When it comes to running a used car lot, there’s more to consider than just the vehicles on the lot. Behind the scenes, the right insurance coverage plays a vital role in protecting your business, your employees, and your customers. Navigating the world of insurance can feel overwhelming—especially when you’re trying to focus on building trust and growing your dealership. That’s why understanding the essential types of insurance your used car lot needs isn’t just smart—it’s necessary. In this blog, we’ll gently guide you through the key policies that provide a safety net, giving you peace of mind as you steer your business toward success.

Table of Contents

- Choosing the Right Liability Coverage to Protect Your Business

- Understanding Comprehensive Insurance for Physical Damage and Theft

- The Importance of Dealer’s Open Lot Insurance for Used Car Lots

- Tailoring Workers Compensation to Support Your Team Safely

- In Retrospect

Choosing the Right Liability Coverage to Protect Your Business

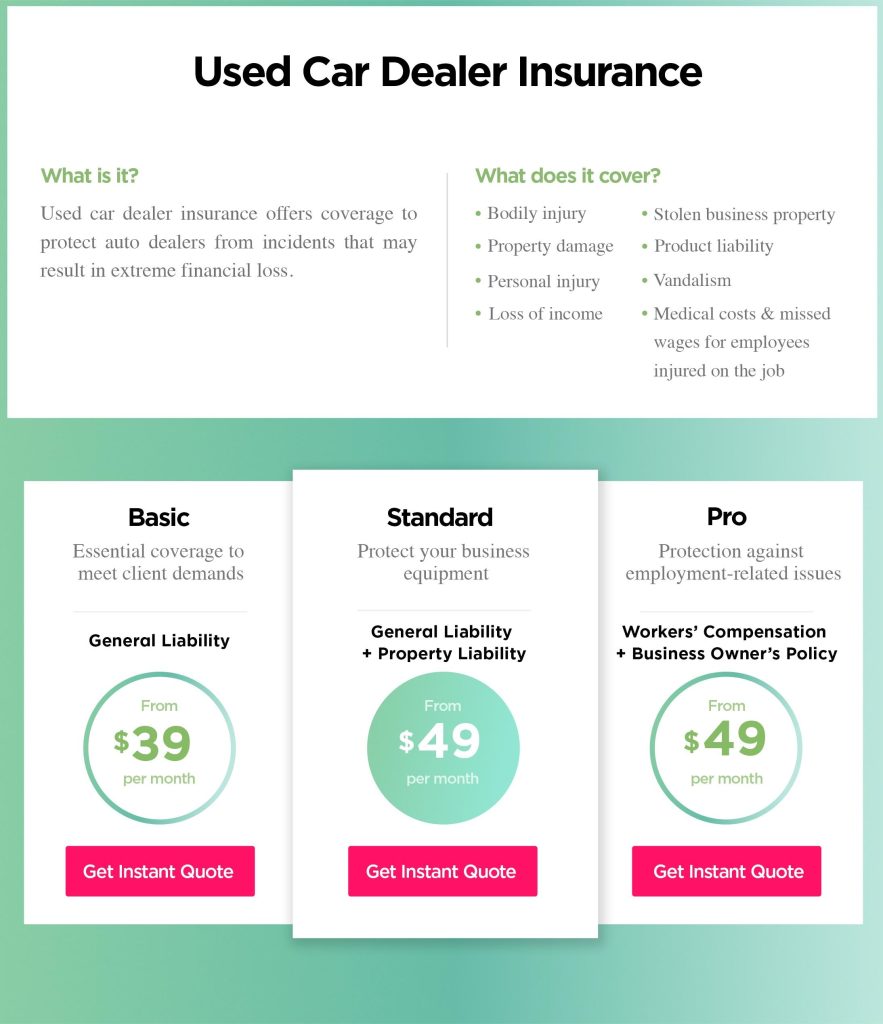

When protecting your used car lot, understanding the nuances of liability insurance can feel overwhelming. However, selecting the right coverage hinges on recognizing the specific risks associated with your business operations—from customer test drives to vehicle maintenance and sales transactions. It’s essential to weigh options such as general liability, product liability, and garage liability insurance, ensuring each aligns with your unique exposure to potential lawsuits or claims.

