Navigating the world of health insurance can feel like trying to decode a secret language — confusing terms, endless paperwork, and countless plan options. But it doesn’t have to be that way! Whether you’re new to health insurance or just need a simple refresher, this guide will break down the basics in a friendly, easy-to-understand way. From what health insurance actually is, to how it works in everyday life, we’ve got you covered. Let’s dive in and make sense of health insurance together!

Table of Contents

- Understanding the Basics of Health Insurance and Why It Matters

- Breaking Down Common Health Insurance Terms So You Don’t Get Confused

- How to Choose the Right Health Insurance Plan for Your Needs

- Tips for Maximizing Your Health Insurance Benefits Without Stress

- The Way Forward

Understanding the Basics of Health Insurance and Why It Matters

At its core, health insurance is a safety net that helps you manage the cost of medical care. Instead of paying hefty medical bills out of pocket every time you visit a doctor or need treatment, health insurance allows you to pay a monthly fee—called a premium—that covers a portion of your healthcare expenses. This means you can access necessary medical services without the stress of unexpected costs. It’s important to understand that health insurance plans come with terms like deductibles, copayments, and coinsurance, which determine how much you pay versus how much your insurer covers. Getting familiar with these terms helps you pick a plan that fits your budget and healthcare needs.

Why does this all matter? Because health insurance is more than just a financial tool—it’s a way to protect your well-being and peace of mind. Without coverage, even a minor accident or illness can result in expensive bills that set you back months or years financially. Having insurance means you gain access to preventative care, like vaccinations and screenings, which are crucial for catching health issues early. Plus, insurers often provide networks of trusted healthcare providers, which can simplify choosing where to go for care. Simply put, health insurance empowers you to focus on getting better, not stressing over costs.

- Financial protection against unexpected medical expenses

- Access to a network of doctors and hospitals

- Preventative services to keep you healthy

- Peace of mind knowing you’re covered when it matters most

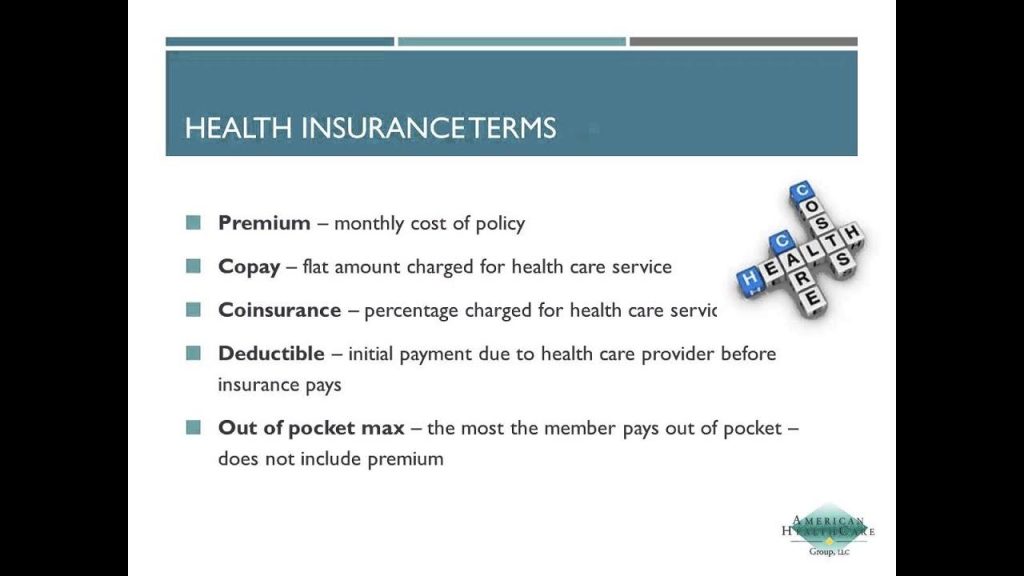

Breaking Down Common Health Insurance Terms So You Don’t Get Confused

Understanding health insurance can feel like learning a new language, especially when you come across terms like premium, deductible, co-pay, and out-of-pocket maximum. The premium is the amount you pay each month just to keep your insurance active—think of it as your subscription fee. Next, the deductible is what you pay out of your own pocket before your insurance starts covering costs. For example, if your deductible is $1,000, you will pay the first $1,000 of medical bills, after which your insurer begins to help with expenses.

Then there are co-pays, which are fixed amounts you pay for specific services like doctor visits or prescriptions, often ranging from $10 to $50. Lastly, the out-of-pocket maximum is the most you will have to pay in a year before the insurance company covers 100% of your medical costs. Here’s a quick cheat sheet to keep things clear:

- Premium: Monthly subscription to your insurance plan

- Deductible: Amount you pay before insurance kicks in

- Co-pay: Fixed fee for doctor visits or medications

- Out-of-pocket maximum: The yearly cap on your personal expenses

How to Choose the Right Health Insurance Plan for Your Needs

Choosing the perfect health insurance plan can feel overwhelming, but breaking it down into manageable steps helps. Start by evaluating your healthcare needs: consider how often you visit doctors, if you require regular medications, or have ongoing treatments. Also, think about your budget—not just the monthly premium but out-of-pocket costs such as deductibles, copayments, and coinsurance. Plans with lower premiums often mean higher costs when you receive care, so finding balance is key.

Next, examine what each plan covers. Look beyond the basics and check if your preferred doctors and hospitals are in-network to avoid surprise bills. Some plans offer additional benefits like wellness programs, telehealth, or prescription coverage, which can add great value. Here’s a quick checklist to help you compare plans effectively:

- Monthly Premium: What you pay regularly for coverage.

- Deductible: Amount paid out-of-pocket before coverage kicks in.

- Co-payments and Coinsurance: Your share of medical costs.

- Provider Network: Are your doctors included?

- Covered Services: What treatments and medications are included?

- Additional Perks: Wellness or telehealth options.

Tips for Maximizing Your Health Insurance Benefits Without Stress

Understanding the ins and outs of your health insurance plan can feel overwhelming, but a few smart strategies can help you get the most value without added stress. First, always review your policy details annually – insurance terms, coverage limits, and in-network providers can change, so staying informed keeps surprises at bay. Also, leverage preventive services like screenings and vaccinations, which are often covered at no extra cost. Scheduling these early in the year can save you money and support long-term health.

Another way to maximize benefits is by building a relationship with a primary care physician who’s within your network. They can guide you through care options and coordinate referrals, which often means lower out-of-pocket expenses. Keep an organized file of your medical expenses and insurance claims too – this can simplify tracking reimbursements and spotting billing errors. Lastly, take advantage of digital tools: many insurance companies offer apps or portals for easy claim submissions and benefit tracking, helping you stay on top of your healthcare journey effortlessly.

The Way Forward

And there you have it — a simple guide to understanding health insurance without all the confusing jargon. Remember, having the right coverage can make a huge difference when it comes to your peace of mind and financial health. Take your time to explore your options, ask questions, and choose a plan that fits your needs and budget. Health insurance might seem tricky at first, but with a little knowledge, you’ll be navigating it like a pro in no time. Stay healthy and stay informed!