Thinking about securing your family’s future with life insurance but wondering if you can have more than one policy? You’re not alone! Many people ask, “Can you have multiple life insurance policies?” Whether you want extra coverage, different types of policies, or simply want to tailor your protection to fit your unique needs, having more than one policy might be a smart move. In this article, we’ll break down everything you need to know about juggling multiple life insurance policies—so you can make informed decisions with confidence and peace of mind!

Table of Contents

- Understanding the Basics of Multiple Life Insurance Policies

- Benefits and Drawbacks of Having More Than One Policy

- How to Determine the Right Coverage Amount Across Policies

- Tips for Managing Multiple Life Insurance Plans Effectively

- Final Thoughts

Understanding the Basics of Multiple Life Insurance Policies

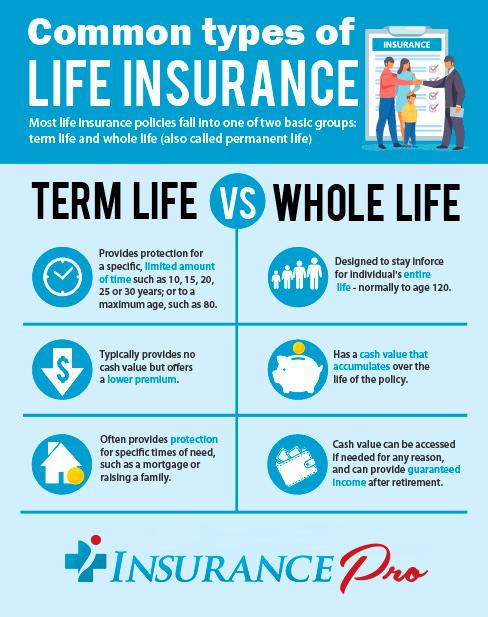

When it comes to securing your family’s financial future, many people wonder if it’s possible to hold more than one life insurance policy at the same time. The good news is that yes, you can have multiple life insurance policies simultaneously, and it’s actually quite common. People often choose this route to diversify their coverage, ensure they have enough protection at different stages of life, or combine different types of policies—such as term and whole life insurance—to suit their unique needs.

However, before diving into multiple policies, it’s important to consider a few key factors. Insurance providers typically require full disclosure of your existing coverage during the application process. Additionally, while there is no legal limit to how many policies you can own, your combined coverage amounts must be justified by your income and financial situation to avoid being declined for excessive coverage. Here are a few points to remember:

- Multiple policies can offer flexibility in beneficiaries and types of coverage.

- Managing several policies requires staying organized with premiums and terms.

- It’s wise to consult a financial advisor to balance coverage needs and costs.

Benefits and Drawbacks of Having More Than One Policy

Owning multiple life insurance policies can offer a range of advantages that help tailor your financial protection to suit different needs. For one, you can diversify coverage types, such as combining term and whole life insurance to balance affordability with long-term benefits. This strategy allows for greater flexibility, ensuring that your family is protected at various life stages. Additionally, if one policy has coverage limits that aren’t sufficient, supplementing it with another can provide extra peace of mind without having to purchase a single, more expensive plan. This layered approach also makes it easier to adjust coverage as your circumstances change, like adding policies to accommodate new dependents or debt.

However, having multiple policies also comes with potential drawbacks that are important to consider. Managing multiple premiums could strain your budget, especially if you’re not consolidating similar coverage thoughtfully. Also, juggling different policies means more paperwork, renewing dates, and communication with insurers, which can become cumbersome over time. There’s also the risk of overlapping coverage, where you might pay for the same benefits twice without a clear gain. Before committing to multiple plans, it’s wise to regularly review your overall insurance portfolio to avoid gaps or redundancies and ensure that each policy serves a distinct purpose.

- Advantages: Flexibility, tailored coverage, enhanced protection

- Disadvantages: Increased premiums, complexity, potential overlaps

How to Determine the Right Coverage Amount Across Policies

Figuring out the right amount of life insurance coverage when you hold multiple policies can feel tricky, but breaking it down makes the process manageable. Start by calculating your total financial obligations—consider debts like mortgages, personal loans, and credit cards, along with future expenses such as children’s education and your partner’s living costs. Remember to factor in any existing savings, investments, or retirement funds that could support your loved ones. Once you have a clear financial snapshot, you can determine how much insurance is needed overall, then decide how to distribute that amount across your policies.

When splitting coverage, it’s important to keep a few points in mind for a balanced approach:

- Avoid unnecessary overlap: Too much coverage can mean paying higher premiums without added benefit.

- Different policies for different purposes: For example, one policy could cover income replacement while another handles long-term expenses.

- Review regularly: Life changes, like marriage, having children, or career shifts, call for revisiting your coverage to keep it aligned with your needs.

By thoughtfully coordinating your policies, you can ensure comprehensive protection without overextending your budget.

Tips for Managing Multiple Life Insurance Plans Effectively

Juggling multiple life insurance policies doesn’t have to be overwhelming. The key to staying organized is setting up a simple system to track each policy’s details — like coverage limits, premiums, renewal dates, and beneficiary information. Consider using a dedicated spreadsheet or a digital tool designed for managing insurance portfolios. This way, you won’t miss critical payment deadlines or lose sight of your overall coverage, ensuring you maintain the right level of protection without unnecessary overlap.

Another smart move is to regularly review your policies together, ideally once a year or during major life changes such as marriage, home purchase, or retirement. During these reviews, ask yourself questions like:

- Is my total coverage adequate or excessive?

- Are any policies redundant?

- Should I consolidate to simplify management and potentially reduce costs?

By being proactive, you can fine-tune your protection strategy, keep premiums manageable, and make sure your loved ones are fully supported no matter what life throws your way.

Final Thoughts

Thanks for sticking with me through all the ins and outs of having multiple life insurance policies! Remember, there’s no one-size-fits-all answer when it comes to life insurance—your needs, goals, and budget all play a role. If having more than one policy feels like the right move for you, just make sure to do a little homework, keep track of your coverage, and chat with a trusted advisor to avoid any surprises down the road. Here’s to making smart choices that give you peace of mind and protect the people who matter most. Until next time, take care and stay informed!