Consider these factors when tailoring your policy:

- Scope of Coverage: Does the policy cover bodily injury, property damage, and legal defense costs?

- Business Activities: Are all your daily operations, including off-site events or transport, included?

- Contractual Requirements: Do your lender or suppliers demand specific coverage limits?

- Deductibles and Premiums: Balancing affordability with comprehensive protection is key.

By addressing these points, you can confidently select a liability insurance plan that not only complies with industry standards but also safeguards your livelihood from unforeseen financial burdens.

Understanding Comprehensive Insurance for Physical Damage and Theft

When protecting a fleet of pre-owned vehicles, it’s vital to safeguard against a wide range of physical damages that can occur both on and off the lot. This coverage extends well beyond simple collision incidents, encompassing risks such as fire, vandalism, falling objects, and natural disasters. Equally important is theft protection, which shields your inventory from losses due to burglary or vehicle theft. Together, these safeguards offer a layer of security that preserves both the value of your vehicles and the stability of your business operations.

Key benefits include:

- Comprehensive coverage: Protects against unforeseen damages that don’t result from collisions.

- Theft protection: Covers losses from stolen vehicles, parts, or accessories.

- Peace of mind: Enables dealers to focus on sales without worrying about sudden, expensive repair costs.

- Enhanced resale value: Vehicles are often repaired professionally in a timely manner, assuring customers of quality and reliability.

The Importance of Dealer’s Open Lot Insurance for Used Car Lots

For used car lot owners, protecting inventory is paramount. This specialized insurance covers vehicles stored outdoors, where they’re vulnerable to a variety of risks including theft, vandalism, weather damage, and even accidental harm from customers or employees. Without it, dealers face the possibility of significant financial losses that could severely impact business operations. Dealer’s open lot insurance offers peace of mind, ensuring that every vehicle on the lot — regardless of whether it’s sold or not — is insured against unforeseen events.

Not only does this coverage mitigate risks tied to physical damage, but it also helps maintain customer trust and operational continuity. Here’s what makes this insurance indispensable:

- Comprehensive protection against natural disasters like hailstorms or flooding.

- Coverage for theft and vandalism that could otherwise exhaust a dealer’s resources.

- Liability coverage for incidents occurring on the lot, such as accidental damage caused by visitors or staff.

Incorporating this insurance into your risk management strategy is not just smart—it’s essential for long-term resilience in the competitive used car market.

Tailoring Workers Compensation to Support Your Team Safely

Employees on a used car lot navigate a unique set of risks daily — from occasional heavy lifting to dealing with test drives and showroom hazards. Designing a workers compensation plan tailored to these specific challenges ensures your team feels protected, valued, and supported. It also reflects your commitment to their health and well-being, fostering a safer workplace culture where everyone can perform their roles with confidence. Customizing coverage to fit the nuances of your operation, such as accounting for outdoor exposures or vehicle-related incidents, safeguards both your staff and your business.

When crafting the right insurance package, consider including key benefits like:

- Medical expense coverage that swiftly addresses work-related injuries.

- Wage replacement options to ease financial stress during recovery periods.

- Rehabilitation support for a smooth return to full duty.

By taking a proactive approach to these elements, you’re not just meeting legal obligations — you’re empowering your team with peace of mind. This thoughtful protection leads to increased morale, lower turnover, and a reputation as an employer who genuinely cares.

In Retrospect

Navigating the world of used car sales comes with its fair share of risks—and having the right insurance in place isn’t just smart, it’s essential for peace of mind. By understanding and securing the essential insurance types for your lot, you protect not only your investment but also your reputation and the trust of your customers. While it might seem overwhelming at first, taking the time to review your coverage ensures that you’re prepared for whatever challenges come your way. Remember, safeguarding your business is a continual process, and staying informed is the best way to drive confidently into the future.