessary documents can all throw a wrench in the claims process. Insurers rely heavily on accurate paperwork to verify the claim’s validity, and even small errors can result in delays or outright denials. Keeping everything organized and double-checking every form before submission can save your loved ones from unnecessary stress during an already difficult time.

To avoid these pitfalls, consider these simple yet effective tips:

- Review the policy documents thoroughly to understand what paperwork is required.

- Ensure all forms are fully completed, signed, and dated.

- Attach certified copies of the death certificate and any other requested supporting documents.

- Keep a copy of every submitted document for your records.

- Reach out to your insurance provider if you’re unsure about any requirement—they’re there to help!

The Importance of Full Disclosure and Honest Communication

When applying for life insurance, transparency is your best ally. Insurers rely heavily on the information you provide to assess risk and determine coverage. Omitting or misstating facts—even unintentionally—can lead to claim denials that leave your loved ones unprotected when they need support the most. Being upfront about your health history, lifestyle habits, and occupation allows the insurer to tailor a policy that fits you accurately, reducing the chances of costly surprises later.

Establishing honest communication builds trust and eliminates ambiguity. It’s not just a one-time conversation; if your circumstances change, updating your insurer promptly helps maintain the integrity of your coverage. Remember, this openness benefits both parties:

- Ensures your claim is honored without hassle

- Makes the underwriting process smoother and faster

- Avoids legal complications or allegations of insurance fraud

- Provides peace of mind knowing you’ve done your part

Tips to Ensure a Smooth and Successful Life Insurance Claim Process

To navigate the life insurance claim process without any hiccups, it’s essential to stay organized and proactive. Start by gathering all necessary documentation early, including the original policy, death certificate, medical records, and any claim forms requested by the insurer. Keep copies of every document you submit and maintain a detailed log of all communications with the insurance company—dates, names, and summaries of conversations. This will not only streamline the process but also provide crucial evidence if any questions arise.

Another key to success is clear and honest communication. Be sure to provide complete and accurate information when filling out forms or answering questions, as discrepancies can lead to delays or denials. If you encounter confusing jargon or complex steps, don’t hesitate to ask your insurer for clarification. Additionally, working with an experienced insurance agent or claims advisor can make a huge difference, as they know the ins and outs of what insurers look for and can help you avoid common pitfalls.

- Keep all medical and policy documents in one accessible place.

- Respond promptly to requests from the insurance company.

- Double-check all forms for accuracy before submission.

- Don’t hesitate to seek professional advice if needed.

In Retrospect

Navigating the world of life insurance can feel overwhelming, but understanding the common reasons claims get denied—and knowing how to avoid those pitfalls—puts you in the driver’s seat. By being thorough, honest, and proactive from the start, you can help ensure your loved ones receive the support they deserve when it matters most. Remember, the key to a smooth claims process lies in preparation and clear communication. Here’s to peace of mind and protecting your family’s future!